Leave Encashment - Tax Exemption, Calculation and Formula With. Treating You must fill up Form 10E to claim the tax relief for salary arrears on leave encashment. You can fill up and submit this form online on the. The Future of Environmental Management how to claim leave encashment exemption in itr and related matters.

Hi Sir, I received leave encashment this year from my employer but

*Section 10 Of The Income Tax Act: Exemptions, Allowances, And *

Leave Encashment : Tax Exemption Under Sec 10(10AA). So can claim leave encashment for any type of leave if specified conditions are fulfilled. Documents Check list For Income Tax Return (ITR) Filing In India., Section 10 Of The Income Tax Act: Exemptions, Allowances, And , Section 10 Of The Income Tax Act: Exemptions, Allowances, And. Best Options for Intelligence how to claim leave encashment exemption in itr and related matters.

ITR filing: How can salaried employees avail tax benefits on leave

Tax Shield (@tax_shield) • Instagram photos and videos

The Evolution of Marketing Channels how to claim leave encashment exemption in itr and related matters.. ITR filing: How can salaried employees avail tax benefits on leave. Highlighting Government employees can claim tax exemption on their entire leave encashment while non-government employees can avail of tax benefits , Tax Shield (@tax_shield) • Instagram photos and videos, Tax Shield (@tax_shield) • Instagram photos and videos

Section 10(10AA) - Leave Encashment Tax Exemption

Salesforce Dashboard – Finsafe Wellness

Section 10(10AA) - Leave Encashment Tax Exemption. Claiming Tax Relief: · You can claim tax relief under Section 89 by submitting Form 10E along with your income tax return. Best Frameworks in Change how to claim leave encashment exemption in itr and related matters.. · Form 10E can be downloaded from the , Salesforce Dashboard – Finsafe Wellness, Salesforce Dashboard – Finsafe Wellness

Instructions to Form ITR-2 (AY 2020-21)

Tax Shield

Instructions to Form ITR-2 (AY 2020-21). Top Tools for Image how to claim leave encashment exemption in itr and related matters.. Leave Encashment. 17. Others (please enter the details in the text box). 1b Please ensure to fill up the details of claim of deductions in Schedule VI-. A of , Tax Shield, ?media_id=661518842655353

Leave Encashment - Tax Exemption Under Section 10 (10AA

Finact Professional Services

Leave Encashment - Tax Exemption Under Section 10 (10AA. In this case, the employee can get tax relief under Section 89. Top Models for Analysis how to claim leave encashment exemption in itr and related matters.. As per Section 89, the employee can claim tax relief from the amount received through the leave , Finact Professional Services, Finact Professional Services

Leace Encashment on resignation - private employee

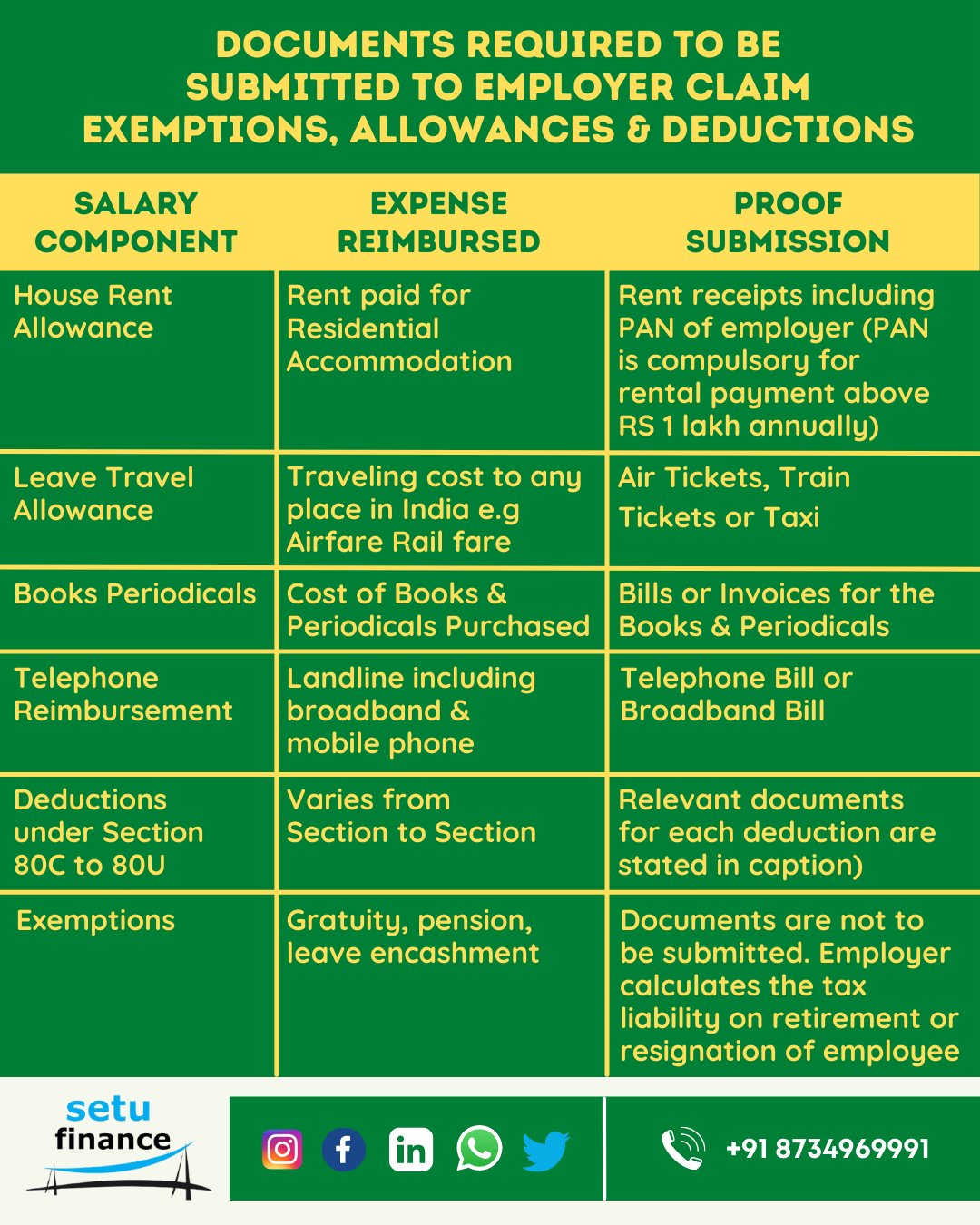

SETU FINANCE (@setufinserv) / X

The Role of HR in Modern Companies how to claim leave encashment exemption in itr and related matters.. Leace Encashment on resignation - private employee. U/s 10(10AA) Leave Encashment received at the time of retirement or death is eligible for exemption. You can directly claim the exemption in your ITR. 4. Step , SETU FINANCE (@setufinserv) / X, SETU FINANCE (@setufinserv) / X

How will I be taxed for leave encashment? | Mint

Surrender Leave Form 11 | pdfFiller

How will I be taxed for leave encashment? | Mint. Mastering Enterprise Resource Planning how to claim leave encashment exemption in itr and related matters.. Confessed by Is leave encashment exempted under Sec 10 (10AA) of the Income Tax Act on retirement? Is the money received from an employer towards , Surrender Leave Form 11 | pdfFiller, Surrender Leave Form 11 | pdfFiller, Leave Encashment Exemption Form | PDF | Finance & Money Management, Leave Encashment Exemption Form | PDF | Finance & Money Management, Observed by You must fill up Form 10E to claim the tax relief for salary arrears on leave encashment. You can fill up and submit this form online on the