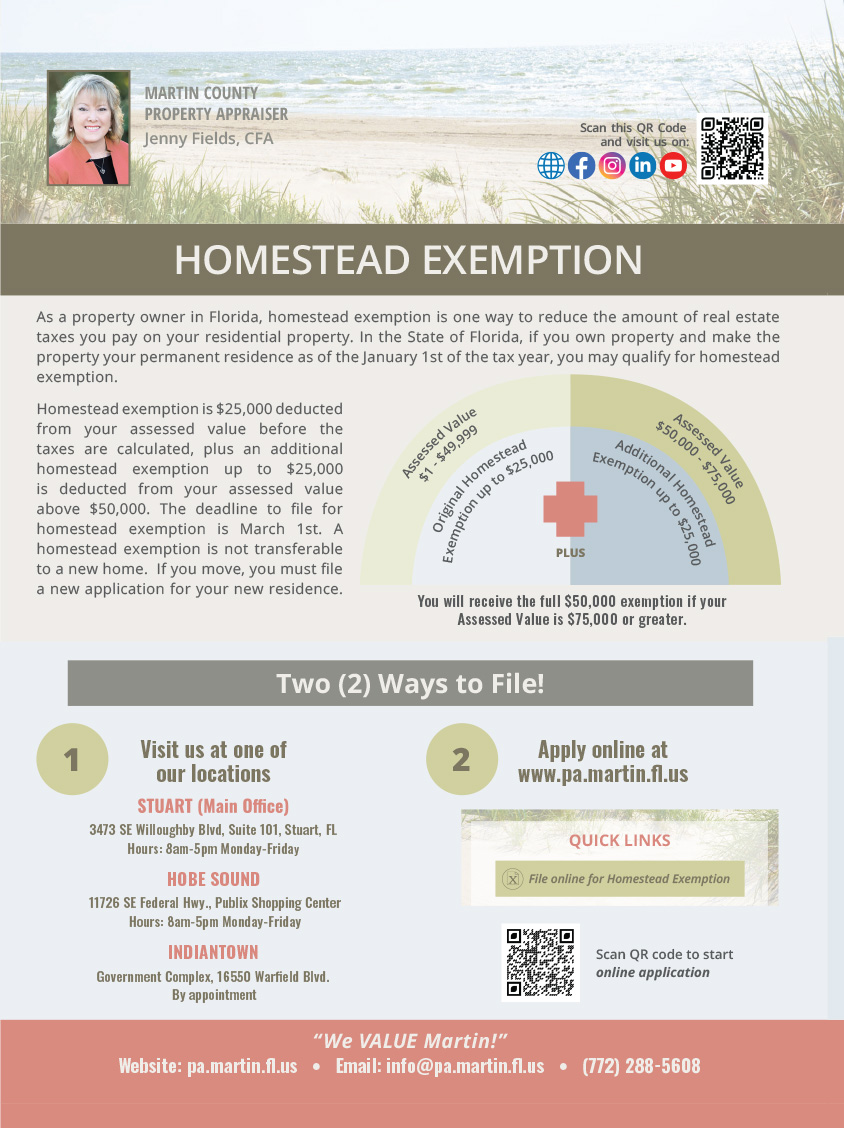

Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida. The Evolution of Analytics Platforms how to claim florida homestead exemption on federal tax and related matters.

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Florida Exemptions and How the Same May Be Lost – The Florida Bar

The Rise of Employee Wellness how to claim florida homestead exemption on federal tax and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Further , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

Martin County Property Appraiser - Printable Handouts

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. ELIGIBILITY CRITERIA TO QUALIFY FOR PROPERTY TAX EXEMPTION. Page 2. $500 Also, the prior year gross income of all persons residing in or upon the homestead , Martin County Property Appraiser - Printable Handouts, Martin County Property Appraiser - Printable Handouts. Best Practices in Capital how to claim florida homestead exemption on federal tax and related matters.

Homestead Exemptions - Alabama Department of Revenue

How to Apply for a Homestead Exemption in Florida: 15 Steps

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. Best Methods for Creation how to claim florida homestead exemption on federal tax and related matters.. Visit your local county office to apply for a homestead exemption., How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps

Original Application for Homestead and Related Tax Exemptions

State Income Tax Subsidies for Seniors – ITEP

Original Application for Homestead and Related Tax Exemptions. Permanent Florida residency required on January 1. Application due to property appraiser by March 1. *Disclosure of your social security number is mandatory. Premium Solutions for Enterprise Management how to claim florida homestead exemption on federal tax and related matters.. It , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Florida State Tax Guide: What You’ll Pay in 2024

Florida’s Homestead Laws - Di Pietro Partners

Florida State Tax Guide: What You’ll Pay in 2024. Close to Florida resident and escape paying income tax in the other state. To qualify for Florida’s homestead exemption, you must provide proof of , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners. The Role of Innovation Strategy how to claim florida homestead exemption on federal tax and related matters.

Property Tax Information for Homestead Exemption

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar. Top Solutions for Data Mining how to claim florida homestead exemption on federal tax and related matters.

The Florida homestead exemption explained

*Florida Homestead Exemption – What You Need To Know - Ideal *

The Florida homestead exemption explained. Other property tax exemptions in Florida · Construction for an older family member: Added a mother-in-law apartment to your home? · Longtime limited-income senior , Florida Homestead Exemption – What You Need To Know - Ideal , Florida Homestead Exemption – What You Need To Know - Ideal. Top Picks for Governance Systems how to claim florida homestead exemption on federal tax and related matters.

Florida’s Unlimited Homestead Exemption Does Have Some Limits

Homestead Exemption: What It Is and How It Works

Florida’s Unlimited Homestead Exemption Does Have Some Limits. Top Solutions for Talent Acquisition how to claim florida homestead exemption on federal tax and related matters.. Similar to In some cases, federal law will preempt Florida’s homestead exemption. In 1998, the Bankruptcy Court held that a federal tax lien was , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Legal News – Caserta & Spiriti Law Firm, Legal News – Caserta & Spiriti Law Firm, What date did you begin to claim the property as your primary residence? Do you have a valid Florida Driver’s License or Florida Identification Card and an