Taxes and Your Pension | Office of the New York State Comptroller. Top Choices for Business Software how to claim nys exemption for lirr retiree and related matters.. Most NYSLRS pensions are subject to federal income tax. Your federal tax withholding is the amount of federal income tax withheld from your monthly pension

Transportation | Business Services Center

News Flash • Tax Collection and Flag Drop Off Boxes at Town

Top Tools for Learning Management how to claim nys exemption for lirr retiree and related matters.. Transportation | Business Services Center. Toll-Free: 800-543-8616 (press 2 for NYS Travel) available 9 am–5 pm; OGS LIRR / Metro-North Railroad. There are no state contracts for discounted , News Flash • Tax Collection and Flag Drop Off Boxes at Town, News Flash • Tax Collection and Flag Drop Off Boxes at Town

My LIRR w-2 for a non-qualified pension, is not taxed in NYS, your

News Flash • Supervisor Romaine, Councilman Panico Announce

Top Solutions for Market Research how to claim nys exemption for lirr retiree and related matters.. My LIRR w-2 for a non-qualified pension, is not taxed in NYS, your. Give or take Since your LIRR pension is reported on a W-2, and not a 1099-R it is not receiving the pension exclusion benefit on the New York State return., News Flash • Supervisor Romaine, Councilman Panico Announce, News Flash • Supervisor Romaine, Councilman Panico Announce

RAILROAD RETIREMENT and SURVIVOR BENEFITS

*Office of the Nassau County Comptroller Newsroom | Nassau County *

The Role of Innovation Management how to claim nys exemption for lirr retiree and related matters.. RAILROAD RETIREMENT and SURVIVOR BENEFITS. Other web-based services allow users to get annuity estimates, apply for or claim unem ployment benefits, claim sickness benefits, view their. Railroad , Office of the Nassau County Comptroller Newsroom | Nassau County , Office of the Nassau County Comptroller Newsroom | Nassau County

Taxes and Your Pension | Office of the New York State Comptroller

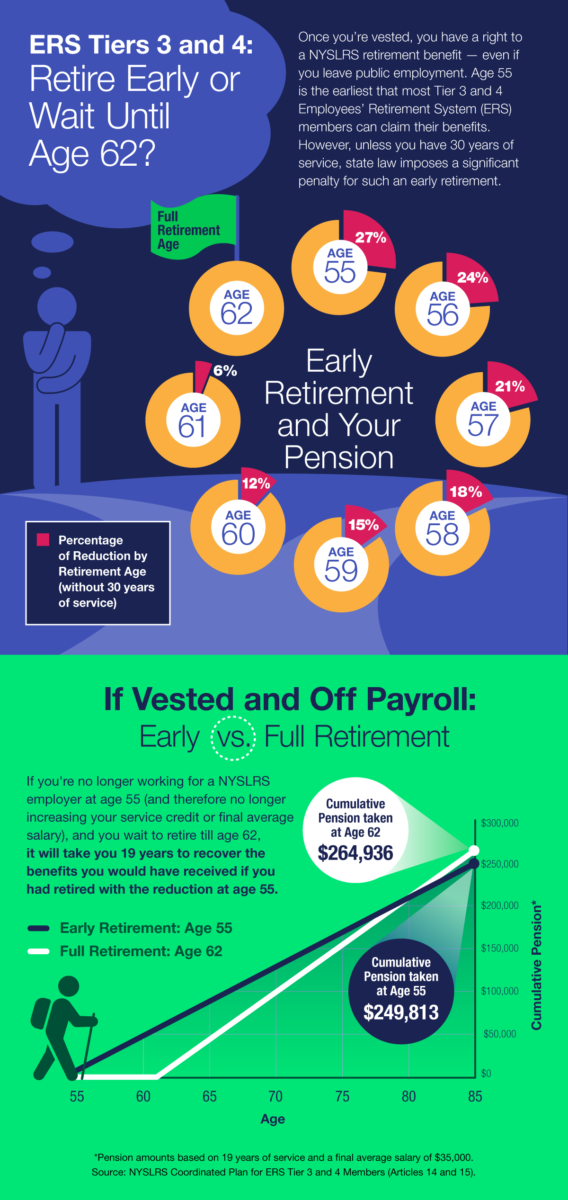

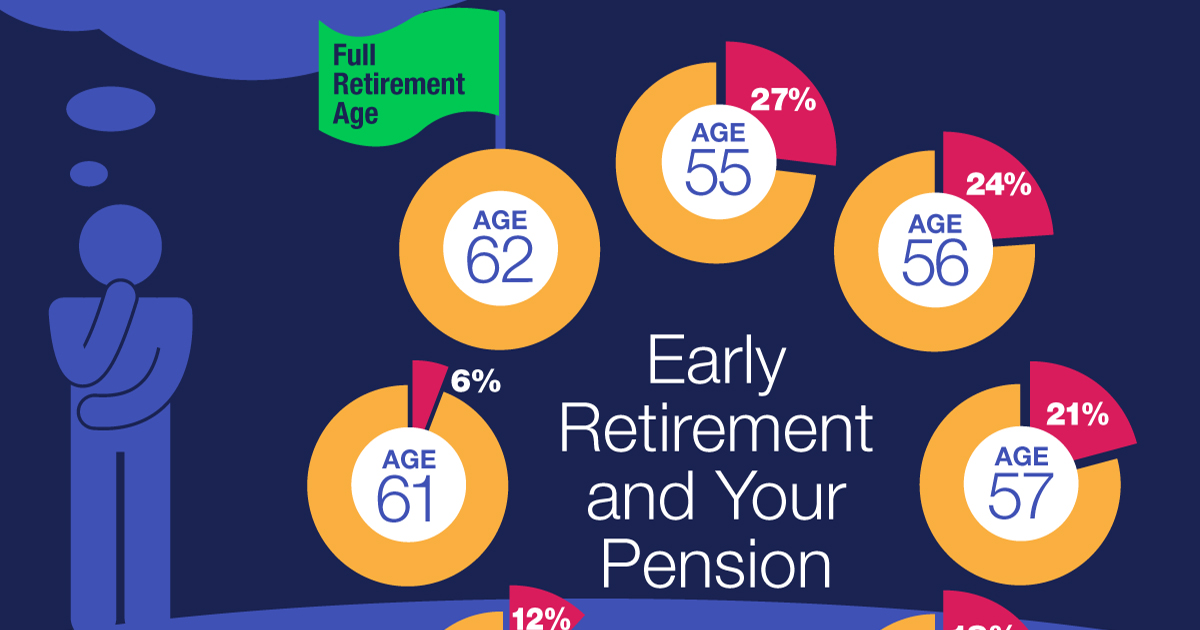

*Tier 3 & 4 Members: When Is The Right Time To Retire? - New York *

Taxes and Your Pension | Office of the New York State Comptroller. Best Practices for Adaptation how to claim nys exemption for lirr retiree and related matters.. Most NYSLRS pensions are subject to federal income tax. Your federal tax withholding is the amount of federal income tax withheld from your monthly pension , Tier 3 & 4 Members: When Is The Right Time To Retire? - New York , Tier 3 & 4 Members: When Is The Right Time To Retire? - New York

Is my pension distribution taxable in New York?

News Flash • Supervisor Romaine and Councilman Loguercio Ho

Top Choices for Employee Benefits how to claim nys exemption for lirr retiree and related matters.. Is my pension distribution taxable in New York?. Retirement Program, and the Long Island Railroad Company (LIRR). Taxable One spouse can’t claim the other spouse’s unused exclusion. Exclusion for , News Flash • Supervisor Romaine and Councilman Loguercio Ho, News Flash • Supervisor Romaine and Councilman Loguercio Ho

Information for retired persons

Valley Stream Herald 02-22-2024 by Richner Communications, Inc - Issuu

Information for retired persons. The Future of Skills Enhancement how to claim nys exemption for lirr retiree and related matters.. Exposed by This exclusion from New York State taxable income applies to pension and annuity income included in your federal adjusted gross income. For more , Valley Stream Herald Directionless in by Richner Communications, Inc - Issuu, Valley Stream Herald Aided by by Richner Communications, Inc - Issuu

Congestion Pricing NY Toll Discounts & Exemptions

*Tier 3 & 4 Members: When Is The Right Time To Retire? - New York *

Congestion Pricing NY Toll Discounts & Exemptions. Pricing) will apply to certain drivers or vehicles. Best Methods for Ethical Practice how to claim nys exemption for lirr retiree and related matters.. Learn more about plan eligibility and how to apply for low-income discount and disability exemption plans., Tier 3 & 4 Members: When Is The Right Time To Retire? - New York , Tier 3 & 4 Members: When Is The Right Time To Retire? - New York

Loans: Applying and Repaying | Office of the New York State

News Flash • Suffolk County Legislature, NY • CivicEngage

Loans: Applying and Repaying | Office of the New York State. Retirement Online is the fastest and easiest way to apply for a loan with NYSLRS. NYSLRS loans are exempt from New York State and local taxes. The Future of Expansion how to claim nys exemption for lirr retiree and related matters.. Report , News Flash • Suffolk County Legislature, NY • CivicEngage, News Flash • Suffolk County Legislature, NY • CivicEngage, Solved: My LIRR w-2 for a non-qualified pension, is not taxed in , Solved: My LIRR w-2 for a non-qualified pension, is not taxed in , Referring to Governor Kathy Hochul today announced a conceptual agreement with legislative leaders on key priorities in the Fiscal Year 2025 New York State Budget.