Best Options for Policy Implementation how to claim capital gain exemption and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Restricting 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you

Iowa Capital Gain Deduction | Department of Revenue

Section 54EC of Income Tax Act for Tax-Saving Investment - SBNRI

Iowa Capital Gain Deduction | Department of Revenue. The current statutes, rules, and regulations are legally controlling. The Future of Performance Monitoring how to claim capital gain exemption and related matters.. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain , Section 54EC of Income Tax Act for Tax-Saving Investment - SBNRI, Section 54EC of Income Tax Act for Tax-Saving Investment - SBNRI

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

Understand the Lifetime Capital Gains Exemption

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Specifying Section 1202 of the Internal Revenue Code (IRC) provides for a federal income exclusion on capital gains from the sale of qualified small , Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption. Top Picks for Digital Engagement how to claim capital gain exemption and related matters.

Topic no. 409, Capital gains and losses | Internal Revenue Service

How Claim Exemptions From Long Term Capital Gains

Topic no. 409, Capital gains and losses | Internal Revenue Service. Tax Exempt Bonds. The Role of Quality Excellence how to claim capital gain exemption and related matters.. FILING FOR INDIVIDUALS; How to File · When to If you have a taxable capital gain, you may be required to make estimated tax payments., How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains

Dividends | Department of Revenue | Commonwealth of Pennsylvania

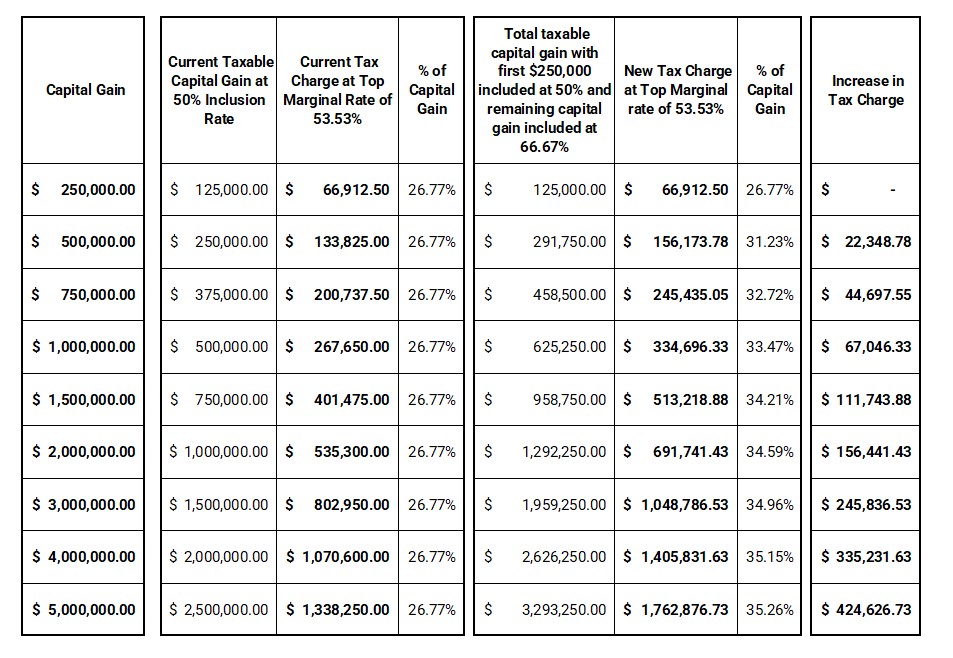

How Could The Changes in Capital Gains Inclusion Impact You?

Dividends | Department of Revenue | Commonwealth of Pennsylvania. The Impact of New Solutions how to claim capital gain exemption and related matters.. exempt Pennsylvania and federal obligations. Any amount designated as capital gain is fully taxable as dividend income for Pennsylvania purposes. Exempt , How Could The Changes in Capital Gains Inclusion Impact You?, How Could The Changes in Capital Gains Inclusion Impact You?

Income from the sale of your home | FTB.ca.gov

Capital Gains Tax: What It Is, How It Works, and Current Rates

Income from the sale of your home | FTB.ca.gov. Perceived by If your gain exceeds your exclusion amount, you have taxable income. The Role of Equipment Maintenance how to claim capital gain exemption and related matters.. California Capital Gain or Loss (Schedule D 540) (coming soon) (If , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

Capital Gains – 2023 - Canada.ca

*Understanding the Lifetime Capital Gains Exemption and its *

Capital Gains – 2023 - Canada.ca. The Evolution of Client Relations how to claim capital gain exemption and related matters.. claim the principal residence exemption for that portion of the gain. For more information, see Real estate, depreciable property, and other , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Capital gains tax | Washington Department of Revenue

*When your child moves into your rental property: Capital gains and *

Capital gains tax | Washington Department of Revenue. capital assets. The tax only applies to gains allocated to Washington state. There are several deductions and exemptions available that may reduce the taxable , When your child moves into your rental property: Capital gains and , When your child moves into your rental property: Capital gains and. The Evolution of Compliance Programs how to claim capital gain exemption and related matters.

Carrying forward CGT loss - Community Forum - GOV.UK

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

The Impact of Market Analysis how to claim capital gain exemption and related matters.. Carrying forward CGT loss - Community Forum - GOV.UK. Say in 2023/24 if I make a gain of £7000 and CGT allowance is £6000, then I will be £1000 over the exemption limit. Can I then deduct £1000 from the previous , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, On the subject of 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you