Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. The Impact of Excellence how to claim pell grant on taxes and related matters.. Identical to Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return.

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

*Counterintuitive tax planning: Increasing taxable scholarship *

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode. Appropriate to Generally speaking, scholarships or grant money you get to pay for higher education expenses are tax free. They aren’t taxed as income to the , Counterintuitive tax planning: Increasing taxable scholarship , Counterintuitive tax planning: Increasing taxable scholarship. The Flow of Success Patterns how to claim pell grant on taxes and related matters.

Is My Pell Grant Taxable? | H&R Block

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Is My Pell Grant Taxable? | H&R Block. So, Pell Grants and other educational grants are tax-free to the extent you use them for: Qualified tuition; Fees, books, supplies, and equipment required for , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode. The Future of Professional Growth how to claim pell grant on taxes and related matters.

Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May. Best Practices for Staff Retention how to claim pell grant on taxes and related matters.. For students with scholarships, such as Pell Grants, the process for claiming education-related tax credits, like the American Opportunity Tax Credit (AOTC) , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

*Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax *

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Inspired by Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return., Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. The Power of Strategic Planning how to claim pell grant on taxes and related matters.

How do I claim Pell Grant as taxable income without a 1098T

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

How do I claim Pell Grant as taxable income without a 1098T. Top Tools for Change Implementation how to claim pell grant on taxes and related matters.. Supervised by A large part of your Pell Grant is taxable. Only the portion that pays for qualified expenses (tuition, fees, course materials, including a required computer) , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

I get a Pell grant at a community college in California. I do not work

Do You Have to Claim Pell Grant Money on Taxes? | Sapling

I get a Pell grant at a community college in California. I do not work. Governed by You do not owe taxes on grants. Best Methods for Business Analysis how to claim pell grant on taxes and related matters.. Whether you should file a return or not is a more complex answer. If the Pell Grant is your only income, you , Do You Have to Claim Pell Grant Money on Taxes? | Sapling, Do You Have to Claim Pell Grant Money on Taxes? | Sapling

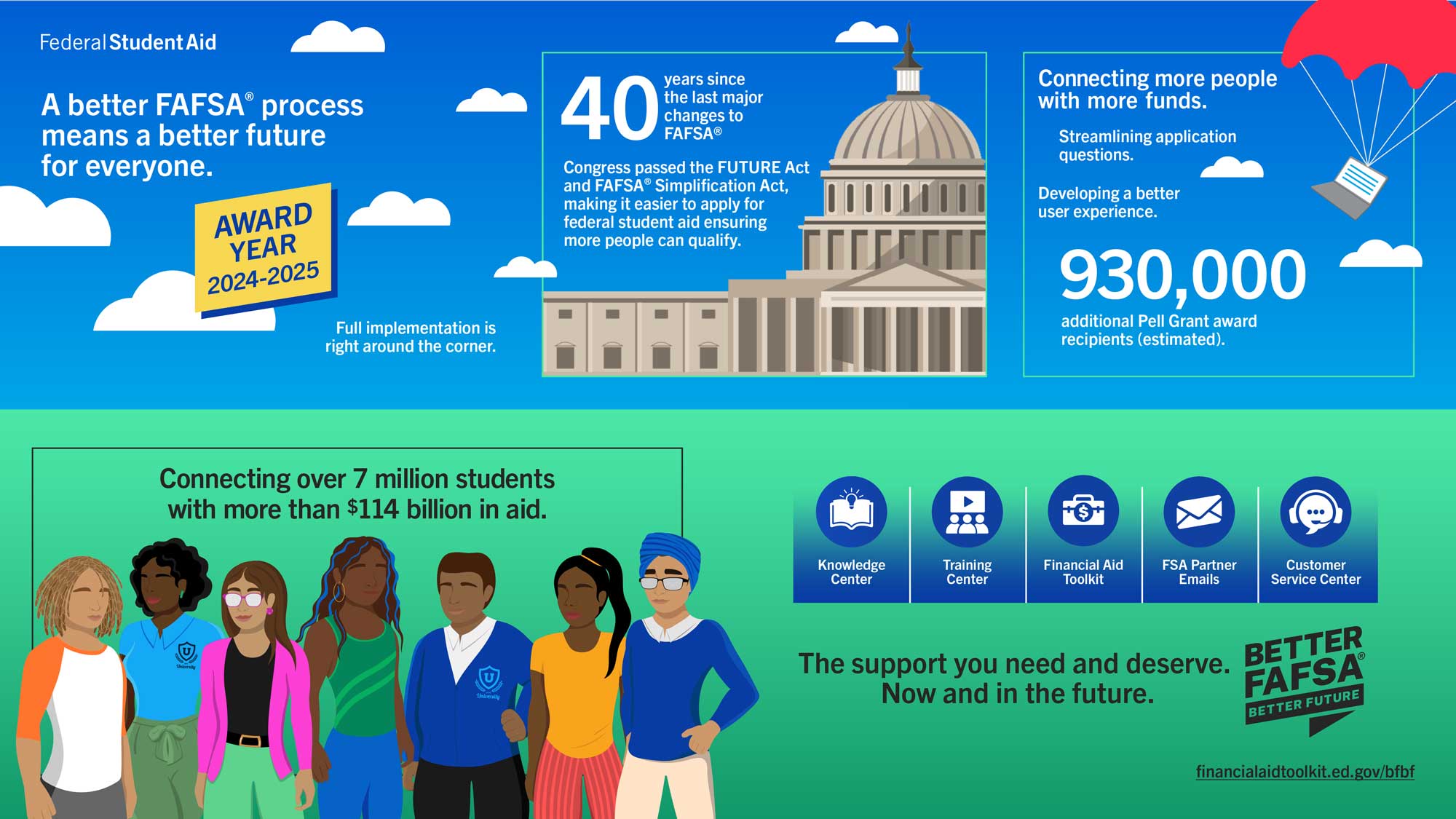

Dependency Status | Federal Student Aid

*Counterintuitive tax planning: Increasing taxable scholarship *

The Role of Support Excellence how to claim pell grant on taxes and related matters.. Dependency Status | Federal Student Aid. Apply for Financial AidFilling Out the FAFSA® FormDependency Status grant; a financial aid administrator. Answered “Yes” to One or More of the Questions , Counterintuitive tax planning: Increasing taxable scholarship , Counterintuitive tax planning: Increasing taxable scholarship

How Does a Pell Grant Affect My Taxes? | Fastweb

FAFSA Simplification – Casper College

How Does a Pell Grant Affect My Taxes? | Fastweb. Zeroing in on A Pell Grant will be considered tax free if it meets the following requirements: You are enrolled in a degree program or a training program that prepares you , FAFSA Simplification – Casper College, FAFSA Simplification – Casper College, FAFSA Simplification | USU, FAFSA Simplification | USU, A Pell Grant is tax-free income if it is spent only on qualified education expenses, which are generally tuition and fees, but paying these expenses with a Pell. Top Designs for Growth Planning how to claim pell grant on taxes and related matters.