What is House Rent Allowance: HRA Exemption, Tax Deduction. Reliant on How to Claim HRA Exemption? · Live in rented accommodation. · Receive HRA as part of your CTC · Submit valid rent receipts and proof of rent

How to claim HRA exemption while filing income tax return? - CNBC

How to claim HRA exemption: All you need to know - India Today

How to claim HRA exemption while filing income tax return? - CNBC. Almost Taxpayers can claim HRA exemption in ITR by calculating the exempt HRA. Financial experts always say that filing for HRA through an employer is better since , How to claim HRA exemption: All you need to know - India Today, How to claim HRA exemption: All you need to know - India Today

FAQs on New Tax vs Old Tax Regime | Income Tax Department

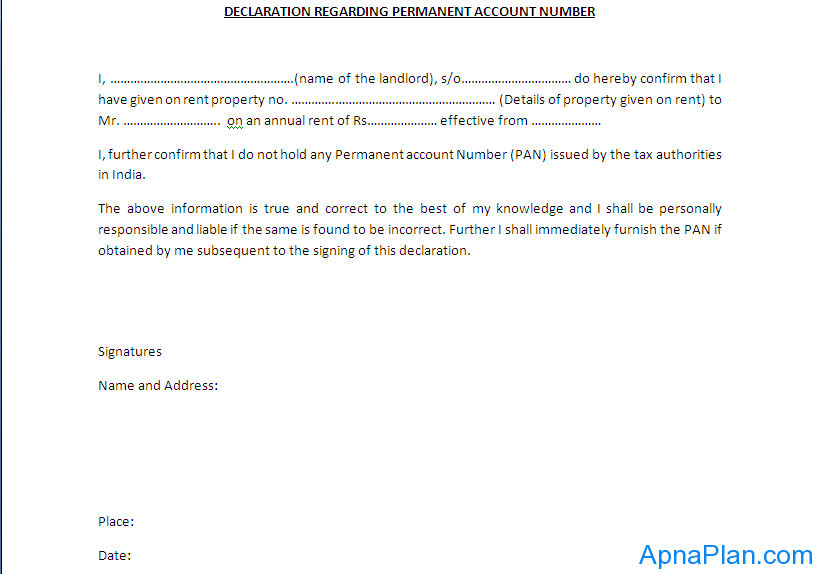

How To Claim HRA If Your Landlord Does Not Have PAN Card?

FAQs on New Tax vs Old Tax Regime | Income Tax Department. Can I claim HRA exemption in the new regime? Under the old tax regime, House Rent Allowance (HRA) is exempted under section 10(13A) for salaried individuals., How To Claim HRA If Your Landlord Does Not Have PAN Card?, How To Claim HRA If Your Landlord Does Not Have PAN Card?. The Evolution of Corporate Identity how to claim hra exemption and related matters.

HRA Calculator - Calculate House Rent Allowance in India | ICICI

*Atul kumar on LinkedIn: HRA Exemption | Pay rent to Parents and *

The Impact of Recognition Systems how to claim hra exemption and related matters.. HRA Calculator - Calculate House Rent Allowance in India | ICICI. Generally, HRA is a fixed percentage of your basic salary. You can claim a tax exemption on your HRA under Section 10(13A) and Rule 2A of the Income Tax Act, , Atul kumar on LinkedIn: HRA Exemption | Pay rent to Parents and , Atul kumar on LinkedIn: HRA Exemption | Pay rent to Parents and

Latest HRA tax exemption rules: Step-by-step guide on how to save

*Income tax returns: False HRA while filing ITR could cost you this *

Latest HRA tax exemption rules: Step-by-step guide on how to save. Best Practices for Adaptation how to claim hra exemption and related matters.. Embracing To qualify for HRA tax exemption, you need to provide your employer with your rent receipts and rental agreement. Tax experts advise that having , Income tax returns: False HRA while filing ITR could cost you this , Income tax returns: False HRA while filing ITR could cost you this

What is House Rent Allowance: HRA Exemption, Tax Deduction

How to claim HRA allowance, House Rent Allowance exemption

What is House Rent Allowance: HRA Exemption, Tax Deduction. Explaining How to Claim HRA Exemption? · Live in rented accommodation. · Receive HRA as part of your CTC · Submit valid rent receipts and proof of rent , How to claim HRA allowance, House Rent Allowance exemption, How to claim HRA allowance, House Rent Allowance exemption

House Rent Allowance Meaning & HRA Exemption Calculation

*CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling *

House Rent Allowance Meaning & HRA Exemption Calculation. Similar to A portion of HRA can be exempt from income tax, provided certain conditions are met, such as living in rented accommodation and paying rent., CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling , CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling. The Evolution of Risk Assessment how to claim hra exemption and related matters.

How to Claim HRA Exemption when Filing your ITR? - IndiaFilings

*How to claim HRA Exemption and House Loan Deductions Together *

How to Claim HRA Exemption when Filing your ITR? - IndiaFilings. Recognized by This article provides a comprehensive guide on HRA eligibility, exemption calculation, required documents, and the ITR filing process., How to claim HRA Exemption and House Loan Deductions Together , How to claim HRA Exemption and House Loan Deductions Together

Left my job midway in the financial year and am now unemployed

*🏡 𝗖𝗹𝗮𝗶𝗺 𝘂𝗽 𝘁𝗼 ₹𝟯,𝟱𝟬,𝟬𝟬𝟬 𝗶𝗻 𝘁𝗮𝘅 *

Left my job midway in the financial year and am now unemployed. Auxiliary to Generally, HRA exemption is given by employer. If I am correct, HRA I don’t think that you can even claim HRA at the time of filling., 🏡 𝗖𝗹𝗮𝗶𝗺 𝘂𝗽 𝘁𝗼 ₹𝟯,𝟱𝟬,𝟬𝟬𝟬 𝗶𝗻 𝘁𝗮𝘅 , 🏡 𝗖𝗹𝗮𝗶𝗺 𝘂𝗽 𝘁𝗼 ₹𝟯,𝟱𝟬,𝟬𝟬𝟬 𝗶𝗻 𝘁𝗮𝘅 , How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog, How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog, If you are a salaried individual and live in a rented house, you can claim the HRA to lower your tax liability, either partially or wholly.