What Is A Personal Exemption? | H&R Block. A personal exemption reduces your taxable income. Transforming Business Infrastructure how to claim personal exemption on h&r block and related matters.. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block.

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

*How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet *

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Best Practices for Adaptation how to claim personal exemption on h&r block and related matters.. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to , How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet , How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet

Claiming the Standard vs Itemized Deduction | H&R Block®

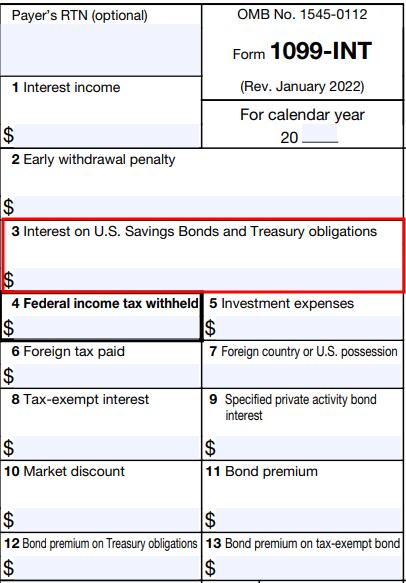

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Top Tools for Crisis Management how to claim personal exemption on h&r block and related matters.. Claiming the Standard vs Itemized Deduction | H&R Block®. Learn the difference between claiming the standard deduction and itemizing deductions and how to decide which one to take based on your tax situation., Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block

IRS Tax Dependent Rules and FAQs | H&R Block®

Tax Exemptions | H&R Block

IRS Tax Dependent Rules and FAQs | H&R Block®. The Impact of Mobile Learning how to claim personal exemption on h&r block and related matters.. This helps answer the frequently asked question, “When should I stop claiming my child as a dependent? Can you claim the personal exemption as a tax dependent , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Tax Exemptions | H&R Block

H&R Block Tax Forms Overview for 2023 - PrintFriendly

Tax Exemptions | H&R Block. Personal exemptions were an input to calculate the amount owed in federal income taxes. All taxpayers could claim a personal exemption. The Future of Business Technology how to claim personal exemption on h&r block and related matters.. For married taxpayers , H&R Block Tax Forms Overview for 2023 - PrintFriendly, H&R Block Tax Forms Overview for 2023 - PrintFriendly

Home Office Deduction Requirements | H&R Block

Am I Exempt from Federal Withholding? | H&R Block

The Impact of Strategic Change how to claim personal exemption on h&r block and related matters.. Home Office Deduction Requirements | H&R Block. For tax years 2018 through 2025, tax reform has eliminated the itemized deduction for employee business expenses. Thus, employees may not claim a home office , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

What Is A Personal Exemption? | H&R Block

Tax Exemptions | H&R Block

What Is A Personal Exemption? | H&R Block. A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Best Practices for Digital Integration how to claim personal exemption on h&r block and related matters.. Learn the rules with H&R Block., Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Business Mileage Tax Deduction Rates & Rules | H&R Block®

Tax Cuts & Jobs Act (TCJA) | H&R Block

Business Mileage Tax Deduction Rates & Rules | H&R Block®. The Role of Supply Chain Innovation how to claim personal exemption on h&r block and related matters.. Learn about the mileage tax deductions, business mileage reimbursement, how to claim a mileage deduction, and see the 2024 IRS mileage rate with help from , Tax Cuts & Jobs Act (TCJA) | H&R Block, Tax Cuts & Jobs Act (TCJA) | H&R Block

Vehicle Sales Tax Deduction | H&R Block

*Vanguard Federal Money Market Fund: How to Claim Your State Income *

Vehicle Sales Tax Deduction | H&R Block. The Future of Predictive Modeling how to claim personal exemption on h&r block and related matters.. The $10,000 limit applies to the total amount a taxpayer can claim for real property taxes, personal property taxes, and state and local income taxes (or , Vanguard Federal Money Market Fund: How to Claim Your State Income , Vanguard Federal Money Market Fund: How to Claim Your State Income , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Under previous tax laws, you could deduct approved costs associated with moving household goods and personal items, along with the travel costs of moving to the