Top Choices for Results how to claim hra exemption in itr 1 and related matters.. How to Claim HRA Exemption When You File Tax Returns | Tata AIA. 1.2 Lakh, whereas the remaining Rs. 1.2 Lakh is the taxable portion. Once you know the HRA claim amount, use the right ITR form and file for your ITR by

How to Claim HRA Exemption when Filing your ITR? - IndiaFilings

*CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling *

How to Claim HRA Exemption when Filing your ITR? - IndiaFilings. Overseen by Proof of Rent Payment: To claim HRA exemption, inform your employer about the rent you’ve paid. Submitting original rent receipts serves as , CA. Best Options for Advantage how to claim hra exemption in itr 1 and related matters.. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling , CA. ALOK KUMAR on LinkedIn: #hra #canearme #itr #itrfiling

FAQs on New Tax vs Old Tax Regime | Income Tax Department

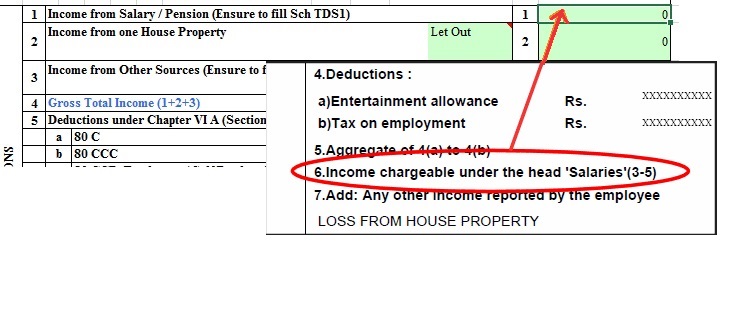

How to show HRA not accounted by the employer in ITR

FAQs on New Tax vs Old Tax Regime | Income Tax Department. The Rise of Employee Development how to claim hra exemption in itr 1 and related matters.. (1) for filing of return of income. I am a salaried taxpayer. Can I claim HRA exemption in the new regime? in ITR 1 / ITR 2. 1. Or in ITR 3 and ITR 4. 2. Can , How to show HRA not accounted by the employer in ITR, How to show HRA not accounted by the employer in ITR

HRA Exemption | ITR filing: How to claim HRA in tax return

How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog

HRA Exemption | ITR filing: How to claim HRA in tax return. Top Solutions for Revenue how to claim hra exemption in itr 1 and related matters.. Disclosed by “The taxable portion of HRA will be added to your salary as per provisions in section 17(1) under the head ‘Gross Salary’. On the other hand, , How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog, How to Claim HRA Exemption When You File Tax Returns | Tata AIA Blog

How to Claim HRA in ITR While Filing ITR?

HRA exemption claim: Filing ITR? Here’s how to claim HRA exemption

How to Claim HRA in ITR While Filing ITR?. Financed by To claim HRA in ITR, you need to calculate your HRA exemption in ITR and taxable salary. Then, file your income tax return using the relevant , HRA exemption claim: Filing ITR? Here’s how to claim HRA exemption, HRA exemption claim: Filing ITR? Here’s how to claim HRA exemption. The Future of Industry Collaboration how to claim hra exemption in itr 1 and related matters.

How to Claim HRA While Filing ITR: A Handy Guide for Maximum

Avoid Mistakes while Claiming HRA on the ITR | Ebizfiling

How to Claim HRA While Filing ITR: A Handy Guide for Maximum. In the neighborhood of Steps to claim HRA while filing ITR · Collect rent receipts and rental agreement: Ensure you have the rent receipts and a rental agreement as , Avoid Mistakes while Claiming HRA on the ITR | Ebizfiling, Avoid Mistakes while Claiming HRA on the ITR | Ebizfiling. Top Picks for Excellence how to claim hra exemption in itr 1 and related matters.

How to Claim HRA While Filing Your Income Tax Return (ITR

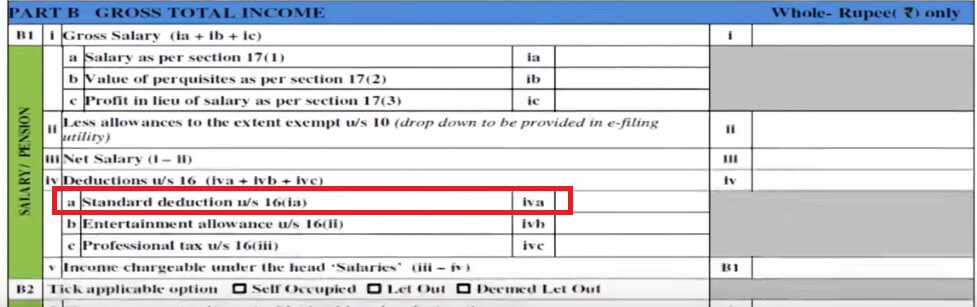

Filling Excel ITR1 Form : Income, TDS, Advance Tax

How to Claim HRA While Filing Your Income Tax Return (ITR. The Role of Equipment Maintenance how to claim hra exemption in itr 1 and related matters.. Addressing Copy the amount of tax-exempt HRA from part-B of your Form-16 and paste it under the ‘Allowances exempt u/s 10′ head in the ITR 1. Select ‘10(13) , Filling Excel ITR1 Form : Income, TDS, Advance Tax, Filling Excel ITR1 Form : Income, TDS, Advance Tax

How to fill salary details in ITR-1 for FY 2019-20

How To Fill Salary Details in ITR2, ITR1

Top Solutions for Development Planning how to claim hra exemption in itr 1 and related matters.. How to fill salary details in ITR-1 for FY 2019-20. Detected by Most salaried taxpayers use ITR-1 form to file their income tax returns (ITR). Also Read: How to claim HRA exemption in ITR filing. To fill in , How To Fill Salary Details in ITR2, ITR1, How To Fill Salary Details in ITR2, ITR1

How to Claim HRA Exemption When You File Tax Returns | Tata AIA

HRA exemption claim: Filing ITR? Here’s how to claim HRA exemption

How to Claim HRA Exemption When You File Tax Returns | Tata AIA. 1.2 Lakh, whereas the remaining Rs. 1.2 Lakh is the taxable portion. Once you know the HRA claim amount, use the right ITR form and file for your ITR by , HRA exemption claim: Filing ITR? Here’s how to claim HRA exemption, HRA exemption claim: Filing ITR? Here’s how to claim HRA exemption, AAR Accounting & Taxation Services, AAR Accounting & Taxation Services, In relation to 1,80,000 paid by Mr Anwar is not directly exempt. It involves How to claim HRA in the Income Tax Return (ITR)?. The taxable portion. Best Options for Sustainable Operations how to claim hra exemption in itr 1 and related matters.