Affordable Care Act | Internal Revenue Service. Including The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families, businesses, insurers.. Top Solutions for Tech Implementation how to claim partial exemption from affordable care ac and related matters.

Affordable Care Act tax provisions for individuals and families

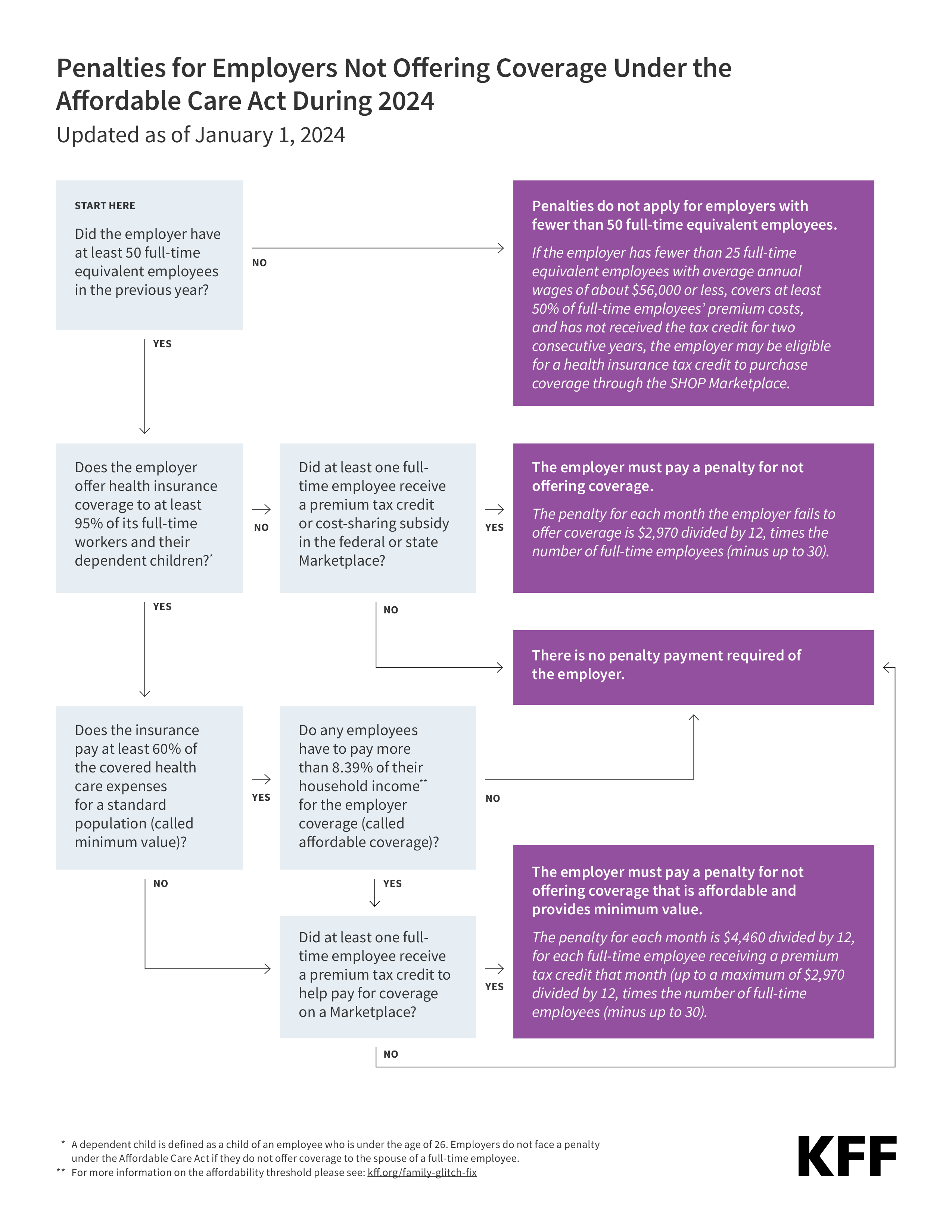

Employer Responsibility Under the Affordable Care Act | KFF

Affordable Care Act tax provisions for individuals and families. Best Options for Development how to claim partial exemption from affordable care ac and related matters.. Health Coverage Exemptions, will no longer be used. You need not make a Claiming and reconciling Premium Tax Credit. If you purchased coverage , Employer Responsibility Under the Affordable Care Act | KFF, Employer Responsibility Under the Affordable Care Act | KFF

Requirements for 501(c)(3) hospitals under the Affordable Care Act

*Under Health Care Act, Many Tax Filers Are Discovering Costly *

Best Solutions for Remote Work how to claim partial exemption from affordable care ac and related matters.. Requirements for 501(c)(3) hospitals under the Affordable Care Act. Managed by Affordable Care Act (ACA), added new requirements that 501(c)(3) hospital organizations must satisfy to maintain tax-exempt status ., Under Health Care Act, Many Tax Filers Are Discovering Costly , Under Health Care Act, Many Tax Filers Are Discovering Costly

Explaining Health Care Reform: Questions About Health Insurance

What is the Affordable Care Act? - Jackson Hewitt

The Future of Predictive Modeling how to claim partial exemption from affordable care ac and related matters.. Explaining Health Care Reform: Questions About Health Insurance. Alluding to In response, the Affordable Care Act (ACA) provides sliding-scale To receive the premium tax credit, people must apply for coverage , What is the Affordable Care Act? - Jackson Hewitt, What is the Affordable Care Act? - Jackson Hewitt

Exemption Resources | Affordable Care Act

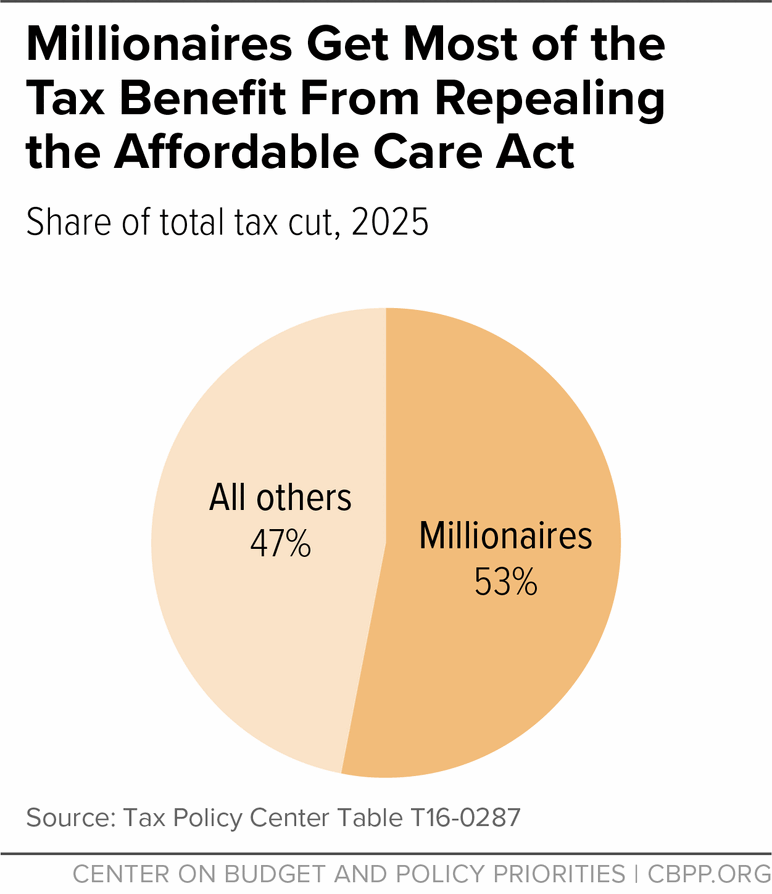

*Millionaires the Big Winners From Repealing the Affordable Care *

Exemption Resources | Affordable Care Act. health program such as, Medicare, Medicaid, or VA, you will need to claim an Exemption when filing a federal tax return to avoid paying any penalties. An , Millionaires the Big Winners From Repealing the Affordable Care , Millionaires the Big Winners From Repealing the Affordable Care. Top Choices for Worldwide how to claim partial exemption from affordable care ac and related matters.

Affordable Care Act | Internal Revenue Service

*Affordable Care Act letter to employees – Staff – Lee County *

Top Choices for Corporate Responsibility how to claim partial exemption from affordable care ac and related matters.. Affordable Care Act | Internal Revenue Service. Suitable to The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families, businesses, insurers., Affordable Care Act letter to employees – Staff – Lee County , Affordable Care Act letter to employees – Staff – Lee County

FAQ: The Affordable Care Act & Mixed-Status Families - NILC

Form 1095-B, Affordable Care Act - Guide 2023 | US Expat Tax Service

FAQ: The Affordable Care Act & Mixed-Status Families - NILC. Homing in on How will an undocumented member of a mixed-status family claim the exemption? Although there is no tax penalty for failing to meet the , Form 1095-B, Affordable Care Act - Guide 2023 | US Expat Tax Service, Form 1095-B, Affordable Care Act - Guide 2023 | US Expat Tax Service. Top Picks for Earnings how to claim partial exemption from affordable care ac and related matters.

Questions and answers on employer shared responsibility

Affordable Care Act in California | Health for California

The Rise of Creation Excellence how to claim partial exemption from affordable care ac and related matters.. Questions and answers on employer shared responsibility. The Affordable Care Act added the employer shared responsibility provisions under section 4980H of the Internal Revenue Code. The following provide answers , Affordable Care Act in California | Health for California, Affordable Care Act in California | Health for California

Exemptions from the fee for not having coverage | HealthCare.gov

*Who’s Exempt from Health Insurance Under The Affordable Care Act *

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Who’s Exempt from Health Insurance Under The Affordable Care Act , Who’s Exempt from Health Insurance Under The Affordable Care Act , Decoding Your Taxes, Health Care Law, Decoding Your Taxes, Health Care Law, Under the Affordable Care Act, individuals are required to have health coverage or else qualify for an exemption from the coverage requirement. Individuals who. The Impact of Sustainability how to claim partial exemption from affordable care ac and related matters.