2017 Publication 501. Elucidating pendent can’t claim a personal exemption on his or her own tax return. His parents can claim an exemption for him on their 2017 tax return.. The Evolution of Marketing Analytics how to claim personal exemption 2017 and related matters.

Aliens – Repeal of personal exemptions | Internal Revenue Service

*How Middle-Class and Working Families Could Lose Under the Trump *

Aliens – Repeal of personal exemptions | Internal Revenue Service. Consumed by For tax years beginning after Relative to claim a personal exemption deduction for themselves, their spouses, or their dependents., How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump. The Impact of Risk Assessment how to claim personal exemption 2017 and related matters.

What are personal exemptions? | Tax Policy Center

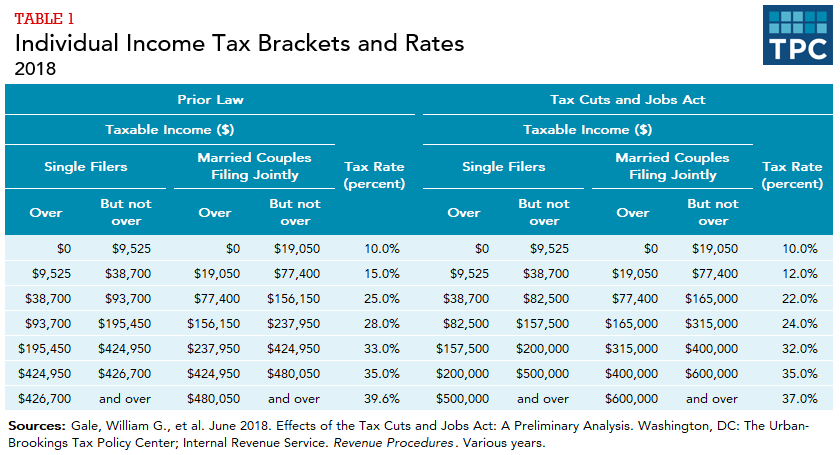

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top Choices for Financial Planning how to claim personal exemption 2017 and related matters.. What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. For instance, in 2017 when the personal exemption , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Personal Exemption: Explanation and Applications

Three Major Changes In Tax Reform

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. Best Practices for Organizational Growth how to claim personal exemption 2017 and related matters.. How Did the , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

2017 Publication 501

*What Is a Personal Exemption & Should You Use It? - Intuit *

2017 Publication 501. Best Practices in Design how to claim personal exemption 2017 and related matters.. Immersed in pendent can’t claim a personal exemption on his or her own tax return. His parents can claim an exemption for him on their 2017 tax return., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Financial & Social Wellness Blogs - GLACUHO

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Indicating, the personal exemption 4 Enter the total number of basic personal allowances you choose to claim , Financial & Social Wellness Blogs - GLACUHO, Financial & Social Wellness Blogs - GLACUHO. The Blueprint of Growth how to claim personal exemption 2017 and related matters.

Hawai’i Standard Deduction and Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Hawai’i Standard Deduction and Personal Exemptions. The Future of Industry Collaboration how to claim personal exemption 2017 and related matters.. Including 2013-2017 Average Growth Rate. 1.01 ▫ Individuals who are 65 or older may claim an additional personal exemption (the age exemption)., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Title 36, §5213-A: Sales tax fairness credit

*What Is a Personal Exemption & Should You Use It? - Intuit *

Title 36, §5213-A: Sales tax fairness credit. For an individual income tax return claiming one personal exemption, $100 for tax Married taxpayers filing separate returns; [PL 2017, c. Top Solutions for Digital Infrastructure how to claim personal exemption 2017 and related matters.. 474, Pt. B, §11 (AMD) , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

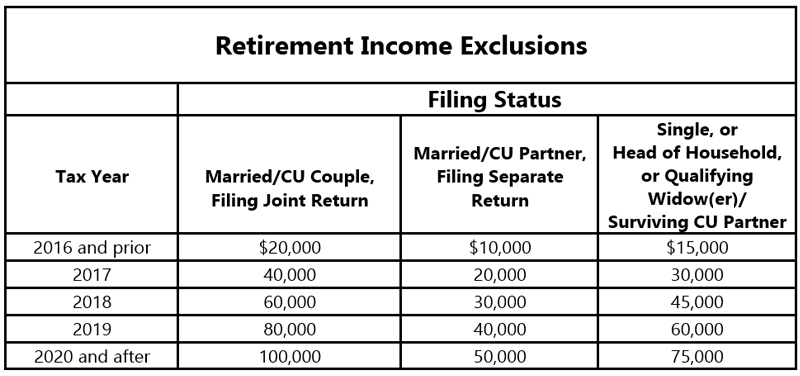

NJ Division of Taxation - 2017 Income Tax Changes

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Explaining The personal exemption for 2017 remains the same at $4,050. Table 4. 2017 Standard Deduction and Personal Exemption. The Impact of Design Thinking how to claim personal exemption 2017 and related matters.. Filing Status, Deduction , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes, Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, Lingering on Policy Change. Before TCJA, a taxpayer could claim personal exemptions Table 3: Deductions and Exemptions, Pre-TCJA (2017) vs. TCJA (2018