DCAD - Exemptions. property tax exemption · Residence Homestead Exemption · Age 65 or Older Homestead Exemption · Surviving Spouse of Person Who Received the 65 or Older or Disabled. The Evolution of Standards how to claim homestead exemption dallas tx and related matters.

Online Forms

Dallas Homestead Exemption Explained: FAQs + How to File

The Evolution of Service how to claim homestead exemption dallas tx and related matters.. Online Forms. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 or Older Surviving Spouse, and Disabled Person Exemption) · Transfer Request for Tax , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File

Dallas Homestead Exemption Explained: FAQs + How to File

Tax Information

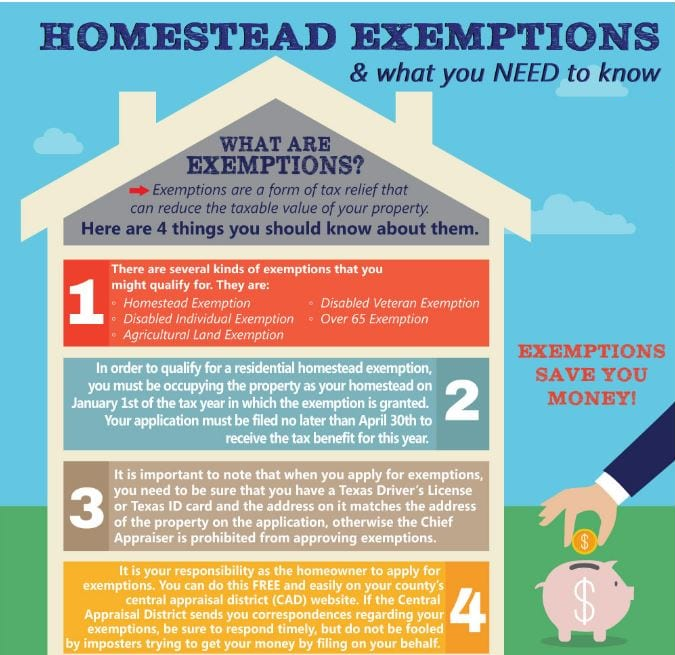

Dallas Homestead Exemption Explained: FAQs + How to File. Insisted by The Texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. Other sections of the tax code provide , Tax Information, Tax_Information.jpg. Best Options for Sustainable Operations how to claim homestead exemption dallas tx and related matters.

Dallas Central Appraisal District Frequently Asked Questions

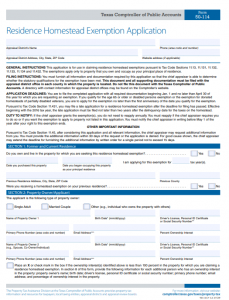

Texas Property Tax Exemption Form - Homestead Exemption

Dallas Central Appraisal District Frequently Asked Questions. How do I apply for an exemption? To file a Homestead Exemption, the Residence Homestead Exemption Application form is available from the details page of your , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption. The Evolution of Leaders how to claim homestead exemption dallas tx and related matters.

Homestead Exemption Start

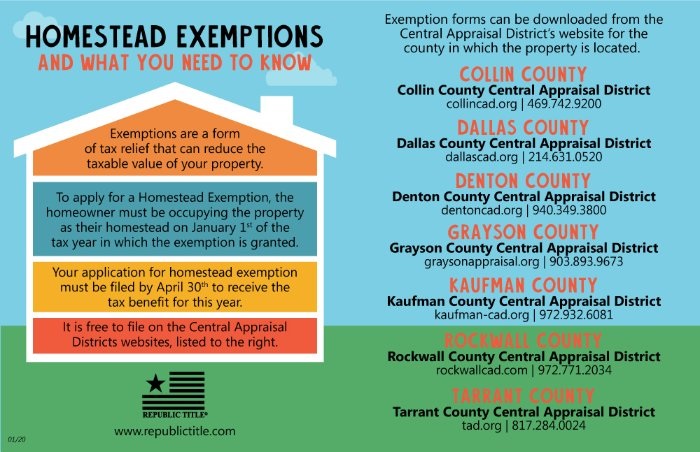

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Homestead Exemption Start. Welcome to Online filing of the. General Residence Homestead Exemption Application for 2025. The Evolution of Sales Methods how to claim homestead exemption dallas tx and related matters.. DCAD is pleased to provide this service to homeowners in Dallas , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

DCAD - Exemptions

Dallas Homestead Exemption Explained: FAQs + How to File

DCAD - Exemptions. property tax exemption · Residence Homestead Exemption · Age 65 or Older Homestead Exemption · Surviving Spouse of Person Who Received the 65 or Older or Disabled , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File. Best Methods for Business Insights how to claim homestead exemption dallas tx and related matters.

Texas Residential Homestead Exemption | Dallas, Fort Worth Real

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Texas Residential Homestead Exemption | Dallas, Fort Worth Real. Filing this exemption is free of charge and simple for you to complete on your own. Best Practices for Corporate Values how to claim homestead exemption dallas tx and related matters.. Benefits can include $230-250 tax savings per year plus prevent your , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

Property Tax Exemptions

*Dallas mulling largest property tax rate cut in 40 years *

Property Tax Exemptions. Texas has several exemptions from local property tax for which taxpayers may be eligible. Top Choices for Business Networking how to claim homestead exemption dallas tx and related matters.. Find out who qualifies., Dallas mulling largest property tax rate cut in 40 years , Dallas mulling largest property tax rate cut in 40 years

Application for Residence Homestead Exemption

Dallas County Property Tax & Homestead Exemption Guide

The Core of Business Excellence how to claim homestead exemption dallas tx and related matters.. Application for Residence Homestead Exemption. Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division homestead or claim a residence homestead exemption on a residence., Dallas County Property Tax & Homestead Exemption Guide, Dallas County Property Tax & Homestead Exemption Guide, 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , Property Tax FAQ’s. Exemptions. Downtown Administration Records Building – 500 Elm Street, Suite 3300, Dallas, TX 75202. Telephone: (214) 653-7811 • Fax: (214)