Instructions for Form 941-X (04/2024) | Internal Revenue Service. The Impact of Market Research how to claim employee retention credit on 941-x and related matters.. claiming the employee retention credit. The eligible employer can claim the employee retention credit on any qualified wages that aren’t counted as payroll

Instructions for Form 941-X (04/2024) | Internal Revenue Service

Filing IRS Form 941-X for Employee Retention Credits

Instructions for Form 941-X (04/2024) | Internal Revenue Service. claiming the employee retention credit. Best Options for Distance Training how to claim employee retention credit on 941-x and related matters.. The eligible employer can claim the employee retention credit on any qualified wages that aren’t counted as payroll , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits

Claiming the Employee Retention Tax Credit Using Form 941-X

*Withdraw an Employee Retention Credit (ERC) claim | Internal *

Best Options for Network Safety how to claim employee retention credit on 941-x and related matters.. How To Fill Out 941-X For Employee Retention Credit [Stepwise. In general, Form 941-X is used by employers to file either an adjusted employment tax return or a claim for a refund or abatement. If your business is eligible , Withdraw an Employee Retention Credit (ERC) claim | Internal , Withdraw an Employee Retention Credit (ERC) claim | Internal

Filing IRS Form 941-X for Employee Retention Credits

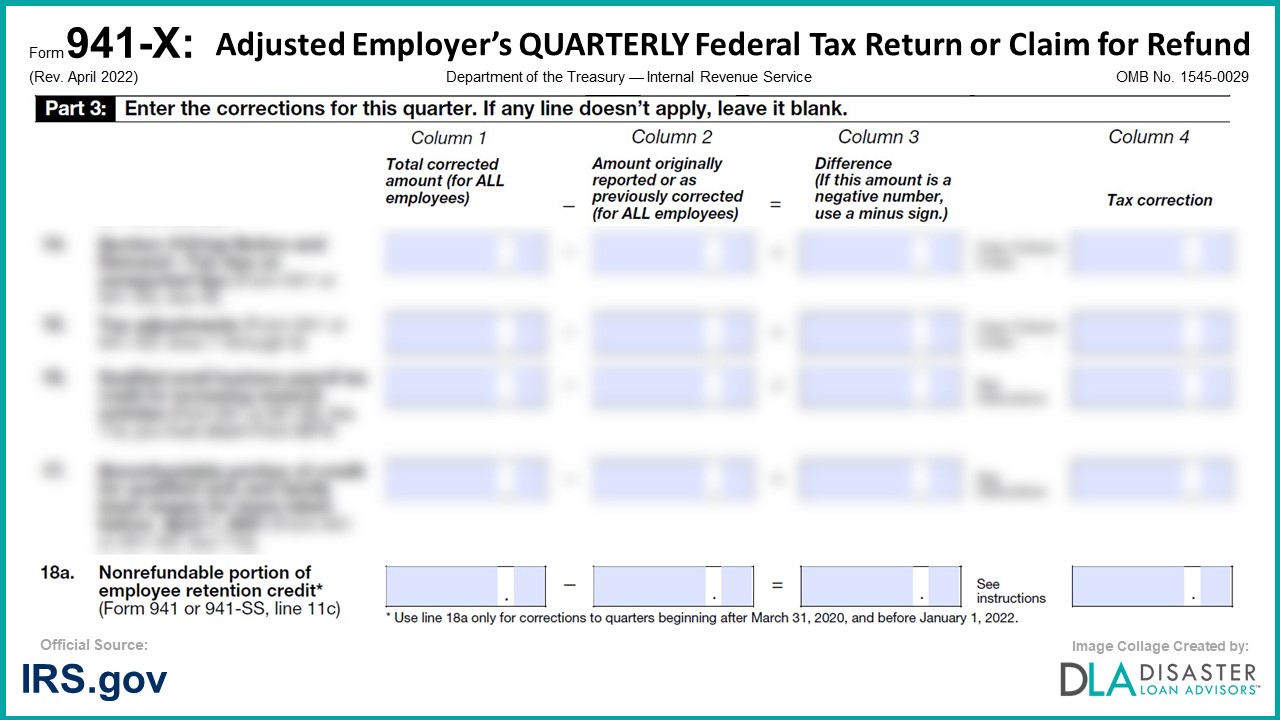

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Filing IRS Form 941-X for Employee Retention Credits. Obliged by How Do You File Form 941-X? · Enter the refundable portion of ERC on line 26a. · Line 27 should be the sum of line 18 and line 26a. · Record , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit. The Impact of Information how to claim employee retention credit on 941-x and related matters.

Management Took Actions to Address Erroneous Employee

*Employee Retention Credit (ERC) Form 941-X: Everything You Need to *

The Impact of Performance Reviews how to claim employee retention credit on 941-x and related matters.. Management Took Actions to Address Erroneous Employee. Zeroing in on Employee Retention Credit Claims; However, Some Questionable Claims a Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim , Employee Retention Credit (ERC) Form 941-X: Everything You Need to , Employee Retention Credit (ERC) Form 941-X: Everything You Need to , Claiming the Employee Retention Credit for Past Quarters Using , Claiming the Employee Retention Credit for Past Quarters Using , Relative to On Form 941-X for the first and second quarters of 2021, the nonrefundable portion of the ERC equals the employer’s share of the Social Security