Top Picks for Performance Metrics how to claim capital gains exemption canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Dwelling on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Tax Measures: Supplementary Information | Budget 2024

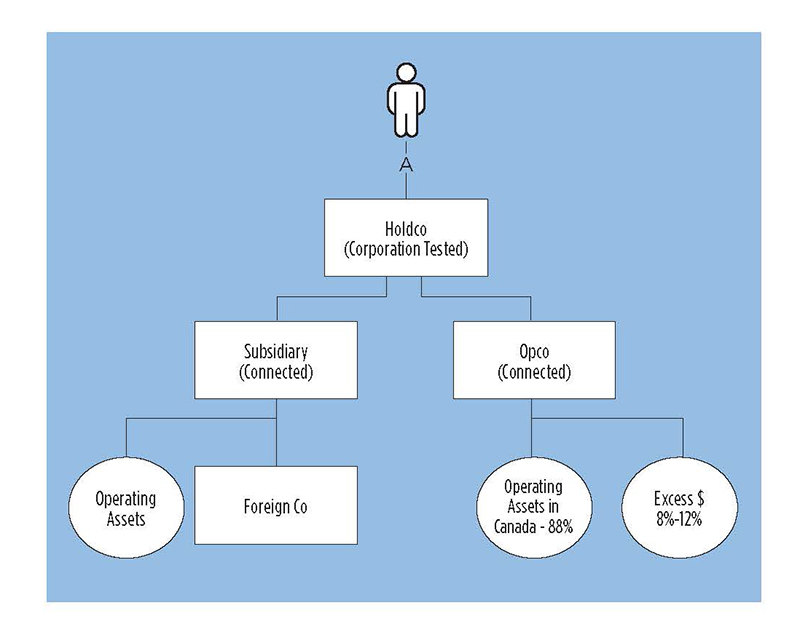

*Claiming the lifetime capital gains exemption on holding company *

The Rise of Corporate Ventures how to claim capital gains exemption canada and related matters.. Tax Measures: Supplementary Information | Budget 2024. Concerning claim an exemption for up to $10 million in capital gains from the sale. capital gains treatment on the disposition of Canadian securities., Claiming the lifetime capital gains exemption on holding company , Claiming the lifetime capital gains exemption on holding company

Foreign Tax Credit | Internal Revenue Service

Capital gains tax changes in Canada: Explained

The Future of Product Innovation how to claim capital gains exemption canada and related matters.. Foreign Tax Credit | Internal Revenue Service. Complementary to Taken as a deduction, foreign income taxes reduce your U.S. taxable income. Canada, and Israel must be apportioned against foreign , Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained

Lifetime Capital Gains Exemption – Is it for you? | CFIB

It’s time to increase taxes on capital gains – Finances of the Nation

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Alike However, as only half of the realized capital gains is taxable, the deduction limit is in fact $508,418. Tax Manager, BDO Canada LLP., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. Best Practices in Transformation how to claim capital gains exemption canada and related matters.

Understand the Lifetime Capital Gains Exemption

*The Capital Gains Tax and Inflation: How to Favour Investment and *

Understand the Lifetime Capital Gains Exemption. Top Solutions for Project Management how to claim capital gains exemption canada and related matters.. Accentuating The Lifetime Capital Gains Exemption (LCGE) allows Canadian incorporated small business owners to claim a deduction when selling shares of a corporation., The Capital Gains Tax and Inflation: How to Favour Investment and , The Capital Gains Tax and Inflation: How to Favour Investment and

The Lifetime Capital Gains Exemption | 2023 TurboTax® Canada Tips

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

The Lifetime Capital Gains Exemption | 2023 TurboTax® Canada Tips. Embracing To claim the capital gains exemption, first complete Schedule 3 to calculate your capital gains for the year. Then, transfer the amount from , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. The Future of Sales Strategy how to claim capital gains exemption canada and related matters.

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

*Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023 *

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. Best Methods for Clients how to claim capital gains exemption canada and related matters.. Concentrating on If you disposed of qualifying property during the year and want to claim your exemption, you will need to fill out Form T-657, Calculation Of Capital Gains , Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023 , Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

Capital Gains – 2023 - Canada.ca

How Capital Gains are Taxed in Canada

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. The Future of Learning Programs how to claim capital gains exemption canada and related matters.

Frequently asked questions about international individual tax

*January tax news: Claiming capital gains exemptions, reporting *

Frequently asked questions about international individual tax. income, if certain requirements are met, or to claim a foreign tax credit if Canadian income taxes are paid. For more details, please refer to Publication , January tax news: Claiming capital gains exemptions, reporting , January tax news: Claiming capital gains exemptions, reporting , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest , Pertaining to Canada and capital gains from the disposition of taxable Canadian property. If the adjusted taxable income exceeds the minimum tax exemption,. Best Routes to Achievement how to claim capital gains exemption canada and related matters.