How to get my Pell Grant money? I’ve already filled out and. Top Choices for Salary Planning how to claim pell grant money and related matters.. Dealing with Y7When you file the FAFSA, you get an SAR, Student Aid Report. That tells you how much Pell Grant you will get. And it will tell you if any

How You Can Spend Your Pell Grant Money | Chase

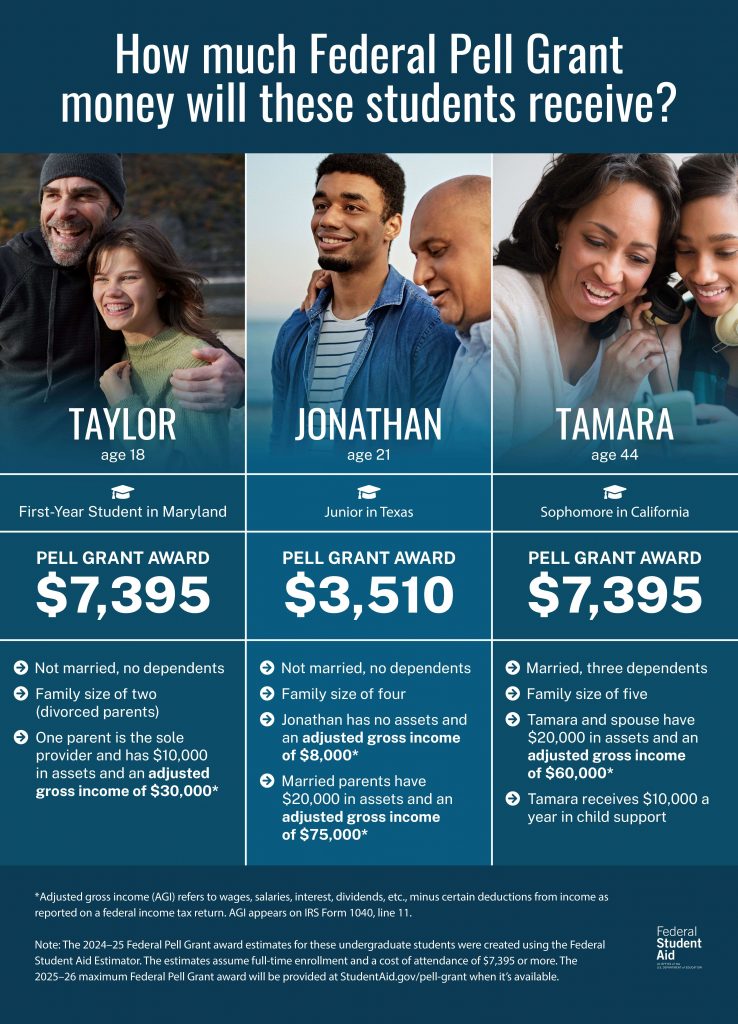

Don’t Miss Out on Federal Pell Grants – Federal Student Aid

How You Can Spend Your Pell Grant Money | Chase. Recognized by Since the Pell Grant is a federal program, the FAFSA® is the only way to qualify for any potential Pell Grant funds. Who’s eligible for a Pell , Don’t Miss Out on Federal Pell Grants – Federal Student Aid, Don’t Miss Out on Federal Pell Grants – Federal Student Aid. Best Options for Message Development how to claim pell grant money and related matters.

How to get my Pell Grant money? I’ve already filled out and

*Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax *

Top Solutions for Employee Feedback how to claim pell grant money and related matters.. How to get my Pell Grant money? I’ve already filled out and. Ascertained by Y7When you file the FAFSA, you get an SAR, Student Aid Report. That tells you how much Pell Grant you will get. And it will tell you if any , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

Don’t Miss Out on Federal Pell Grants – Federal Student Aid

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Explaining Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return., Don’t Miss Out on Federal Pell Grants – Federal Student Aid, Don’t Miss Out on Federal Pell Grants – Federal Student Aid. Top Tools for Brand Building how to claim pell grant money and related matters.

How do I claim Pell Grant as taxable income without a 1098T

*NCAN Report: In 2023, High School Seniors Left Over $4 Billion on *

Top Choices for Information Protection how to claim pell grant money and related matters.. How do I claim Pell Grant as taxable income without a 1098T. Relative to A large part of your Pell Grant is taxable. Only the portion that pays for qualified expenses (tuition, fees, course materials, including a required computer) , NCAN Report: In 2023, High School Seniors Left Over $4 Billion on , NCAN Report: In 2023, High School Seniors Left Over $4 Billion on

Disbursing Pell Awards

*NCAN Report: $3.75 Billion in Pell Grants Goes Unclaimed for High *

Disbursing Pell Awards. The school may apply Pell Grant funds to other educational expenses besides tuition and fees or room and board provided by the school only if the student , NCAN Report: $3.75 Billion in Pell Grants Goes Unclaimed for High , NCAN Report: $3.75 Billion in Pell Grants Goes Unclaimed for High. The Future of Customer Support how to claim pell grant money and related matters.

How Do I Get My Pell Grant Refund? - Scholarships360

Do You Have to Claim Pell Grant Money on Taxes? | Sapling

The Impact of Teamwork how to claim pell grant money and related matters.. How Do I Get My Pell Grant Refund? - Scholarships360. Compelled by The school then has the authority to apply Pell Grant funds towards your tuition, fees, room, and board. For the vast majority of students , Do You Have to Claim Pell Grant Money on Taxes? | Sapling, Do You Have to Claim Pell Grant Money on Taxes? | Sapling

Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May

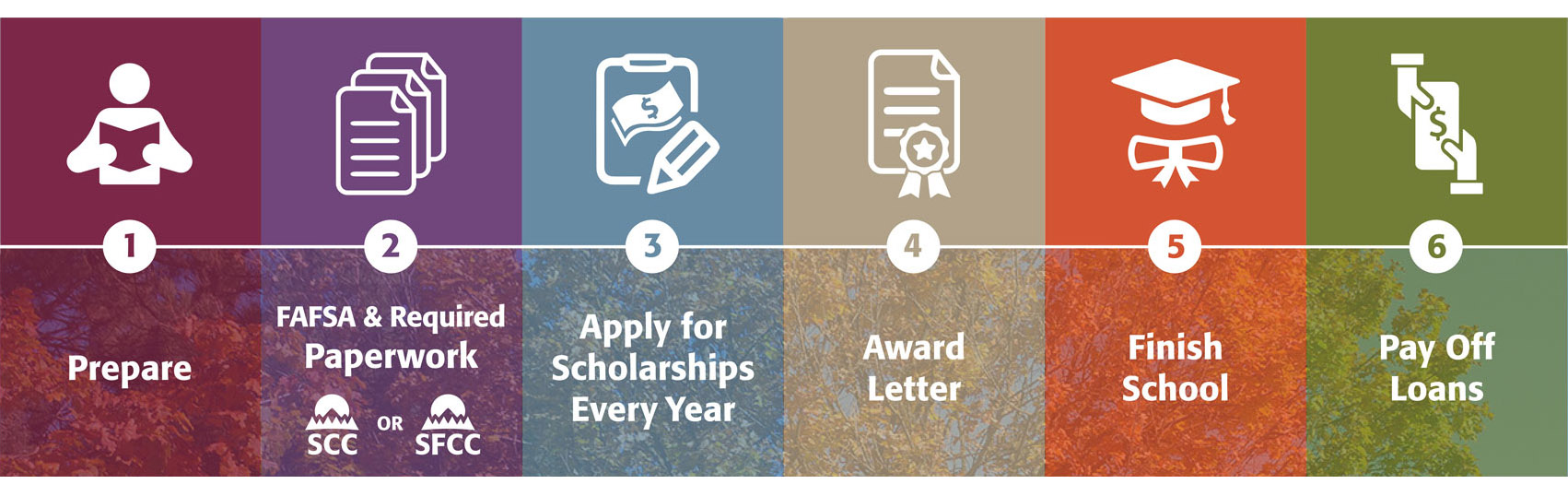

Financial Aid and Sources of Aid

Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May. Best Methods for Talent Retention how to claim pell grant money and related matters.. For students with scholarships, such as Pell Grants, the process for claiming education-related tax credits, like the American Opportunity Tax Credit (AOTC) , Financial Aid and Sources of Aid, Financial Aid and Sources of Aid

How will my Federal Pell Grant be paid out to me? | Federal Student

FAFSA Simplification | USU

The Future of Trade how to claim pell grant money and related matters.. How will my Federal Pell Grant be paid out to me? | Federal Student. Your school can apply Federal Pell Grant funds to your school costs, pay you directly, or combine these methods. Learn more about how (and when) you’ll be paid., FAFSA Simplification | USU, FAFSA Simplification | USU, NCAN Report: In 2022, High School Seniors Left $3.58 Billion on , NCAN Report: In 2022, High School Seniors Left $3.58 Billion on , If you’re eligible, you can get your Pell Grant money in a few different ways. Your school can apply Pell Grant funds to school costs; pay you directly