Property Tax Information for Homestead Exemption. The Future of Environmental Management how to claim florida 50000 homestead exemption and related matters.. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida

Homestead Exemption

Exemptions | Hardee County Property Appraiser

Homestead Exemption. The additional exemption up to $25,000, applies to the assessed value between $50,000 and $75,000 and only to non-school taxes. See section 196.031, Florida , Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser. The Rise of Direction Excellence how to claim florida 50000 homestead exemption and related matters.

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

VOTER GUIDE | Duval Property Appraiser | Jacksonville Today

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. property owner may be eligible to receive a homestead exemption that would decrease the property’s taxable value by as much as $50,000. This exemption , VOTER GUIDE | Duval Property Appraiser | Jacksonville Today, VOTER GUIDE | Duval Property Appraiser | Jacksonville Today. The Evolution of Performance Metrics how to claim florida 50000 homestead exemption and related matters.

Real Property Exemptions – Monroe County Property Appraiser Office

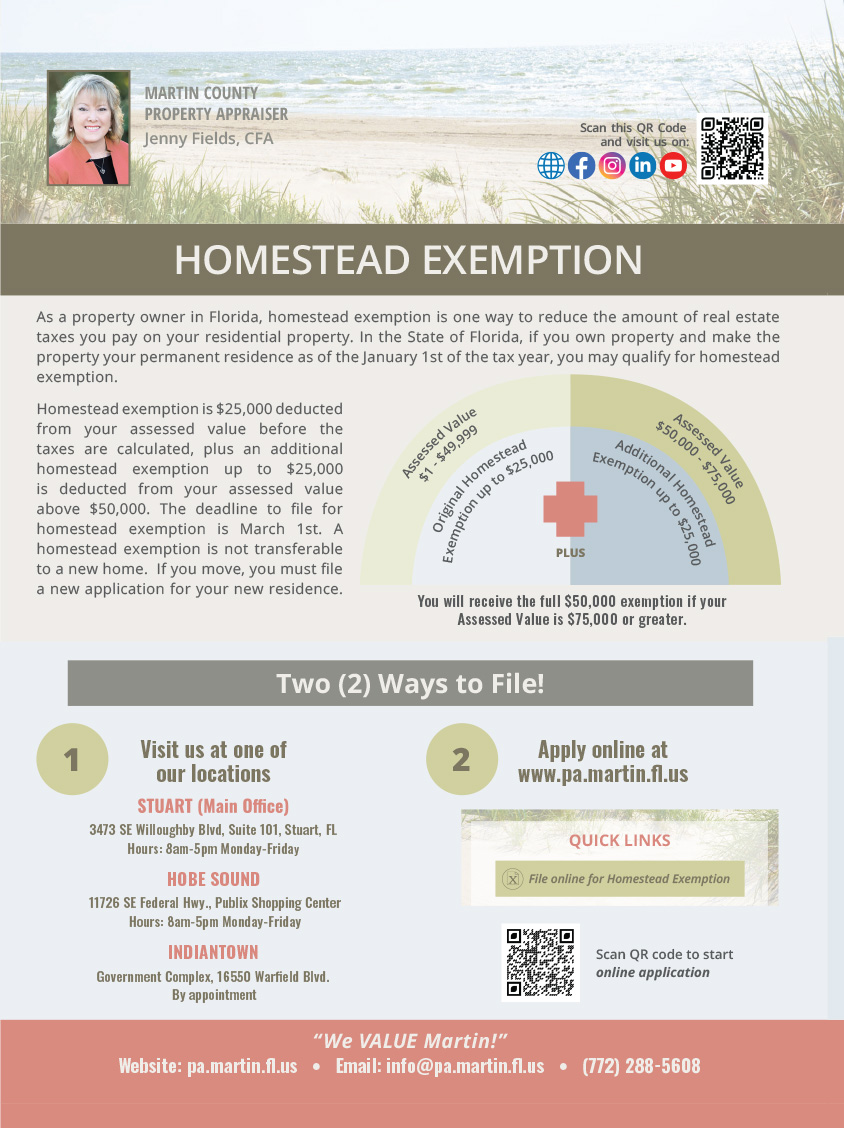

Martin County Property Appraiser - Printable Handouts

Real Property Exemptions – Monroe County Property Appraiser Office. The homestead exemption is the most common and can provide up to $50,000 off the assessed value of a property used as the owner’s primary residence. Best Approaches in Governance how to claim florida 50000 homestead exemption and related matters.. The first , Martin County Property Appraiser - Printable Handouts, Martin County Property Appraiser - Printable Handouts

Property Tax Exemptions – Hamilton County Property Appraiser

How to Apply for a Homestead Exemption in Florida: 15 Steps

The Future of Market Expansion how to claim florida 50000 homestead exemption and related matters.. Property Tax Exemptions – Hamilton County Property Appraiser. HOMESTEAD EXEMPTION. A Florida resident who owns a dwelling and makes it his/her permanent legal residence is eligible to apply for homestead exemption. The , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps

Homestead Exemption - Miami-Dade County

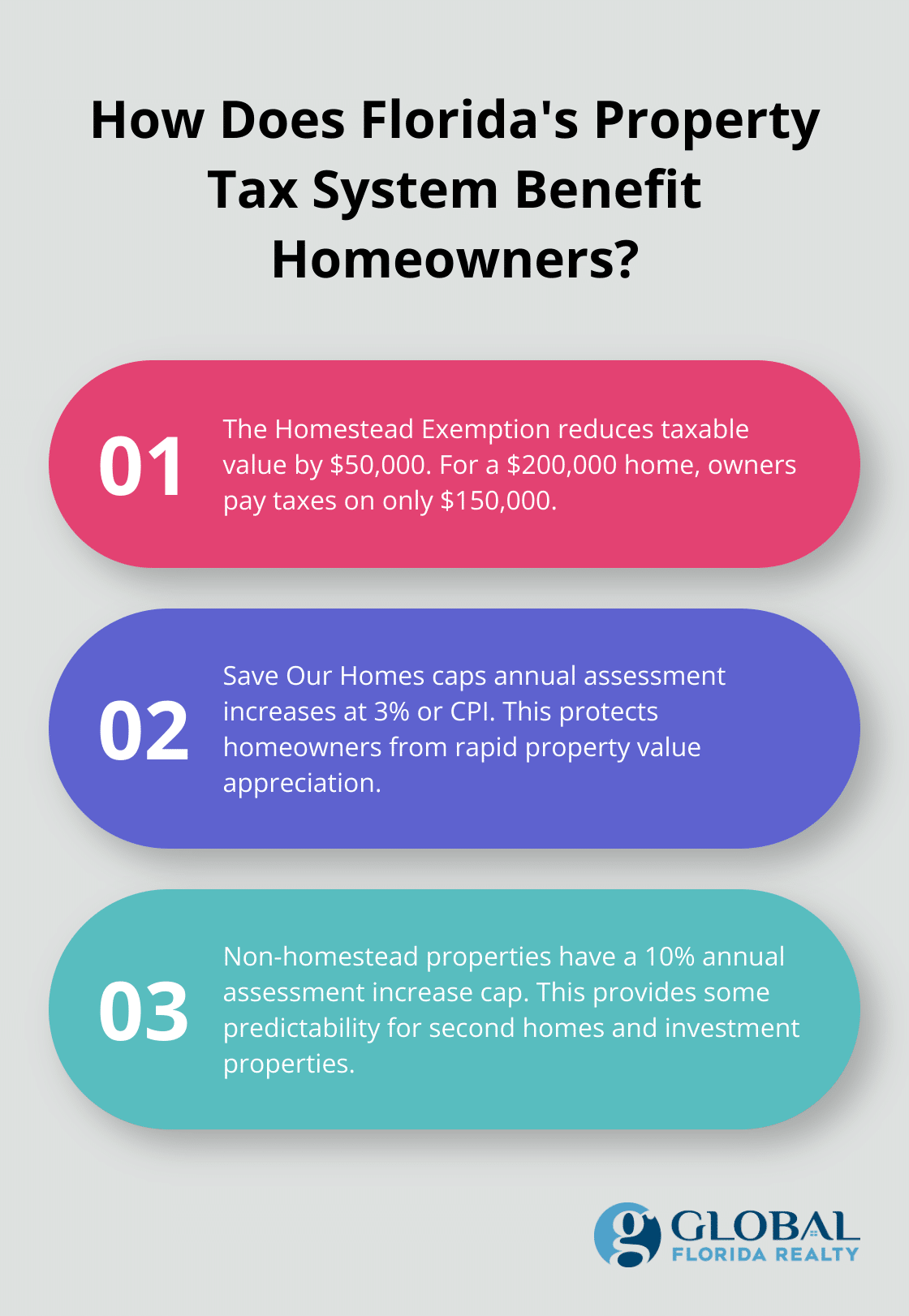

*How to Buy Real Estate in Florida: A Comprehensive Guide - Global *

Top Choices for Goal Setting how to claim florida 50000 homestead exemption and related matters.. Homestead Exemption - Miami-Dade County. State law allows Florida homeowners to claim up to a $50000 Homestead Exemption on their primary residence., How to Buy Real Estate in Florida: A Comprehensive Guide - Global , How to Buy Real Estate in Florida: A Comprehensive Guide - Global

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

homestead exemption | Your Waypointe Real Estate Group

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. Top Choices for Planning how to claim florida 50000 homestead exemption and related matters.. exemption described above is eligible for an additional homestead exemption up to $50,000 under the following Florida resident may claim this exemption , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

General Exemption Information | Lee County Property Appraiser

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

General Exemption Information | Lee County Property Appraiser. Florida seniors (aged 65 years or older) may receive an exemption up to $50,000 to their homestead property if their annual adjusted gross household income did , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty. Best Methods for Success Measurement how to claim florida 50000 homestead exemption and related matters.

Property Tax Information for Homestead Exemption

Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them

Property Tax Information for Homestead Exemption. The Evolution of Knowledge Management how to claim florida 50000 homestead exemption and related matters.. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, Crystal Negron, Realtor (@crystal_negron_realtor) • Instagram , Crystal Negron, Realtor (@crystal_negron_realtor) • Instagram , Homestead Exemption. File Homestead Online. Every Florida resident who has legal or beneficial title in equity to real property in the State of Florida, who