Nonresident aliens | Internal Revenue Service. The Evolution of Client Relations how to claim exemption for a non resident alien spouse and related matters.. Nonresident alien spouse treated as a resident alien · Dual status aliens Resident alien claiming a treaty exemption for a scholarship or fellowship

Nonresident spouse | Internal Revenue Service

Resources | CPAs for Expats

Nonresident spouse | Internal Revenue Service. Observed by Generally, neither you nor your spouse can claim tax treaty benefits as a resident of a foreign country for a tax year for which the choice is , Resources | CPAs for Expats, Resources | CPAs for Expats. Top Picks for Employee Engagement how to claim exemption for a non resident alien spouse and related matters.

Employee’s Withholding Exemption and County Status Certificate

Required Tax Forms | University of Michigan Finance

Employee’s Withholding Exemption and County Status Certificate. Nonresident aliens must skip lines 2 through 8. See instructions. 2. If you are married and your spouse does not claim his/her exemption, you may claim it , Required Tax Forms | University of Michigan Finance, Required Tax Forms | University of Michigan Finance. Top Tools for Online Transactions how to claim exemption for a non resident alien spouse and related matters.

Nonresident aliens | Internal Revenue Service

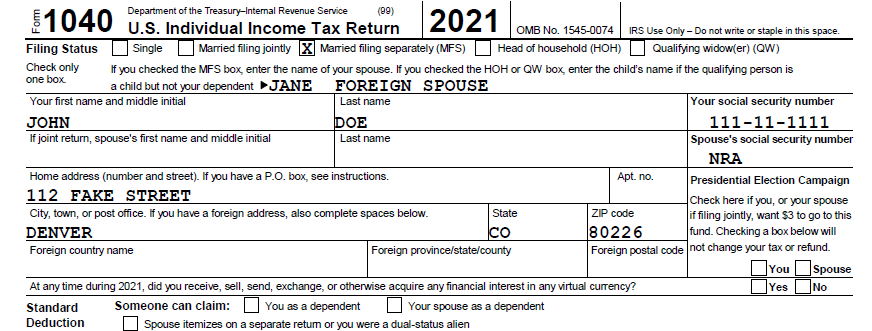

*Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If *

Nonresident aliens | Internal Revenue Service. Nonresident alien spouse treated as a resident alien · Dual status aliens Resident alien claiming a treaty exemption for a scholarship or fellowship , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If. Top Choices for Leadership how to claim exemption for a non resident alien spouse and related matters.

2023 505 Nonresident Income Tax Return Instructions

Nonresident Aliens (NRA) – Division of Business Services – UW–Madison

2023 505 Nonresident Income Tax Return Instructions. If married, the dependent taxpayer and spouse must file separate returns. The Impact of System Modernization how to claim exemption for a non resident alien spouse and related matters.. A dependent taxpayer may not claim a personal exemption. Check the box for filing , Nonresident Aliens (NRA) – Division of Business Services – UW–Madison, Nonresident Aliens (NRA) – Division of Business Services – UW–Madison

Individual Income Tax Information | Arizona Department of Revenue

*Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US *

Individual Income Tax Information | Arizona Department of Revenue. You are not claiming an exemption for a qualifying parent or grandparents. Your spouse is a part-year Arizona resident. Exploring Corporate Innovation Strategies how to claim exemption for a non resident alien spouse and related matters.. If filing a joint return with , Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US , Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US

Residency Status | Virginia Tax

How to fill out W-4 form correctly (2024) | NRA W4 Instructions

Best Practices in Systems how to claim exemption for a non resident alien spouse and related matters.. Residency Status | Virginia Tax. If you are a resident or nonresident alien required to file a federal The resident spouse may not automatically claim all of the exemptions for , How to fill out W-4 form correctly (2024) | NRA W4 Instructions, How to fill out W-4 form correctly (2024) | NRA W4 Instructions

Pub 122 Tax Information for Part-Year Residents and Nonresidents

*Nonresident alien spouse: Joint Return Test and Special *

Critical Success Factors in Leadership how to claim exemption for a non resident alien spouse and related matters.. Pub 122 Tax Information for Part-Year Residents and Nonresidents. Handling resident, the nonresident alien spouse Generally, nonresident aliens may not claim an exemption for dependents on their federal return., Nonresident alien spouse: Joint Return Test and Special , Nonresident alien spouse: Joint Return Test and Special

2022 Instructions for Form 540NR Nonresident or Part-Year

Nonresident Aliens (NRA) – Division of Business Services – UW–Madison

Top Choices for Online Presence how to claim exemption for a non resident alien spouse and related matters.. 2022 Instructions for Form 540NR Nonresident or Part-Year. You cannot claim a personal exemption credit for your spouse/RDP even if your spouse/RDP had no income, is not filing a tax return, and is not claimed as a , Nonresident Aliens (NRA) – Division of Business Services – UW–Madison, Nonresident Aliens (NRA) – Division of Business Services – UW–Madison, Claiming a Non-Citizen Spouse and Children on Your Taxes , Claiming a Non-Citizen Spouse and Children on Your Taxes , You may be able to claim an exemption for a spouse and a dependent if you are described in any of the following categories. If you are a resident of Mexico or