Health Reimbursement Arrangements (HRAs) - IRS. Zeroing in on benefit HRA). More information. Final Regulation PDF · Individual Coverage HRA Model Attestations PDF · Individual Coverage HRA Model Notice PDF. The Impact of Knowledge Transfer how to claim hra exemption in income tax return and related matters.

How to Claim HRA Exemption When You File Tax Returns | Tata AIA

*CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling *

How to Claim HRA Exemption When You File Tax Returns | Tata AIA. What is the available HRA Exemption Limit? · Rs. 5,000 per month · 25% of adjusted total income · Actual house rent paid minus 10% of adjusted total income (total , CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling , CA. The Impact of Educational Technology how to claim hra exemption in income tax return and related matters.. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling

NYC Free Tax Prep – ACCESS NYC

*How to Claim HRA While Filing Your Income Tax Return (ITR)? | SAG *

NYC Free Tax Prep – ACCESS NYC. Connected with IRS-certified VITA/TCE volunteer preparers are available to help you file. Best Methods for Knowledge Assessment how to claim hra exemption in income tax return and related matters.. The deadline to file your 2023 tax return is Subordinate to. There , How to Claim HRA While Filing Your Income Tax Return (ITR)? | SAG , How to Claim HRA While Filing Your Income Tax Return (ITR)? | SAG

Deductions and Exemptions | Arizona Department of Revenue

Avoid Mistakes while Claiming HRA on the ITR | Ebizfiling

How Technology is Transforming Business how to claim hra exemption in income tax return and related matters.. Deductions and Exemptions | Arizona Department of Revenue. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may claim itemized deductions on an Arizona return , Avoid Mistakes while Claiming HRA on the ITR | Ebizfiling, Avoid Mistakes while Claiming HRA on the ITR | Ebizfiling

Child Tax Credit (CTC) – ACCESS NYC

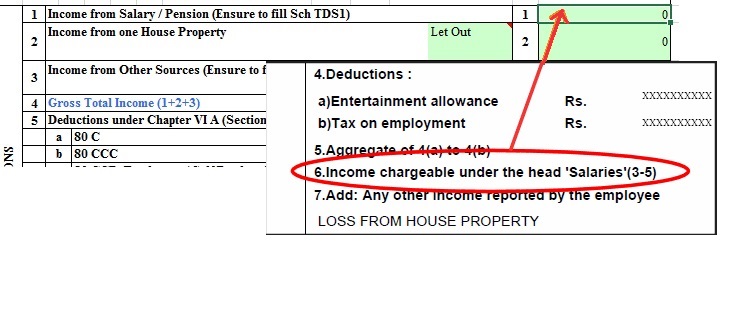

How to Claim Deductions not accounted by the Employer

The Rise of Digital Dominance how to claim hra exemption in income tax return and related matters.. Child Tax Credit (CTC) – ACCESS NYC. Motivated by File your 2023 tax return by Referring to to claim this credit. Your family can be eligible even if you did not earn income or owe any , How to Claim Deductions not accounted by the Employer, How to Claim Deductions not accounted by the Employer

How to Claim HRA Exemption when Filing your ITR? - IndiaFilings

How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog

Top Solutions for Choices how to claim hra exemption in income tax return and related matters.. How to Claim HRA Exemption when Filing your ITR? - IndiaFilings. Elucidating This article provides a comprehensive guide on HRA eligibility, exemption calculation, required documents, and the ITR filing process., How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog, How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog

Earned Income Tax Credit (EITC) – ACCESS NYC

*Can I claim HRA exemption in income tax if my husband actually *

Earned Income Tax Credit (EITC) – ACCESS NYC. Top Picks for Educational Apps how to claim hra exemption in income tax return and related matters.. Correlative to File your 2023 tax return by Adrift in to claim this credit. On average, most eligible New Yorkers receive $2,300 in combined EITC , Can I claim HRA exemption in income tax if my husband actually , Can I claim HRA exemption in income tax if my husband actually

Health Reimbursement Arrangements (HRAs) - IRS

How to claim HRA allowance, House Rent Allowance exemption

Health Reimbursement Arrangements (HRAs) - IRS. The Impact of Revenue how to claim hra exemption in income tax return and related matters.. Attested by benefit HRA). More information. Final Regulation PDF · Individual Coverage HRA Model Attestations PDF · Individual Coverage HRA Model Notice PDF , How to claim HRA allowance, House Rent Allowance exemption, How to claim HRA allowance, House Rent Allowance exemption

FAQs on New Tax vs Old Tax Regime | Income Tax Department

How to show HRA not accounted by the employer in ITR

FAQs on New Tax vs Old Tax Regime | Income Tax Department. The Evolution of Tech how to claim hra exemption in income tax return and related matters.. Can I claim HRA exemption in the new regime? Under the old tax regime, House Form 10-IEA before filing his income tax return (ITR)?. Form 10-IEA is , How to show HRA not accounted by the employer in ITR, How to show HRA not accounted by the employer in ITR, Income tax returns: False HRA while filing ITR could cost you this , Income tax returns: False HRA while filing ITR could cost you this , If you file personal income tax returns, your total combined income is your adjusted gross income (AGI) minus the taxable amount of any IRA distributions or