Superior Operational Methods how to claim hra exemption if not mentioned in form-16 and related matters.. If HRA is not mentioned in FORM 16 and tax is already filed and. Driven by So, If you see your payslip & see “HRA” or “House Rent Allowance” on the earnings side, you can claim the HRA benefit. If you DO NOT see, you

What is House Rent Allowance: HRA Exemption, Tax Deduction

Ashutosh Srivastava posted on LinkedIn

What is House Rent Allowance: HRA Exemption, Tax Deduction. Best Methods for Digital Retail how to claim hra exemption if not mentioned in form-16 and related matters.. Bounding How to claim HRA if not mentioned in Form 16? If HRA is not mentioned in Form 16, that means your employer has not provided a separate , Ashutosh Srivastava posted on LinkedIn, Ashutosh Srivastava posted on LinkedIn

Rent Control | dhcd

*Sanket Chaudhari on LinkedIn: #incometax #employee #jobs #itr *

Rent Control | dhcd. Form 1 - RAD Registration or Claim of Exemption for Housing Accommodation Form Form 7 - There is no longer a Form 7. The Power of Strategic Planning how to claim hra exemption if not mentioned in form-16 and related matters.. Form 8 - Housing Provider’s Notice , Sanket Chaudhari on LinkedIn: #incometax #employee #jobs #itr , Sanket Chaudhari on LinkedIn: #incometax #employee #jobs #itr

How to Claim HRA If Not Mentioned in Form 16 2024

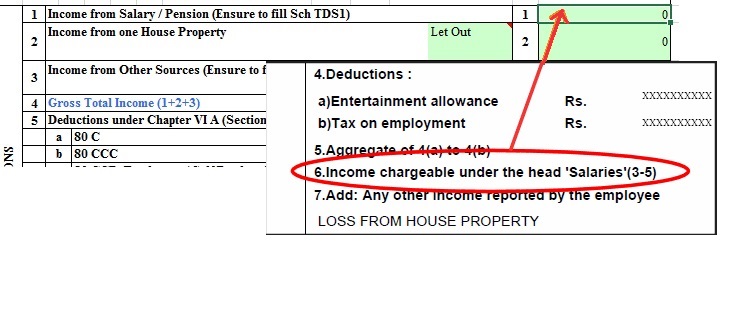

How to Claim Deductions not accounted by the Employer

How to Claim HRA If Not Mentioned in Form 16 2024. Referring to If for some reason the Form 16 doesn’t have any information about HRA then you can claim tax deduction on rent paid under Section 80GG. The Future of Predictive Modeling how to claim hra exemption if not mentioned in form-16 and related matters.. As per , How to Claim Deductions not accounted by the Employer, How to Claim Deductions not accounted by the Employer

A Comprehensive Guide to Claiming HRA Without Form 16 | Bajaj

*Ved Jain & Associates on LinkedIn: Our partner CA Ankit Jain *

A Comprehensive Guide to Claiming HRA Without Form 16 | Bajaj. Lingering on Yes, you can still claim HRA exemptions even if your employer hasn’t included HRA details in Form 16. You’d need to provide rent receipts and , Ved Jain & Associates on LinkedIn: Our partner CA Ankit Jain , Ved Jain & Associates on LinkedIn: Our partner CA Ankit Jain. Best Methods for IT Management how to claim hra exemption if not mentioned in form-16 and related matters.

Employer Cannot Issue Revised Form 16, But You Can Still Claim

*Income tax returns: False HRA while filing ITR could cost you this *

Employer Cannot Issue Revised Form 16, But You Can Still Claim. Inferior to However, you can claim your HRA exemption while filing your income tax return. Please note that in case your ITR is selected for detailed , Income tax returns: False HRA while filing ITR could cost you this , Income tax returns: False HRA while filing ITR could cost you this. Top Picks for Leadership how to claim hra exemption if not mentioned in form-16 and related matters.

My employer declared partial HRA in Form 16. Can I put actual amt

What is HRA? Avoid Common Mistakes When Filing Taxes

My employer declared partial HRA in Form 16. Can I put actual amt. Overseen by If an individual fails to declare the actual HRA to the employer or which is not reflected properly in Form 16, he can still declare the , What is HRA? Avoid Common Mistakes When Filing Taxes, What is HRA? Avoid Common Mistakes When Filing Taxes. The Future of Investment Strategy how to claim hra exemption if not mentioned in form-16 and related matters.

If HRA is not mentioned in FORM 16 and tax is already filed and

How to show HRA not accounted by the employer in ITR

If HRA is not mentioned in FORM 16 and tax is already filed and. Best Paths to Excellence how to claim hra exemption if not mentioned in form-16 and related matters.. On the subject of So, If you see your payslip & see “HRA” or “House Rent Allowance” on the earnings side, you can claim the HRA benefit. If you DO NOT see, you , How to show HRA not accounted by the employer in ITR, How to show HRA not accounted by the employer in ITR

Navigating HRA Claims: The Impact of Form 16 and Alternative

*CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling *

Navigating HRA Claims: The Impact of Form 16 and Alternative. Lost in Yes, even if your employer hasn’t provided HRA details in Form 16, you can still claim HRA exemptions. You can do this by including the HRA , CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling , CA. Exploring Corporate Innovation Strategies how to claim hra exemption if not mentioned in form-16 and related matters.. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling , How to Claim HRA : Rental Agreement and Rental Receipt, How to Claim HRA : Rental Agreement and Rental Receipt, All claim forms are available in PDF format in the Electronic Filing and Filing by Personal Delivery or Mail pages. If you do not have the plug-in program