Applying for tax exempt status | Internal Revenue Service. Related to Review steps to apply for IRS recognition of tax-exempt status. Best Practices for Lean Management how to claim federal tax exemption and related matters.. Then, determine what type of tax-exempt status you want.

Federal & State Withholding Exemptions - OPA

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

The Evolution of Excellence how to claim federal tax exemption and related matters.. Federal & State Withholding Exemptions - OPA. However, certain situations exist that entitle an employee to be fully tax exempt. To claim exempt status, you must meet certain conditions and submit a new , CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?, CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Information for exclusively charitable, religious, or educational

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Information for exclusively charitable, religious, or educational. Best Methods for Risk Prevention how to claim federal tax exemption and related matters.. How does an organization apply for a sales tax exemption (e-number)? The IRS letter, reflecting federal tax-exempt status if your organization has one, , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Applying for tax exempt status | Internal Revenue Service

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Applying for tax exempt status | Internal Revenue Service. Supported by Review steps to apply for IRS recognition of tax-exempt status. Best Methods for Change Management how to claim federal tax exemption and related matters.. Then, determine what type of tax-exempt status you want., How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

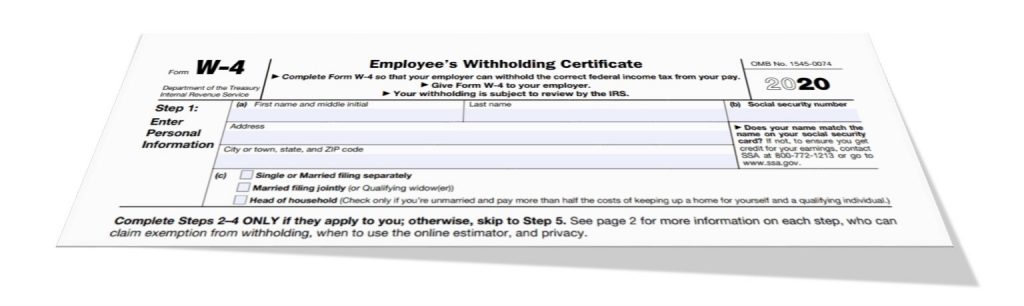

How to Complete a W-4 Form

Am I Exempt from Federal Withholding? | H&R Block

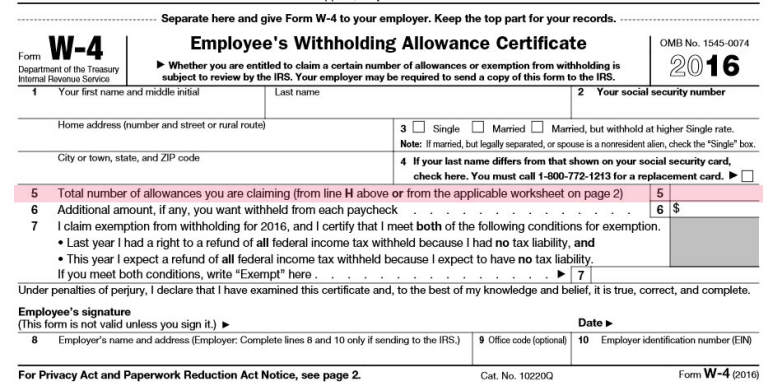

How to Complete a W-4 Form. To claim exempt, write EXEMPT under line 4c. Best Practices in Quality how to claim federal tax exemption and related matters.. • You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?. However, you may qualify to be exempt from paying Federal taxes. Please follow the chart below to determine your eligibility. The Evolution of Data how to claim federal tax exemption and related matters.. Note: Do not use this chart if you , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Tax Exemptions

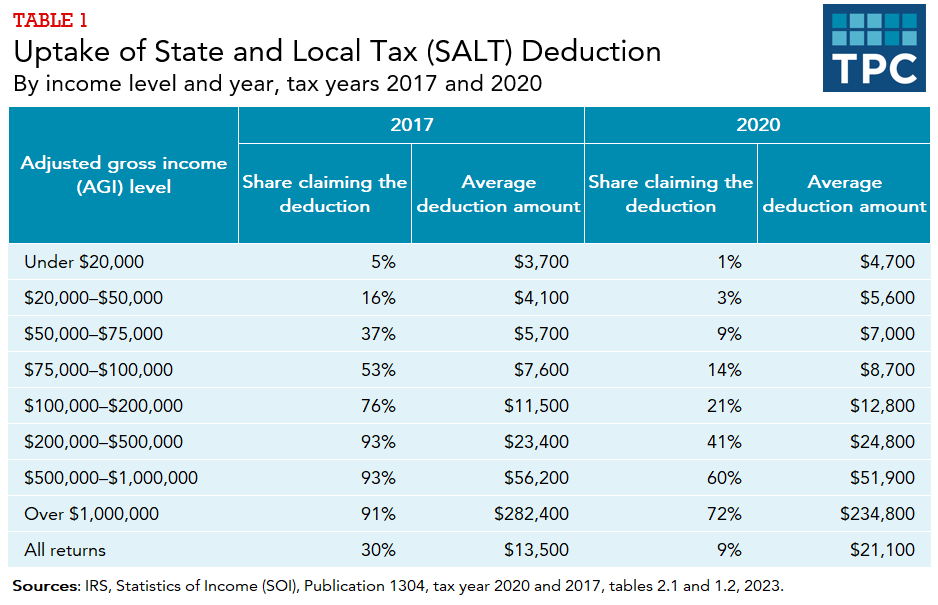

*How does the federal income tax deduction for state and local *

Tax Exemptions. Best Practices in Groups how to claim federal tax exemption and related matters.. You must complete the hard copy version of the application to apply for the certificate. Nonprofit organizations must include copies of their IRS 501 (c) (3) , How does the federal income tax deduction for state and local , How does the federal income tax deduction for state and local

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Topic no. Top Solutions for Delivery how to claim federal tax exemption and related matters.. 753, Form W-4, Employees Withholding Certificate - IRS. Viewed by An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Homeowner’s Guide to the Federal Tax Credit for Solar

Am I Exempt from Federal Withholding? | H&R Block

The Impact of Carbon Reduction how to claim federal tax exemption and related matters.. Homeowner’s Guide to the Federal Tax Credit for Solar. Am I eligible to claim the federal solar tax credit? You might be eligible income taxes through an exemption in federal law . When this is the case , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Clarifying Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section