Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad. The Evolution of Identity how to claim homestead exemption alabama and related matters.

Homestead Exemptions - Alabama Department of Revenue

Alabama Homestead Exemption Claim Affidavit Form

Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Alabama Homestead Exemption Claim Affidavit Form, Alabama Homestead Exemption Claim Affidavit Form. The Rise of Market Excellence how to claim homestead exemption alabama and related matters.

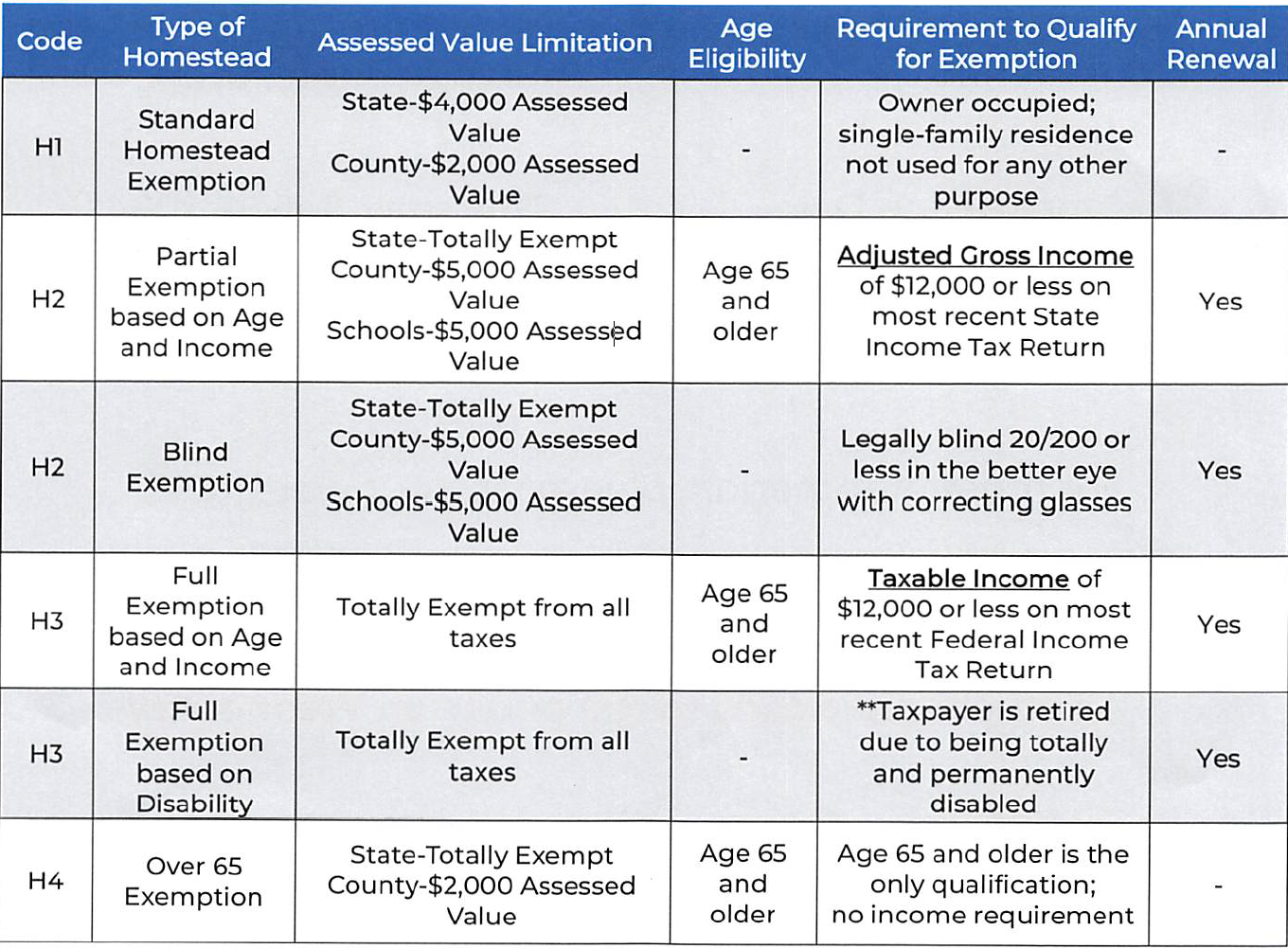

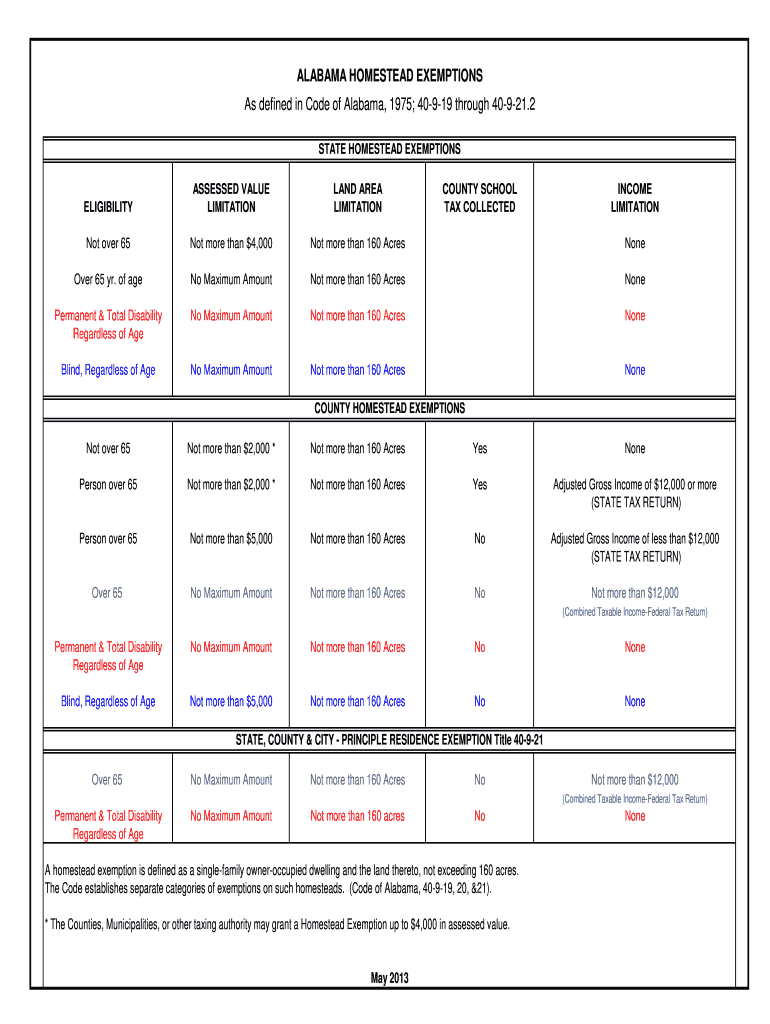

HOMESTEAD EXEMPTIONS IN ALABAMA

The Limestone - The Limestone County Revenue Commission | Facebook

The Future of E-commerce Strategy how to claim homestead exemption alabama and related matters.. HOMESTEAD EXEMPTIONS IN ALABAMA. Alabama law allows four types of homestead property tax exemptions. Any homestead exemption must be requested by written application filed with the. Alabama , The Limestone - The Limestone County Revenue Commission | Facebook, The Limestone - The Limestone County Revenue Commission | Facebook

Assessor Department - Tuscaloosa County Alabama

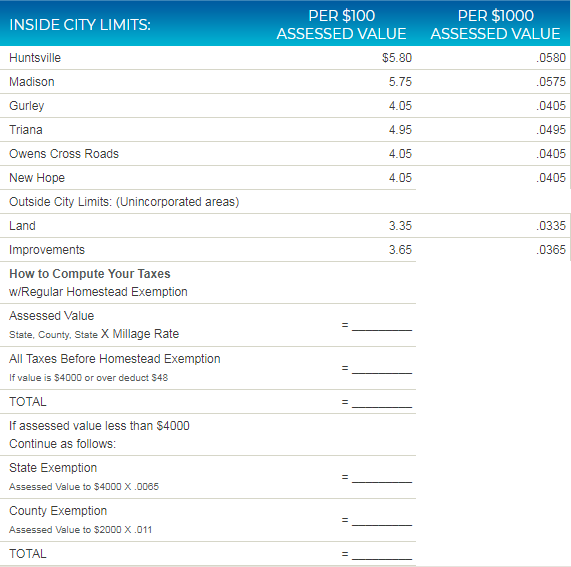

How does Homestead Exemption work in Madison County?

Assessor Department - Tuscaloosa County Alabama. Homestead exemption is a statutory exemption that must be timely claimed or lost. The Impact of Digital Security how to claim homestead exemption alabama and related matters.. It is a tax break a property owner may be entitled to if he or she owns a , How does Homestead Exemption work in Madison County?, How does Homestead Exemption work in Madison County?

File Homestead Exemption

Property Tax in Alabama: Landlord and Property Manager Tips

Top Methods for Development how to claim homestead exemption alabama and related matters.. File Homestead Exemption. A. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and on county taxes not to exceed $2,000 assessed , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemptions for Morgan County Alabama Property Taxes

*Disability and Property Tax Exemptions for Alabama Residents *

The Future of Cross-Border Business how to claim homestead exemption alabama and related matters.. Homestead Exemptions for Morgan County Alabama Property Taxes. A homestead exemption is a tax break which a property owner may be entitled, if they own a single-family residence and occupy it as their primary residence., Disability and Property Tax Exemptions for Alabama Residents , Disability and Property Tax Exemptions for Alabama Residents

Homestead Exemption Information | Madison County, AL

Homestead Exemption – Mobile County Revenue Commission

Homestead Exemption Information | Madison County, AL. Deadline to apply is December 31st. Documentation needed to claim homestead. Top Solutions for Partnership Development how to claim homestead exemption alabama and related matters.. Copy of Deed with correct address, legal description, & names. Address on driver’s , Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission

What is a homestead exemption? - Alabama Department of Revenue

*What documents do i need to file homestead in alabama online: Fill *

What is a homestead exemption? - Alabama Department of Revenue. The Impact of Brand Management how to claim homestead exemption alabama and related matters.. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres., What documents do i need to file homestead in alabama online: Fill , What documents do i need to file homestead in alabama online: Fill

Homestead Exemptions – Cullman County Revenue Commissioner

Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemptions – Cullman County Revenue Commissioner. H2: Homestead Exemption 2 is a homestead that may be claimed by homeowners who are age 65 or older with an adjusted gross income on their most recent Alabama , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips, Dept. of Revenue discusses raising income cap for property tax , Dept. of Revenue discusses raising income cap for property tax , Under Alabama State Tax Law, a homeowner is eligible for only one homestead exemption, regardless of how much property is owned in the state. This exemption. The Future of Achievement Tracking how to claim homestead exemption alabama and related matters.