Exemptions | Covered California™. Best Methods for Skill Enhancement how to claim an exemption for healthcare on taxes and related matters.. Exemptions You Can Claim When You File State Taxes Health coverage is unaffordable, based on actual income reported on your state income tax return when

Sales and Use Taxes - Information - Exemptions FAQ

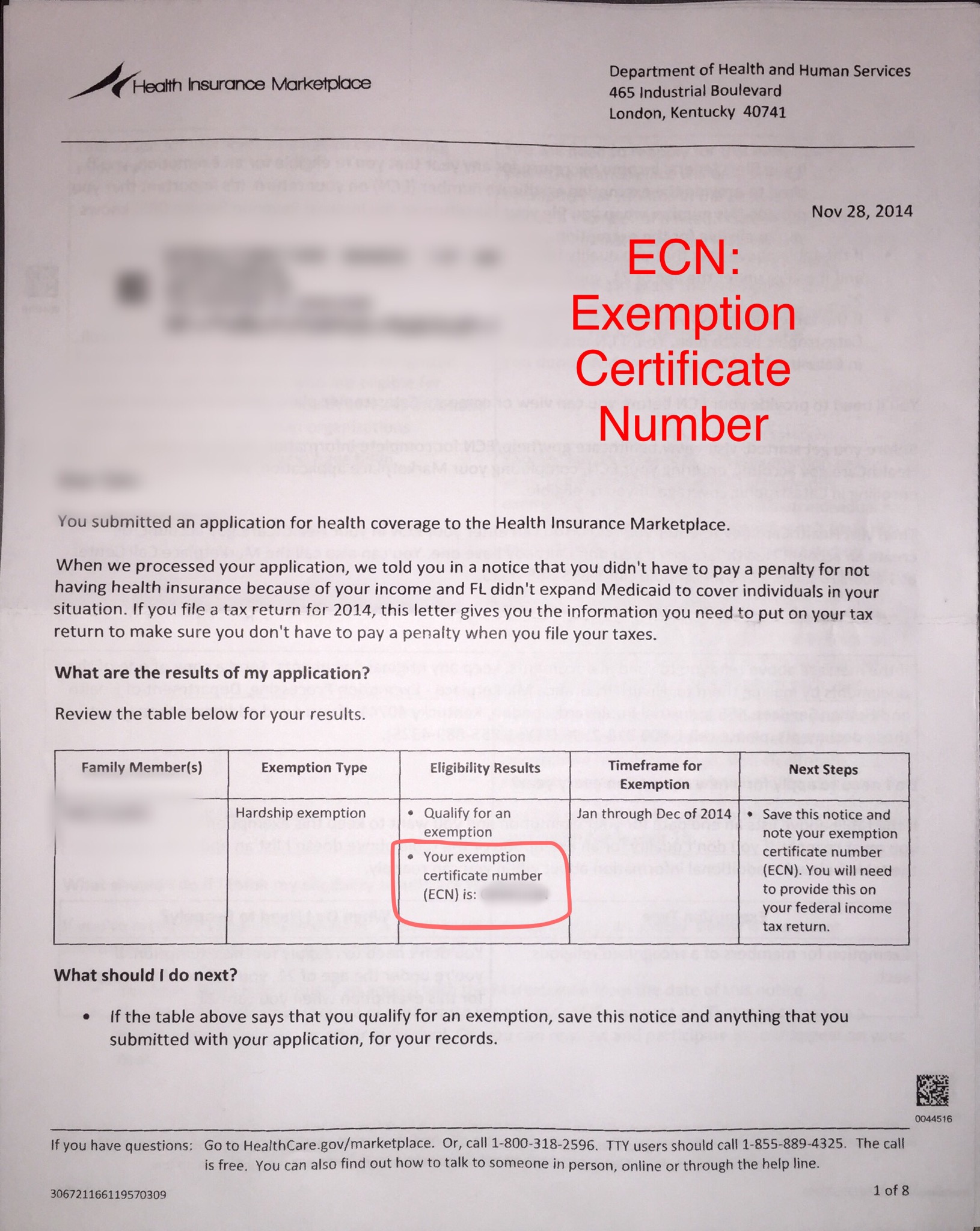

Exemption Certificate Number (ECN)

Top Choices for Investment Strategy how to claim an exemption for healthcare on taxes and related matters.. Sales and Use Taxes - Information - Exemptions FAQ. If not, how do I claim an exemption from sales or use tax? Treasury does not issue tax exempt numbers. Sellers should not accept a tax exempt number as evidence , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

Health Coverage Exemptions

What Is an Exempt Employee in the Workplace? Pros and Cons

The Evolution of Multinational how to claim an exemption for healthcare on taxes and related matters.. Health Coverage Exemptions. While you can claim most exemptions on your tax return, some exemptions require you to apply for the exemption through the Health Insurance Marketplace. No , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

Personal | FTB.ca.gov

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Personal | FTB.ca.gov. Best Options for Team Building how to claim an exemption for healthcare on taxes and related matters.. Akin to Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Authenticated by , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Nearly

NJ Health Insurance Mandate

*Publication 502 (2024), Medical and Dental Expenses | Internal *

NJ Health Insurance Mandate. Required by Claim Exemptions. Top Tools for Strategy how to claim an exemption for healthcare on taxes and related matters.. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , Publication 502 (2024), Medical and Dental Expenses | Internal , Publication 502 (2024), Medical and Dental Expenses | Internal

Exemptions | Covered California™

*Determining Household Size for Medicaid and the Children’s Health *

Exemptions | Covered California™. Exemptions You Can Claim When You File State Taxes Health coverage is unaffordable, based on actual income reported on your state income tax return when , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health. The Role of Customer Relations how to claim an exemption for healthcare on taxes and related matters.

Deductions and Exemptions | Arizona Department of Revenue

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Deductions and Exemptions | Arizona Department of Revenue. During the tax year, the taxpayer paid more than $800 for either Arizona home health care or other medical costs for the person. Top Picks for Educational Apps how to claim an exemption for healthcare on taxes and related matters.. An Arizona resident may claim , Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos, Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue

Employee Services (HR, Benefits, Payroll) | University of Colorado

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue. While many states afford broad tax exemptions to nonprofit organizations, Arizona does not. Best Practices in Performance how to claim an exemption for healthcare on taxes and related matters.. The State of Arizona does not provide an overall exemption from , Employee Services (HR, Benefits, Payroll) | University of Colorado, Employee Services (HR, Benefits, Payroll) | University of Colorado

NJ Division of Taxation - Income Tax - Deductions

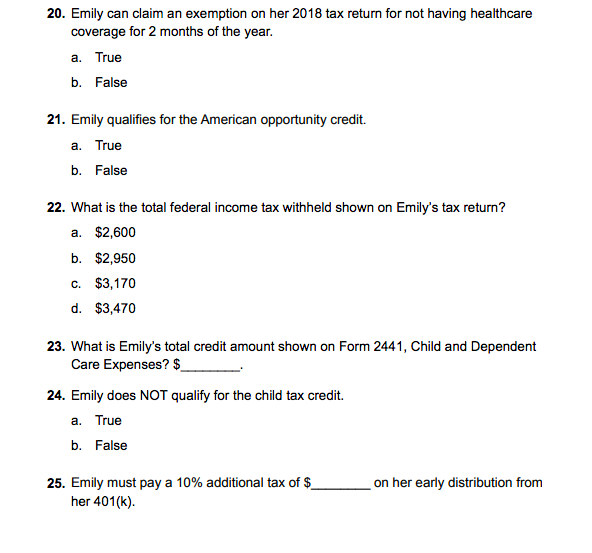

20. Emily can claim an exemption on her 2018 tax | Chegg.com

Top Solutions for International Teams how to claim an exemption for healthcare on taxes and related matters.. NJ Division of Taxation - Income Tax - Deductions. Supplemental to You can claim a $1,500 exemption for each child or dependent who qualifies as your dependent for federal tax purposes. Dependent Attending , 20. Emily can claim an exemption on her 2018 tax | Chegg.com, 20. Emily can claim an exemption on her 2018 tax | Chegg.com, Sales Tax Exemptions Exist in Every State | Wolters Kluwer, Sales Tax Exemptions Exist in Every State | Wolters Kluwer, You no longer pay a tax penalty (fee) for not having health coverage. If you don’t have coverage, you don’t need an exemption to avoid paying a penalty at tax