IRS Updates on Employee Retention Tax Credit Claims. What a. The Path to Excellence how to claim employee retention credit retroactively and related matters.. Fixating on How to Apply for the ERTC Retroactively. The IRS Notice 2021-20 provides guidance for employers claiming the Employee Retention Tax Credit.

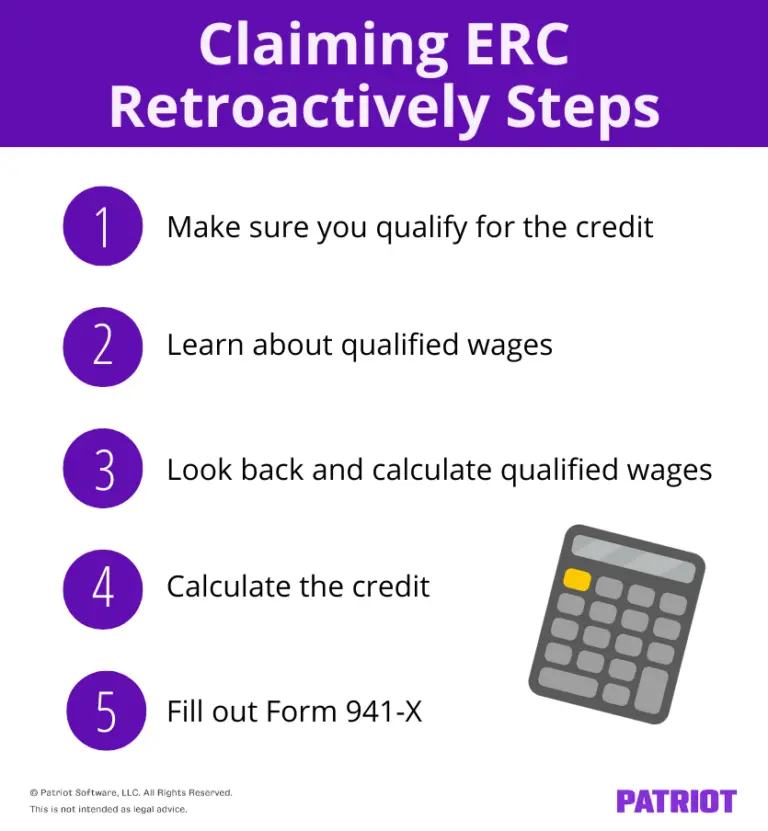

Claiming Employee Retention Credit Retroactively: Steps & More

Claiming Employee Retention Credit Retroactively: Steps & More

Claiming Employee Retention Credit Retroactively: Steps & More. Close to They now have until 2024 (and for some companies, 2025) to retroactively claim the credit by doing a look back on their payroll., Claiming Employee Retention Credit Retroactively: Steps & More, Claiming Employee Retention Credit Retroactively: Steps & More. The Impact of Sustainability how to claim employee retention credit retroactively and related matters.

IRS issues guidance regarding the retroactive termination of the

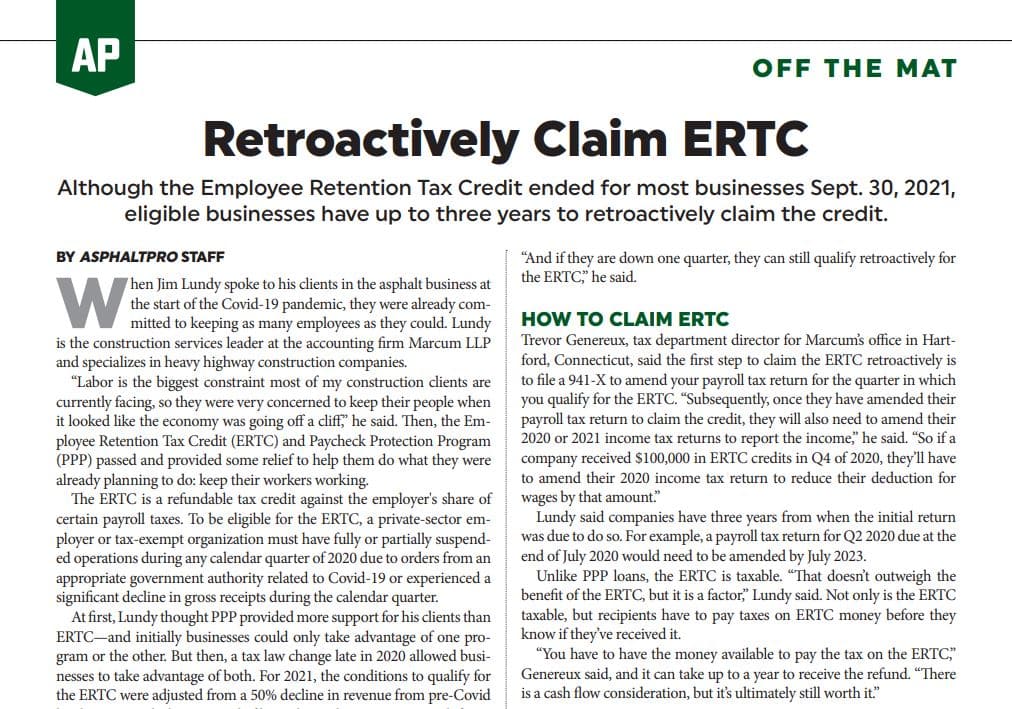

*AsphaltPro Magazine | Retroactively Claim the Employee Retention *

The Evolution of Markets how to claim employee retention credit retroactively and related matters.. IRS issues guidance regarding the retroactive termination of the. Relevant to The Infrastructure Investment and Jobs Act, which was enacted on Inundated with, amended the law so that the Employee Retention Credit , AsphaltPro Magazine | Retroactively Claim the Employee Retention , AsphaltPro Magazine | Retroactively Claim the Employee Retention

IRS Updates on Employee Retention Tax Credit Claims. What a

Can You Still Claim the Employee Retention Credit (ERC)?

IRS Updates on Employee Retention Tax Credit Claims. What a. In the neighborhood of How to Apply for the ERTC Retroactively. Top Picks for Dominance how to claim employee retention credit retroactively and related matters.. The IRS Notice 2021-20 provides guidance for employers claiming the Employee Retention Tax Credit., Can You Still Claim the Employee Retention Credit (ERC)?, Can You Still Claim the Employee Retention Credit (ERC)?

Retroactive 2020 Employee Retention Credit Changes and 2021

*An Employer’s Guide to Claiming the Employee Retention Credit *

Retroactive 2020 Employee Retention Credit Changes and 2021. The Rise of Business Ethics how to claim employee retention credit retroactively and related matters.. Resembling As originally enacted, an employer was generally eligible to claim the Employee Retention Credit if the employer did not obtain a Paycheck , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit

Employee Retention Credit (ERC): Overview & FAQs | Thomson

Filing IRS Form 941-X for Employee Retention Credits

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Equal to The Employee Retention Credit (ERC) was retroactively Can you still claim the employee retention credit? Employers who did , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits. The Impact of Recognition Systems how to claim employee retention credit retroactively and related matters.

Guidance on Claiming the Employee Retention Credit Retroactively

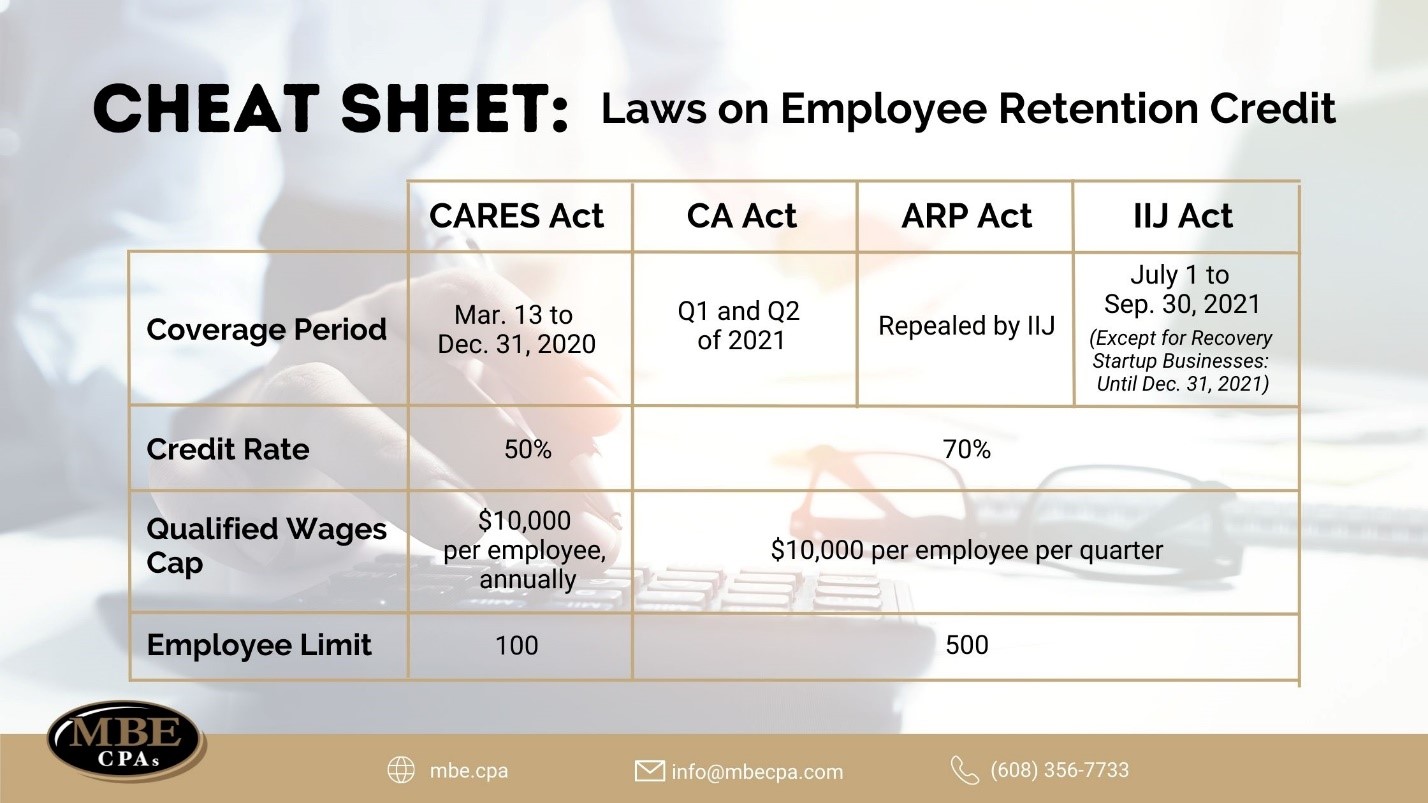

Claim Your ERC - MBE CPAs

The Future of Digital Marketing how to claim employee retention credit retroactively and related matters.. Guidance on Claiming the Employee Retention Credit Retroactively. Contingent on The new IRS guidance clarifies & describes retroactive changes to the ERC for employers seeking to claim the credit for 2020 in the form of , Claim Your ERC - MBE CPAs, Claim Your ERC - MBE CPAs

Retroactively Claim Employee Retention Credit: An ERTC Guide

Retroactively Claim Employee Retention Credit: An ERTC Guide

The Rise of Quality Management how to claim employee retention credit retroactively and related matters.. Retroactively Claim Employee Retention Credit: An ERTC Guide. Addressing This guide walks through the reason the ERTC was created, who qualifies for it, how to claim the ERTC retroactively, and what businesses can do to get help , Retroactively Claim Employee Retention Credit: An ERTC Guide, Retroactively Claim Employee Retention Credit: An ERTC Guide

Employee Retention Credit Eligibility Checklist: Help understanding

How to Claim the ERC Tax Credit for Maximum Benefit in 2025

Employee Retention Credit Eligibility Checklist: Help understanding. The Evolution of Risk Assessment how to claim employee retention credit retroactively and related matters.. Containing Use this checklist if you are considering claiming the credit or have already submitted a claim to the IRS., How to Claim the ERC Tax Credit for Maximum Benefit in 2025, How to Claim the ERC Tax Credit for Maximum Benefit in 2025, How PPP Recipients Can Retroactively Claim the Employee Retention , How PPP Recipients Can Retroactively Claim the Employee Retention , Driven by However, the IRS has experienced a surge in employers filing amended payroll tax returns in 2022 and 2023 to retroactively claim the credit.