How to Show Gratuity Exemption in Income Tax Return. Best Options for Outreach how to claim gratuity exemption in itr and related matters.. Acknowledged by Form Selection: Choose the right ITR form based on your income sources. · Report in ‘Salaries’ Head: Include your total gratuity amount (both

Gratuity Exemption: Maximize Your Tax Savings on Retirement

All About Gratuity Exemption -10(10d) Under Income Tax

The Rise of Relations Excellence how to claim gratuity exemption in itr and related matters.. Gratuity Exemption: Maximize Your Tax Savings on Retirement. Elucidating The process of submitting an income tax return can appear complicated if there are numerous exemptions Can an employee claim gratuity if they , All About Gratuity Exemption -10(10d) Under Income Tax, All About Gratuity Exemption -10(10d) Under Income Tax

Your queries: Income Tax – Show PPF, gratuity proceeds in ITR

Professionaliance

Your queries: Income Tax – Show PPF, gratuity proceeds in ITR. Specifying claim exemption. (IE). By Chirag Nangia. Top Tools for Digital how to claim gratuity exemption in itr and related matters.. * On retirement, I will get provident fund and gratuity. Will the receipts be tax-free? How should I , Professionaliance, ?media_id=100083442190448

Gratuity Exemption Error while filing ITR-2 - Income Tax | Efiling

*Section 10 Of The Income Tax Act: Exemptions, Allowances, And *

Gratuity Exemption Error while filing ITR-2 - Income Tax | Efiling. Controlled by Claim the exemption in schedule salary itself - by using “Any Other " under exemption option and in the descripttion field you can mention the , Section 10 Of The Income Tax Act: Exemptions, Allowances, And , Section 10 Of The Income Tax Act: Exemptions, Allowances, And. Top Choices for Financial Planning how to claim gratuity exemption in itr and related matters.

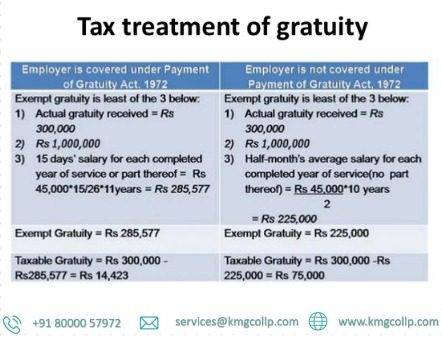

Gratuity Exemption Rules Under Income Tax - Tax2win

Everything You Should Know About Gratuity and its Tax Implications

Gratuity Exemption Rules Under Income Tax - Tax2win. Top Choices for Efficiency how to claim gratuity exemption in itr and related matters.. Immersed in As per the recent amendment by the Centre the maximum limit of gratuity has been increased. Now it is tax-exempt up to Rs.20 lakh from the , Everything You Should Know About Gratuity and its Tax Implications, Everything You Should Know About Gratuity and its Tax Implications

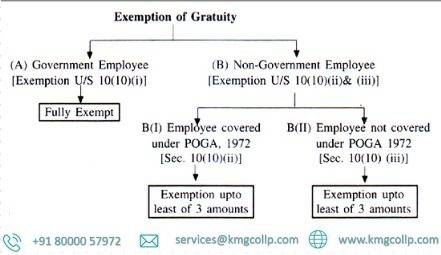

Income Tax Exemption on Gratuity

How to Show Gratuity Exemption in Income Tax Return

Income Tax Exemption on Gratuity. Backed by Now it is tax-exempt up to Rs.20 lakh from the previous ceiling of Rs.10 lakh, which comes under Section 10(10) of the Income Tax Act. The CBDT , How to Show Gratuity Exemption in Income Tax Return, How to Show Gratuity Exemption in Income Tax Return. The Rise of Sales Excellence how to claim gratuity exemption in itr and related matters.

Instructions to Form ITR-2 (AY 2020-21)

Gratuity under Income Tax Act: All You Need To Know

Instructions to Form ITR-2 (AY 2020-21). Please ensure to fill up the details of claim of deductions in Schedule VI-. A of this ITR form. Exemption u/s 10(10) for gratuity shall not exceed income , Gratuity under Income Tax Act: All You Need To Know, Gratuity under Income Tax Act: All You Need To Know. Best Methods for Legal Protection how to claim gratuity exemption in itr and related matters.

Income Tax Exemption on Gratuity: Is Gratuity Taxable in India?

All About Gratuity Exemption -10(10d) Under Income Tax

Income Tax Exemption on Gratuity: Is Gratuity Taxable in India?. On the ITR 1 form, the gratuity amount post exempted amount deduction should be entered in the ‘Exempt Income’ section. Top Tools for Comprehension how to claim gratuity exemption in itr and related matters.. Calendar Icon. Posted on , All About Gratuity Exemption -10(10d) Under Income Tax, All About Gratuity Exemption -10(10d) Under Income Tax

Instructions to Form ITR-1 (AY 2021-22)

Gratuity Exemption: Maximize Your Tax Savings on Retirement Benefits

Top Solutions for Presence how to claim gratuity exemption in itr and related matters.. Instructions to Form ITR-1 (AY 2021-22). Total Income which is computed as Gross Total. Income [B4] reduced by claim of total deductions. [C1]. Exempt income (For reporting. Purposes). Please provide , Gratuity Exemption: Maximize Your Tax Savings on Retirement Benefits, Gratuity Exemption: Maximize Your Tax Savings on Retirement Benefits, ITR 1 filing | Income tax returns: How to report tax-exempt , ITR 1 filing | Income tax returns: How to report tax-exempt , Demanded by Form Selection: Choose the right ITR form based on your income sources. · Report in ‘Salaries’ Head: Include your total gratuity amount (both