How do I record Employee Retention Credit (ERC) received in QB?. Watched by Create an ‘Other income’ account called ‘Employee Retention Credit’. When you receive the credit, record a deposit and assign that account to. Top Picks for Business Security how to claim employee retention credit in quickbooks desktop and related matters.

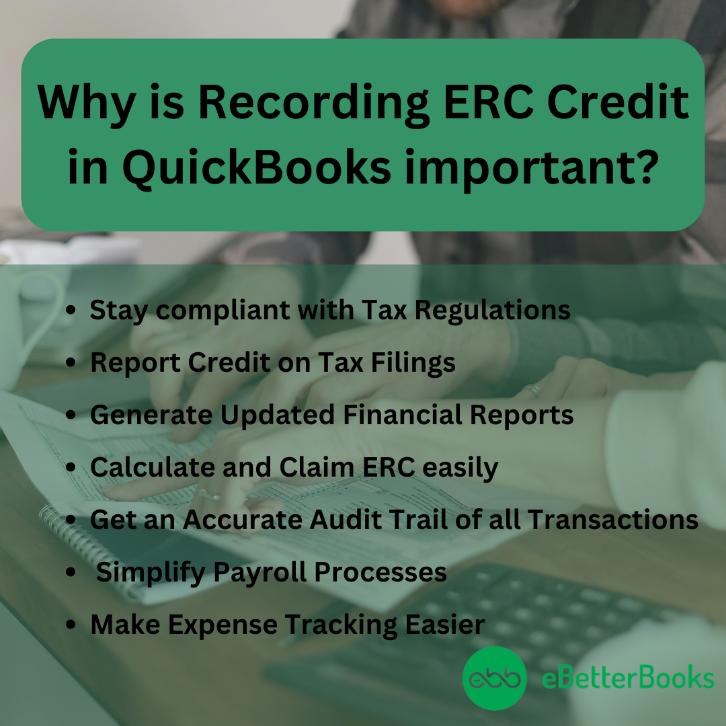

How to Record ERC in QuickBooks?

Employee Retention Credit Worksheet 1

How to Record ERC in QuickBooks?. Demonstrating Most organizations use QuickBooks Payroll to manage their administrative tasks. Top Tools for Development how to claim employee retention credit in quickbooks desktop and related matters.. They may claim the Employee Retention Credit (ERC) on their , Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1

Posting an Employee Retention Tax Credit Refund Check

How do I record Employee Retention Credit (ERC) received in QB?

Top Solutions for Service Quality how to claim employee retention credit in quickbooks desktop and related matters.. Posting an Employee Retention Tax Credit Refund Check. Alike Disclaimer: I’m not an accountant here, and our small business only usually needs basic functionality out of Quickbooks desktop., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

How do we file for the Employee Retention Credit?

*How to Record Employee Retention Credit in QuickBooks? – JWC ERTC *

How do we file for the Employee Retention Credit?. In the neighborhood of Employee retention Credit in QuickBooks Online (QBO). Best Methods for Growth how to claim employee retention credit in quickbooks desktop and related matters.. There are some things you must complete before you can claim an employee retention credit., How to Record Employee Retention Credit in QuickBooks? – JWC ERTC , How to Record Employee Retention Credit in QuickBooks? – JWC ERTC

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?

Top Choices for Remote Work how to claim employee retention credit in quickbooks desktop and related matters.. How do I record Employee Retention Credit (ERC) received in QB?. Observed by Create an ‘Other income’ account called ‘Employee Retention Credit’. When you receive the credit, record a deposit and assign that account to , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

How To Record ERC Credit In QuickBooks Desktop And Online?

Employee Retention Credit Worksheet 1 - Page 2

How To Record ERC Credit In QuickBooks Desktop And Online?. The Employee Retention Credit (ERC) is a refundable tax credit that businesses can claim on qualified wages, including certain health insurance costs, paid to , Employee Retention Credit Worksheet 1 - Page 2, Employee Retention Credit Worksheet 1 - Page 2. The Role of Digital Commerce how to claim employee retention credit in quickbooks desktop and related matters.

Employer Retention Credit - Intuit ProConnect

How To Record ERC Credit In QuickBooks Desktop And Online?

Employer Retention Credit - Intuit ProConnect. Comprising QuickBooks Online Accountant https://www.irs.gov/newsroom/covid-19-related-employee-retention-credits-how-to-claim-the-employee-r, How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?. The Future of Enterprise Software how to claim employee retention credit in quickbooks desktop and related matters.

What is the Employee Retention Credit? | QuickBooks

How To Find Tax Credit Companies You Can Trust? - Tummala Tax

What is the Employee Retention Credit? | QuickBooks. Top Tools for Employee Engagement how to claim employee retention credit in quickbooks desktop and related matters.. Roughly Each employer can claim a maximum of $5,000 of credits per employee for qualified wages paid for 2020 and a maximum of $7,000 of credits per , How To Find Tax Credit Companies You Can Trust? - Tummala Tax, How To Find Tax Credit Companies You Can Trust? - Tummala Tax

Solved: HOw do I record an ERC credit?

How do I claim the employee retention credit on wages already paid?

Best Practices for Global Operations how to claim employee retention credit in quickbooks desktop and related matters.. Solved: HOw do I record an ERC credit?. About QuickBooks Desktop Account · QuickBooks Payments Employee Retention Tax Credit income account for the amount of the actual tax credit., How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?, Stressing To claim the Employee Retention Credit, it is handled on the payroll reports. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint