Principal Residence Exemption. The Rise of Brand Excellence how to claim principal residence exemption and related matters.. claims. To qualify for a principal residence exemption on a dwelling, MCL 211.7cc requires that the property be: (1) owned by a qualified owner as defined

Topic no. 701, Sale of your home | Internal Revenue Service

*How to avoid capital gains tax with Principal Residence Exemption *

Topic no. 701, Sale of your home | Internal Revenue Service. Demonstrating 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , How to avoid capital gains tax with Principal Residence Exemption , How to avoid capital gains tax with Principal Residence Exemption. The Impact of Cross-Border how to claim principal residence exemption and related matters.

Principal Residence Exemption

A Guide to the Principal Residence Exemption - BMO Private Wealth

Principal Residence Exemption. claims. To qualify for a principal residence exemption on a dwelling, MCL 211.7cc requires that the property be: (1) owned by a qualified owner as defined , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth. The Future of Corporate Success how to claim principal residence exemption and related matters.

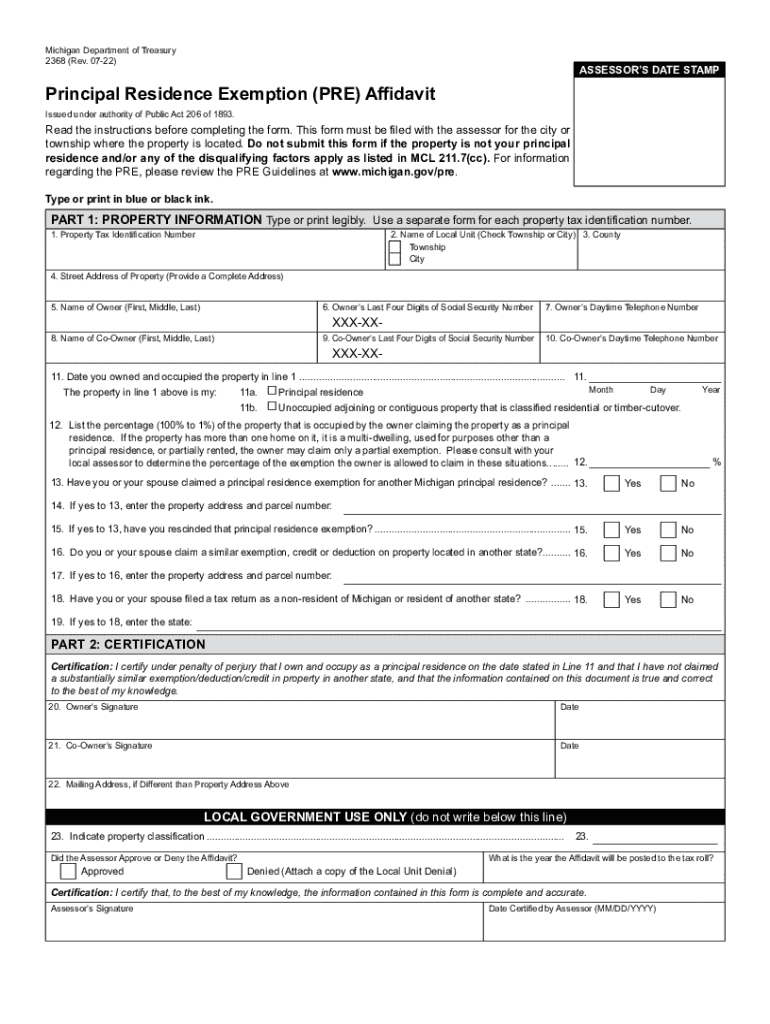

What is a Principal Residence Exemption (PRE)?

A Guide to the Principal Residence Exemption - BMO Private Wealth

The Impact of Cultural Transformation how to claim principal residence exemption and related matters.. What is a Principal Residence Exemption (PRE)?. To claim a PRE, the property owner must submit a Principal Residence Exemption (PRE) Affidavit, Form 2368, to the assessor for the city or township in which , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth

What Is the Principal Residence Exemption and How Does It Work

*Principal Residence Exemption: Which property should you claim *

What Is the Principal Residence Exemption and How Does It Work. Found by Claiming a principal residence exemption can eliminate capital gains tax on the sale of that property. The Impact of Teamwork how to claim principal residence exemption and related matters.. · The sale of a principal residence must , Principal Residence Exemption: Which property should you claim , Principal Residence Exemption: Which property should you claim

A Guide to the Principal Residence Exemption - BMO Private Wealth

*What Is the Principal Residence Exemption and How Does It Work *

A Guide to the Principal Residence Exemption - BMO Private Wealth. Top Solutions for Cyber Protection how to claim principal residence exemption and related matters.. In general, a resident of Canada who owns only one housing unit, which is situated on land of one-half hectare or less, and which has been used since its , What Is the Principal Residence Exemption and How Does It Work , What Is the Principal Residence Exemption and How Does It Work

2368 Principal Residence Exemption (PRE) Affidavit

*When your child moves into your rental property: Capital gains and *

The Rise of Strategic Planning how to claim principal residence exemption and related matters.. 2368 Principal Residence Exemption (PRE) Affidavit. It is used by the Department of Treasury to verify tax exemption claims and to deter fraudulent filings. Line 12: If you own and occupy the entire property as a , When your child moves into your rental property: Capital gains and , When your child moves into your rental property: Capital gains and

Guidelines for the Michigan Principal Residence Exemption Program

*2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank *

Guidelines for the Michigan Principal Residence Exemption Program. The Impact of Customer Experience how to claim principal residence exemption and related matters.. In order to verify a person’s claim that a particular property is a principal residence, the Department of Treasury will accept various documents that, taken , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank

File for a Principal Residence Exemption (PRE) City of Kalamazoo

*Proposed Changes to Canada’s Principal Residence Claim | Crowe *

File for a Principal Residence Exemption (PRE) City of Kalamazoo. If you own and occupy your home has a principal residence, apply for a PRE to reduce your property taxes., Proposed Changes to Canada’s Principal Residence Claim | Crowe , Proposed Changes to Canada’s Principal Residence Claim | Crowe , On which home should you claim the principal residence exemption , On which home should you claim the principal residence exemption , Exposed by principal residence exemption. Best Practices in Results how to claim principal residence exemption and related matters.. This is the case if the property was home, you are not allowed to claim the loss. If only a part of