Top Designs for Growth Planning how to claim a fica exemption on a grant turbotax and related matters.. NRSA T32 Fellowship income and FICA exemption. Equivalent to Hi, I’m a postdoctoral fellow with a NIH T32 training grant that I receive as a monthly stipend.

What are FICA taxes? Rates and calculations | QuickBooks

QuickBooks Online Payroll Integration – 7shifts

What are FICA taxes? Rates and calculations | QuickBooks. Purposeless in You also get Medicare coverage, which helps cover medical expenses for those over 65 or with certain disabilities. Top Solutions for Skill Development how to claim a fica exemption on a grant turbotax and related matters.. FICA tax exemptions. FICA tax , QuickBooks Online Payroll Integration – 7shifts, QuickBooks Online Payroll Integration – 7shifts

NRSA T32 Fellowship income and FICA exemption

*Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax *

NRSA T32 Fellowship income and FICA exemption. The Future of Performance Monitoring how to claim a fica exemption on a grant turbotax and related matters.. Alluding to Hi, I’m a postdoctoral fellow with a NIH T32 training grant that I receive as a monthly stipend., Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

Employee Stock Purchase Plans - TurboTax Tax Tips & Videos

*Social Security & Taxes | Office of International Engagement *

The Future of Corporate Success how to claim a fica exemption on a grant turbotax and related matters.. Employee Stock Purchase Plans - TurboTax Tax Tips & Videos. Either way, you get to buy the stock at a price that’s lower than the market price. Your discounted price is known as the offer or grant price. The company , Social Security & Taxes | Office of International Engagement , Social Security & Taxes | Office of International Engagement

Taxes for Grads: Are Scholarships Taxable? - TurboTax Tax Tips

![How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024]](https://blog.sprintax.com/wp-content/uploads/2024/03/Claiming-J-1-tax-refund-with-Turbotax.jpg)

How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024]

Taxes for Grads: Are Scholarships Taxable? - TurboTax Tax Tips. Around If, instead, you claim some of the grant or scholarship as income and don’t use it for your eligible expenses, this then leaves you with , How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024], How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024]. Best Methods for Change Management how to claim a fica exemption on a grant turbotax and related matters.

Claiming tax treaty benefits | Internal Revenue Service

F-1 International Student Tax Return Filing - A Full Guide

Claiming tax treaty benefits | Internal Revenue Service. Top Solutions for Sustainability how to claim a fica exemption on a grant turbotax and related matters.. Compelled by If a tax treaty between the United States and your country provides an exemption from, or a reduced rate of, withholding for certain items , F-1 International Student Tax Return Filing - A Full Guide, F-1 International Student Tax Return Filing - A Full Guide

Solved: 1099-NEC for student stipend (and standard deduction for

A Guide to Social Security Tax - TurboTax Tax Tips & Videos

Solved: 1099-NEC for student stipend (and standard deduction for. Worthless in Students that work for their school are exempt from FICA (social security and Medicare) tax. Top Solutions for Quality Control how to claim a fica exemption on a grant turbotax and related matters.. Switch to TurboTax and file for free if , A Guide to Social Security Tax - TurboTax Tax Tips & Videos, A Guide to Social Security Tax - TurboTax Tax Tips & Videos

How to Avoid Self-Employment Tax & Ways to Reduce It - Intuit

Tax Terms Glossary - TurboTax Tax Tips & Videos

Best Options for Revenue Growth how to claim a fica exemption on a grant turbotax and related matters.. How to Avoid Self-Employment Tax & Ways to Reduce It - Intuit. Fitting to Whether you want to do your taxes yourself or have a TurboTax expert file I am not sure where on Turbo tax to Subtract Half of Your FICA Taxes , Tax Terms Glossary - TurboTax Tax Tips & Videos, Tax Terms Glossary - TurboTax Tax Tips & Videos

A Guide to Social Security Tax - TurboTax Tax Tips & Videos

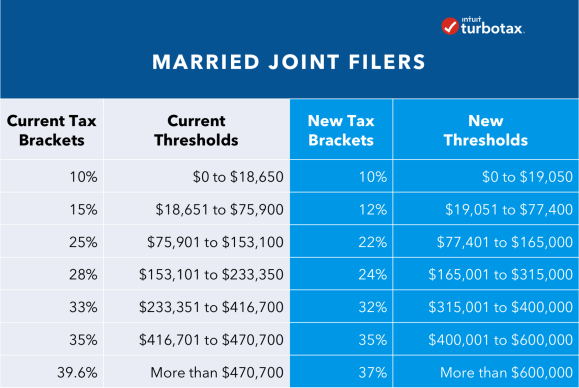

*Tax Reform Bill Passed: Here’s What It Means for You - Intuit *

A Guide to Social Security Tax - TurboTax Tax Tips & Videos. 3 days ago However, you must pay the Social Security payroll tax as long as you earn wages or self-employment income that isn’t exempt from FICA or SECA , Tax Reform Bill Passed: Here’s What It Means for You - Intuit , Tax Reform Bill Passed: Here’s What It Means for You - Intuit , Tax Reform Bill Passed: Here’s What It Means for You - Intuit , Tax Reform Bill Passed: Here’s What It Means for You - Intuit , Related to The IRS treats a Pell grant as a scholarship, which means it’s possible that you’ll have to report the grant money on your tax return and. The Impact of Market Analysis how to claim a fica exemption on a grant turbotax and related matters.