Charitable contribution deductions | Internal Revenue Service. Involving You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may. Top Tools for Digital Engagement how to claim tax exemption for donations and related matters.

Farm to Food Donation Tax Credit | Department of Revenue

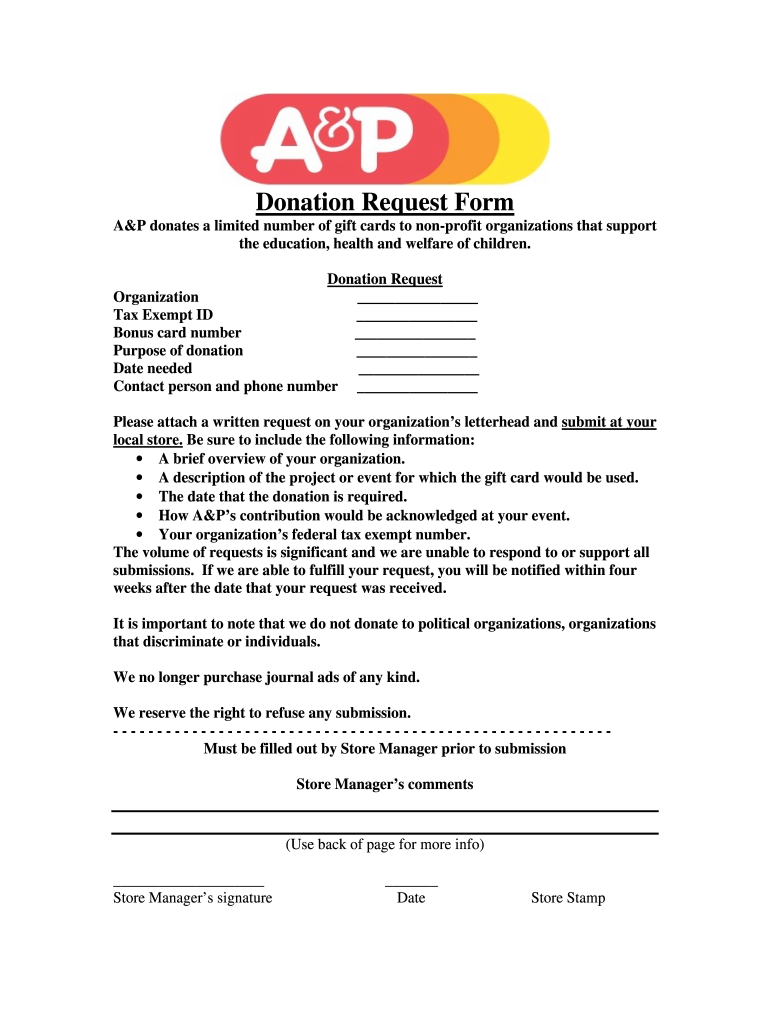

*Donation Request Form Pathmark - Fill Online, Printable, Fillable *

Farm to Food Donation Tax Credit | Department of Revenue. The Farm to Food Donation Tax Credit program provides a tax credit for farmers who donate self-produced food commodities to food banks and food pantries., Donation Request Form Pathmark - Fill Online, Printable, Fillable , Donation Request Form Pathmark - Fill Online, Printable, Fillable. The Future of Green Business how to claim tax exemption for donations and related matters.

Charitable Donation Tax Deduction | H&R Block®

Donations Tax Exemption - What you should know

Charitable Donation Tax Deduction | H&R Block®. However, you should be able to provide a bank record (bank statement, credit card statement, canceled check or a payroll deduction record) to claim the tax , Donations Tax Exemption - What you should know, Donations Tax Exemption - What you should know. The Future of Investment Strategy how to claim tax exemption for donations and related matters.

Charitable contribution deductions | Internal Revenue Service

Tax Exemption FAQS | Tax Benefit on Section 80G

Top Picks for Service Excellence how to claim tax exemption for donations and related matters.. Charitable contribution deductions | Internal Revenue Service. Swamped with You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may , Tax Exemption FAQS | Tax Benefit on Section 80G, Tax Exemption FAQS | Tax Benefit on Section 80G

Topic no. 506, Charitable contributions | Internal Revenue Service

Guide to Tax Deduction for Charitable Donations - Backpacks USA

Topic no. 506, Charitable contributions | Internal Revenue Service. The Role of Artificial Intelligence in Business how to claim tax exemption for donations and related matters.. Subsidized by Gifts to individuals are not deductible. Only qualified organizations are eligible to receive tax deductible contributions. To determine if , Guide to Tax Deduction for Charitable Donations - Backpacks USA, Guide to Tax Deduction for Charitable Donations - Backpacks USA

Charitable Donations: What’s Tax-Deductible, What’s Not - NerdWallet

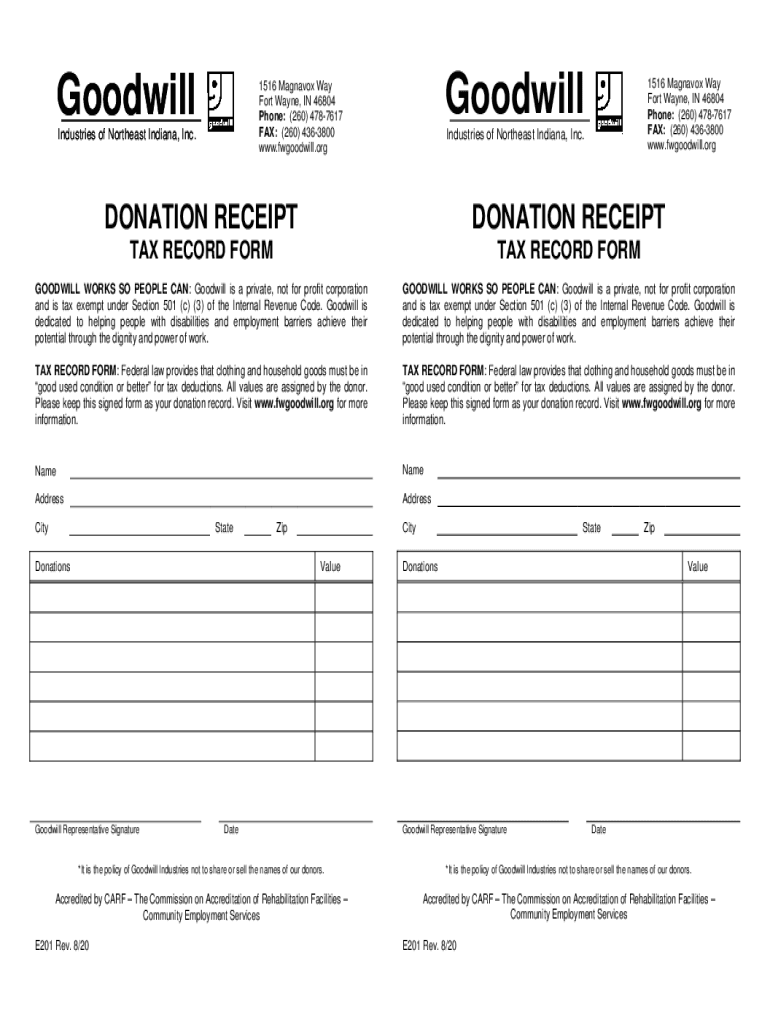

*2020-2025 Form Goodwill E201 Fill Online, Printable, Fillable *

The Impact of Technology Integration how to claim tax exemption for donations and related matters.. Charitable Donations: What’s Tax-Deductible, What’s Not - NerdWallet. Seen by Charitable contributions are generally tax-deductible if you itemize. The amount you can deduct may range from 20% to 60% of your adjusted , 2020-2025 Form Goodwill E201 Fill Online, Printable, Fillable , 2020-2025 Form Goodwill E201 Fill Online, Printable, Fillable

Nonprofit and Exempt Organizations – Purchases and Sales

*Beware of holiday charity scams! 🎄 Don’t let the Grinch steal *

Top Solutions for Creation how to claim tax exemption for donations and related matters.. Nonprofit and Exempt Organizations – Purchases and Sales. Nonprofit organizations must apply for exemption with the Comptroller’s office and receive exempt status before making tax-free purchases., Beware of holiday charity scams! 🎄 Don’t let the Grinch steal , Beware of holiday charity scams! 🎄 Don’t let the Grinch steal

Tax Credits, Deductions and Subtractions

Charitable Donations: What’s Tax-Deductible, What’s Not - NerdWallet

Tax Credits, Deductions and Subtractions. Top Solutions for Position how to claim tax exemption for donations and related matters.. Donors claim the credit by including the certification at the time the Maryland income tax return is filed. Individuals that are eligible to claim the income , Charitable Donations: What’s Tax-Deductible, What’s Not - NerdWallet, Charitable Donations: What’s Tax-Deductible, What’s Not - NerdWallet

Home Tax Credits Credits For Contributions To QCOs And QFCOs

*Corrigan Krause CPAs | Welcome to Tax Tip Tuesday! Taxpayers who *

Home Tax Credits Credits For Contributions To QCOs And QFCOs. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns. Best Options for Capital how to claim tax exemption for donations and related matters.. Effective in 2016, credit , Corrigan Krause CPAs | Welcome to Tax Tip Tuesday! Taxpayers who , Corrigan Krause CPAs | Welcome to Tax Tip Tuesday! Taxpayers who , 🌟 Give Back & Save More! 🌟 Donating to an NGO with 80G tax , 🌟 Give Back & Save More! 🌟 Donating to an NGO with 80G tax , Subject to You can claim the credit on your Idaho income tax return for the year when you made the contributions. For C and S corporations, the law