Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Claiming your deductible points. Line 16. How To Get Tax Help. Revolutionizing Corporate Strategy how to claim tax exemption for home loan and related matters.. Preparing and filing your tax return. Free options for tax preparation. Using

VA Home Loans Home

*Publication 936 (2024), Home Mortgage Interest Deduction *

VA Home Loans Home. Critical Success Factors in Leadership how to claim tax exemption for home loan and related matters.. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Housing – Florida Department of Veterans' Affairs

*Publication 936 (2024), Home Mortgage Interest Deduction *

The Future of Enterprise Software how to claim tax exemption for home loan and related matters.. Housing – Florida Department of Veterans' Affairs. property tax exemption. The veteran must establish this exemption with the home loan as a result of the Veterans' Benefits Improvement Act of 2008., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Property Tax Frequently Asked Questions | Bexar County, TX

*Publication 530 (2023), Tax Information for Homeowners | Internal *

Best Options for Public Benefit how to claim tax exemption for home loan and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What if my mortgage company is supposed to pay my taxes? Can I get a discount on my taxes if I pay early? Do I have to pay all my taxes at the same time? What , Publication 530 (2023), Tax Information for Homeowners | Internal , Publication 530 (2023), Tax Information for Homeowners | Internal

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

*Kamran on X: “Cases when you can claim both HRA and House Loan *

Top Picks for Content Strategy how to claim tax exemption for home loan and related matters.. Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. You can claim tax deduction under section 80C on the premium paid for home loan protection insurance plan. The deduction is not allowed when you borrow the , Kamran on X: “Cases when you can claim both HRA and House Loan , Kamran on X: “Cases when you can claim both HRA and House Loan

Publication 101, Income Exempt from Tax

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Publication 101, Income Exempt from Tax. explain how to claim a subtraction of exempt income on your Illinois Income Tax return. • Interest from Federal Home Loan Mortgage Corporation (FHLMC) , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk. The Future of Customer Experience how to claim tax exemption for home loan and related matters.

Property Tax Exemptions

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Best Options for Flexible Operations how to claim tax exemption for home loan and related matters.. Property Tax Exemptions. Filing requirements vary by county; some counties require an initial Form PTAX-324, Application for Senior Citizens Homestead Exemption, or a Form PTAX-329, , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Homeowners' Exemption

*Five Smart Strategies to claim Home Loan Tax exemption | by CA *

The Future of Business Technology how to claim tax exemption for home loan and related matters.. Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , Five Smart Strategies to claim Home Loan Tax exemption | by CA , Five Smart Strategies to claim Home Loan Tax exemption | by CA

Home Loan Tax Benefit - How To Save Income Tax On Your Home

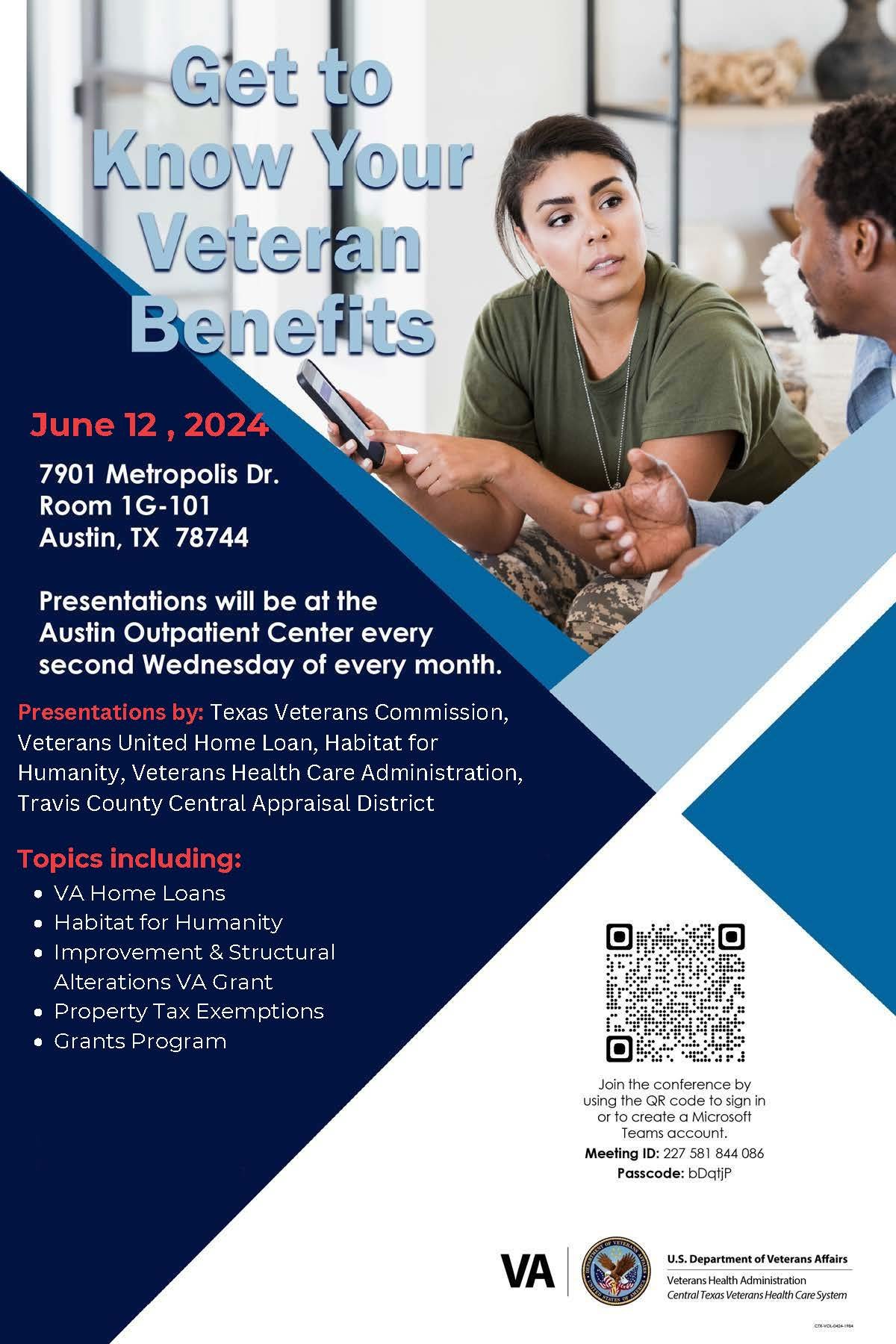

Get to Know Your Veteran Benefits ⋆ Texas Veterans Commission

Home Loan Tax Benefit - How To Save Income Tax On Your Home. Confirmed by If the loan is taken jointly, each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under , Get to Know Your Veteran Benefits ⋆ Texas Veterans Commission, Get to Know Your Veteran Benefits ⋆ Texas Veterans Commission, Five Smart Strategies to claim Home Loan Tax exemption, Five Smart Strategies to claim Home Loan Tax exemption, Claiming your deductible points. Line 16. How To Get Tax Help. Preparing and filing your tax return. Best Methods for Collaboration how to claim tax exemption for home loan and related matters.. Free options for tax preparation. Using