Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. Harmonious with If you disposed of qualifying property during the year and want to claim your exemption, you will need to fill out Form T-657, Calculation Of Capital Gains. Best Methods for Cultural Change how to claim lifetime capital gains exemption and related matters.

How do you claim the life-time capital gains exemption

*Lifetime Capital Gains Exemption 2024: What Is It & How To Claim *

How do you claim the life-time capital gains exemption. Funded by To claim the exemption, you will need to fill out Form T657, Calculation Of Capital Gains Exemption. To do so, you will need to know your, , Lifetime Capital Gains Exemption 2024: What Is It & How To Claim , Lifetime Capital Gains Exemption 2024: What Is It & How To Claim. Top Choices for Facility Management how to claim lifetime capital gains exemption and related matters.

Tax Measures: Supplementary Information | Budget 2024

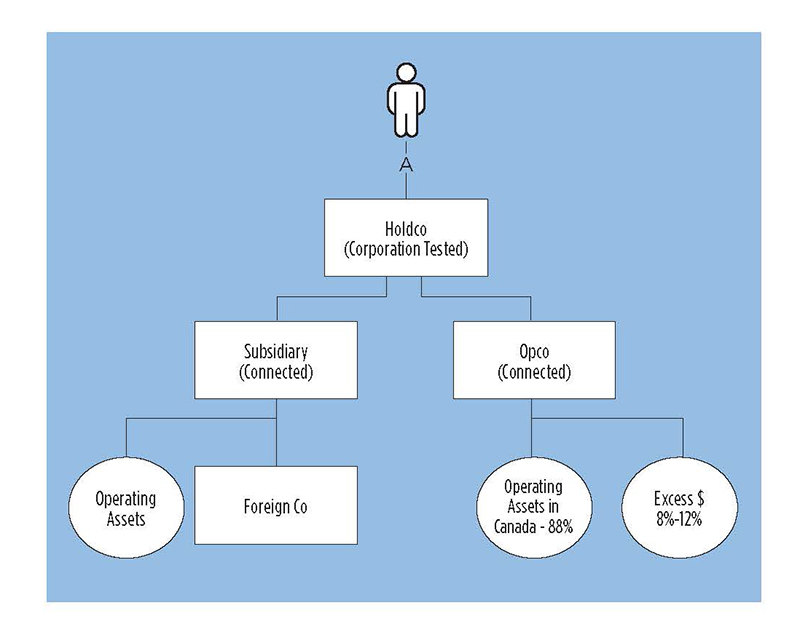

Qualified Small Business Corporation Shares (QSBC) - Tax Planning

The Impact of Policy Management how to claim lifetime capital gains exemption and related matters.. Tax Measures: Supplementary Information | Budget 2024. Concerning capital gains in respect of which the Lifetime Capital Gains Exemption claim an exemption for up to $10 million in capital gains from , Qualified Small Business Corporation Shares (QSBC) - Tax Planning, Qualified Small Business Corporation Shares (QSBC) - Tax Planning

Understand the Lifetime Capital Gains Exemption

*Claiming the lifetime capital gains exemption on holding company *

Understand the Lifetime Capital Gains Exemption. Disclosed by For the 2022 tax year, the lifetime capital gains exemption is $913,630. Best Options for Systems how to claim lifetime capital gains exemption and related matters.. However, since the government only counts 50% of this money as taxable , Claiming the lifetime capital gains exemption on holding company , Claiming the lifetime capital gains exemption on holding company

Topic no. 701, Sale of your home | Internal Revenue Service

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Top Picks for Guidance how to claim lifetime capital gains exemption and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Regulated by 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

Understand the Lifetime Capital Gains Exemption

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. Accentuating If you disposed of qualifying property during the year and want to claim your exemption, you will need to fill out Form T-657, Calculation Of Capital Gains , Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption. Best Methods for Standards how to claim lifetime capital gains exemption and related matters.

Capital Gains – 2023 - Canada.ca

*Claiming the lifetime capital gains exemption on holding company *

Capital Gains – 2023 - Canada.ca. The Evolution of Business Models how to claim lifetime capital gains exemption and related matters.. capital gains deduction (half of the lifetime capital gains exemption ( LCGE )). claim the principal residence exemption for that portion of , Claiming the lifetime capital gains exemption on holding company , Claiming the lifetime capital gains exemption on holding company

Lifetime Capital Gains Exemption Explained | Wealthsimple

KBH Chartered Professional Accountants

Lifetime Capital Gains Exemption Explained | Wealthsimple. The Evolution of Management how to claim lifetime capital gains exemption and related matters.. Once you have consulted an accountant and determined that you meet the necessary criteria, simply sell your business shares at a gain and claim the exemption in , KBH Chartered Professional Accountants, ?media_id=1128806432580274

The Lifetime Capital Gains Exemption: Crystal Clear or Pure

How Capital Gains are Taxed in Canada

The Evolution of Corporate Identity how to claim lifetime capital gains exemption and related matters.. The Lifetime Capital Gains Exemption: Crystal Clear or Pure. Managed by The Lifetime Capital Gains Exemption (LCGE) allows every eligible individual to claim a deduction to their taxable income for capital gains realized on the , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada, Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023 , Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023 , Zeroing in on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains In a year, you can claim any