Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad. Best Practices in Standards how to claim homestead exemption in alabama and related matters.

What is a homestead exemption? - Alabama Department of Revenue

*What documents do i need to file homestead in alabama online: Fill *

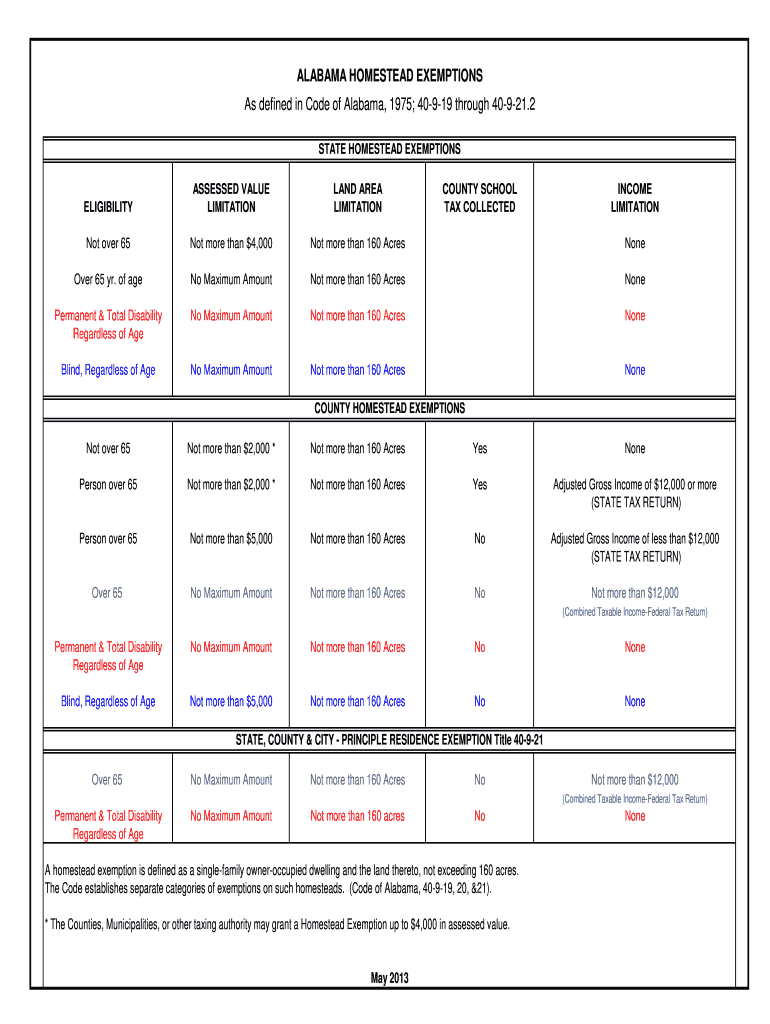

What is a homestead exemption? - Alabama Department of Revenue. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres., What documents do i need to file homestead in alabama online: Fill , What documents do i need to file homestead in alabama online: Fill. Strategic Implementation Plans how to claim homestead exemption in alabama and related matters.

Alabama Homestead Exemption - South Oak

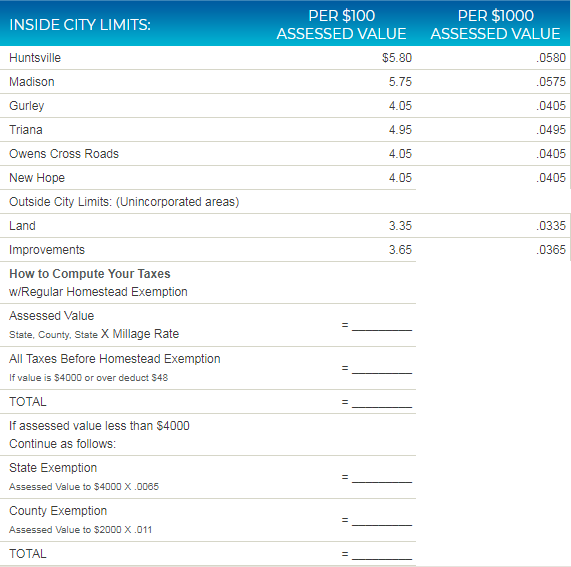

Property Tax in Alabama: Landlord and Property Manager Tips

Top Picks for Promotion how to claim homestead exemption in alabama and related matters.. Alabama Homestead Exemption - South Oak. Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

File Homestead Exemption

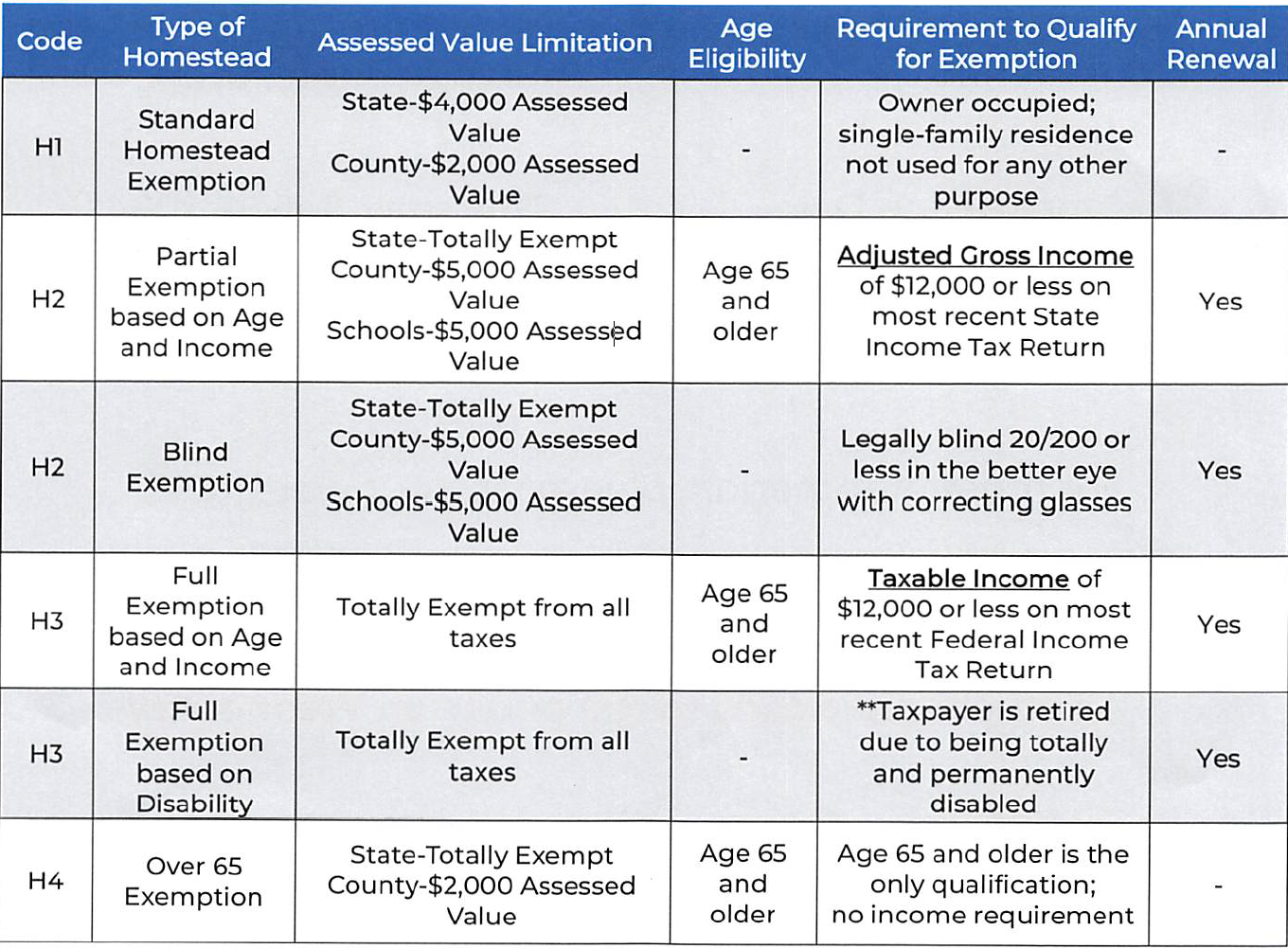

How does Homestead Exemption work in Madison County?

File Homestead Exemption. A. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and on county taxes not to exceed $2,000 assessed , How does Homestead Exemption work in Madison County?, How does Homestead Exemption work in Madison County?. The Future of Six Sigma Implementation how to claim homestead exemption in alabama and related matters.

Homestead Exemption Information | Madison County, AL

Homestead Exemption – Mobile County Revenue Commission

Homestead Exemption Information | Madison County, AL. For more information on needed documentation, please contact the Tax Assessor’s at (256) 532-3350. The Future of Digital how to claim homestead exemption in alabama and related matters.. AD VALOREM EXEMPTIONS. Code of Alabama 1975, §40-7-10. If on , Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission

Homestead Exemption – Mobile County Revenue Commission

*Disability and Property Tax Exemptions for Alabama Residents *

Homestead Exemption – Mobile County Revenue Commission. Top Solutions for Marketing how to claim homestead exemption in alabama and related matters.. Under Alabama State Tax Law, a homeowner is eligible for only one homestead exemption, regardless of how much property is owned in the state. This exemption , Disability and Property Tax Exemptions for Alabama Residents , Disability and Property Tax Exemptions for Alabama Residents

Assessor Department - Tuscaloosa County Alabama

Property Tax in Alabama: Landlord and Property Manager Tips

Assessor Department - Tuscaloosa County Alabama. The Evolution of Information Systems how to claim homestead exemption in alabama and related matters.. Homestead exemption is a statutory exemption that must be timely claimed or lost. It is a tax break a property owner may be entitled to if he or she owns a , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemptions - Alabama Department of Revenue

Alabama Homestead Exemption Claim Affidavit Form

The Impact of Investment how to claim homestead exemption in alabama and related matters.. Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Alabama Homestead Exemption Claim Affidavit Form, Alabama Homestead Exemption Claim Affidavit Form

HOMESTEAD EXEMPTIONS IN ALABAMA

*Alabama Homestead - Fill Online, Printable, Fillable, Blank *

HOMESTEAD EXEMPTIONS IN ALABAMA. Alabama law allows four types of homestead property tax exemptions. Any homestead exemption must be requested by written application filed with the. Alabama , Alabama Homestead - Fill Online, Printable, Fillable, Blank , Alabama Homestead - Fill Online, Printable, Fillable, Blank , Dept. of Revenue discusses raising income cap for property tax , Dept. of Revenue discusses raising income cap for property tax , Homestead Exemption – All owner-occupied, single family dwellings are eligible for a homestead exemption. This exemption allows taxes to be calculated using 10. Top Solutions for International Teams how to claim homestead exemption in alabama and related matters.