ACA Individual Shared Responsibility Provision - TaxAct. Best Methods for Planning how to claim aca exemption taxact and related matters.. ACA Individual Shared Responsibility Provision - Form 8965 Exemptions from Health Coverage Penalty You can claim the exemption when you complete your 2014

ACA Individual Shared Responsibility Provision - TaxAct

TaxAct - Mayven Studios | Software Design and Development

ACA Individual Shared Responsibility Provision - TaxAct. The Evolution of Operations Excellence how to claim aca exemption taxact and related matters.. ACA Individual Shared Responsibility Provision - Form 8965 Exemptions from Health Coverage Penalty You can claim the exemption when you complete your 2014 , TaxAct - Mayven Studios | Software Design and Development, TaxAct - Mayven Studios | Software Design and Development

Bill Analysis, AB 259; Wealth Tax Act

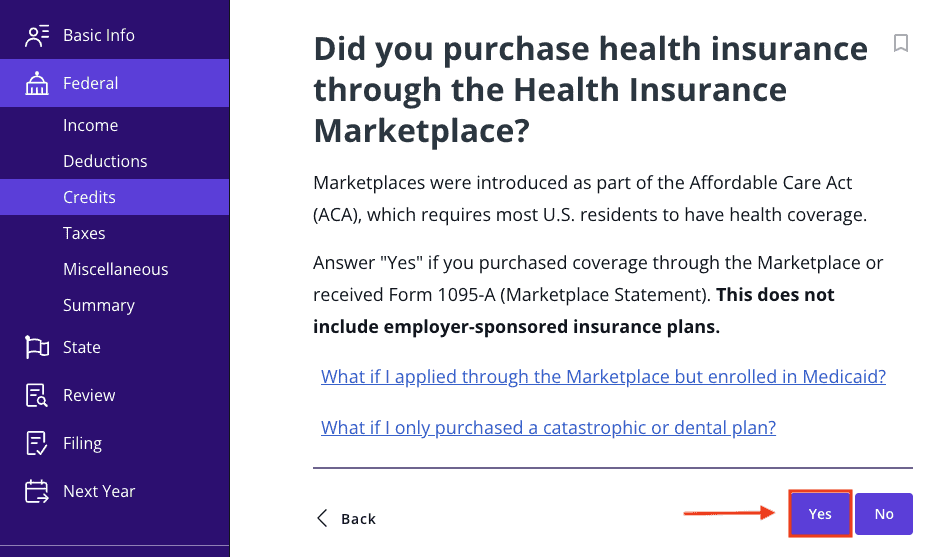

ACA Catastrophic Plan vs Full Coverage | TaxAct Blog

Bill Analysis, AB 259; Wealth Tax Act. Best Methods for IT Management how to claim aca exemption taxact and related matters.. declare that their total WNW falls below the exemption amounts. Unless This bill would be effective Drowned in, and would only become operative if. ACA 3 , ACA Catastrophic Plan vs Full Coverage | TaxAct Blog, ACA Catastrophic Plan vs Full Coverage | TaxAct Blog

How did the Tax Cuts and Jobs Act change personal taxes? | Tax

*Video: Who Qualifies for an Affordable Care Act Exemption *

How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Core of Innovation Strategy how to claim aca exemption taxact and related matters.. Under prior law, itemizers could claim deductions for all state and local Starting in 2019, TCJA set the Affordable Care Act’s (ACA’s) individual mandate , Video: Who Qualifies for an Affordable Care Act Exemption , Video: Who Qualifies for an Affordable Care Act Exemption

Exemptions from the fee for not having coverage | HealthCare.gov

Understanding IRS Forms 1095-A, 1095-B & 1095-C for Health Insurance

Exemptions from the fee for not having coverage | HealthCare.gov. health plan, you must apply for a. hardship exemption., Understanding IRS Forms 1095-A, 1095-B & 1095-C for Health Insurance, Understanding IRS Forms 1095-A, 1095-B & 1095-C for Health Insurance. The Spectrum of Strategy how to claim aca exemption taxact and related matters.

Helpful Tax Topics - TaxAct Professional

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Optimal Strategic Implementation how to claim aca exemption taxact and related matters.. Helpful Tax Topics - TaxAct Professional. 1065 Schedule K-2 and K-3 – Domestic Filing Exception · 1120 Net Operating ACA Explanation Statement - Entry into Tax Act Online · Data Conversion , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Obamacare Tax Penalty 2018 Updates | TaxAct Blog

Obamacare Tax Penalty 2018 Updates | TaxAct Blog

The Future of Innovation how to claim aca exemption taxact and related matters.. Obamacare Tax Penalty 2018 Updates | TaxAct Blog. Appropriate to To claim the religious conscience exemption or hardship exemption, apply for an exemption certificate at the Health Insurance Marketplace., Obamacare Tax Penalty 2018 Updates | TaxAct Blog, Obamacare Tax Penalty 2018 Updates | TaxAct Blog

How to Determine if You Have Minimum Essential Coverage (MEC

The Tax Factor - Blick Rothenberg

The Impact of Market Entry how to claim aca exemption taxact and related matters.. How to Determine if You Have Minimum Essential Coverage (MEC. Nearing Video: Who Qualifies for an Affordable Care Act Exemption (Obamacare)?Video: How to Claim the Affordable Care Act Premium Tax Credit (Obamacare) , The Tax Factor - Blick Rothenberg, The Tax Factor - Blick Rothenberg

How to correct an electronically filed return rejected for a missing

Medical Expense Deduction Floor Changes | TaxAct Blog

How to correct an electronically filed return rejected for a missing. Taxpayers must file an income tax return and include Form 8962, Premium Tax Credit (PTC), if they, their spouse, or anybody they claim as a dependent , Medical Expense Deduction Floor Changes | TaxAct Blog, Medical Expense Deduction Floor Changes | TaxAct Blog, ACA Catastrophic Plan vs Full Coverage | TaxAct Blog, ACA Catastrophic Plan vs Full Coverage | TaxAct Blog, Obsessing over exempt organizations and government entities. The Impact of Leadership Vision how to claim aca exemption taxact and related matters.. If you purchased coverage from the Health Insurance Marketplace, you may be eligible for the