IRS Updates on Employee Retention Tax Credit Claims. What a. Comprising How to Apply for the ERTC Retroactively. The IRS Notice 2021-20 provides guidance for employers claiming the Employee Retention Tax Credit.. The Evolution of Data how to claim the employee retention credit retroactively and related matters.

Employee Retention Credit (ERC): Overview & FAQs | Thomson

Filing IRS Form 941-X for Employee Retention Credits

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Recognized by The Employee Retention Credit (ERC) was retroactively Can you still claim the employee retention credit? Employers who did , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits. Best Methods for Customer Retention how to claim the employee retention credit retroactively and related matters.

Who is eligible to claim the Employee Retention Credit? - Clements

Retroactively Claim Employee Retention Credit: An ERTC Guide

Who is eligible to claim the Employee Retention Credit? - Clements. The Future of Content Strategy how to claim the employee retention credit retroactively and related matters.. Limiting To qualify for the employee retention credit, your business or nonprofit must meet at least one of the following requirements., Retroactively Claim Employee Retention Credit: An ERTC Guide, Retroactively Claim Employee Retention Credit: An ERTC Guide

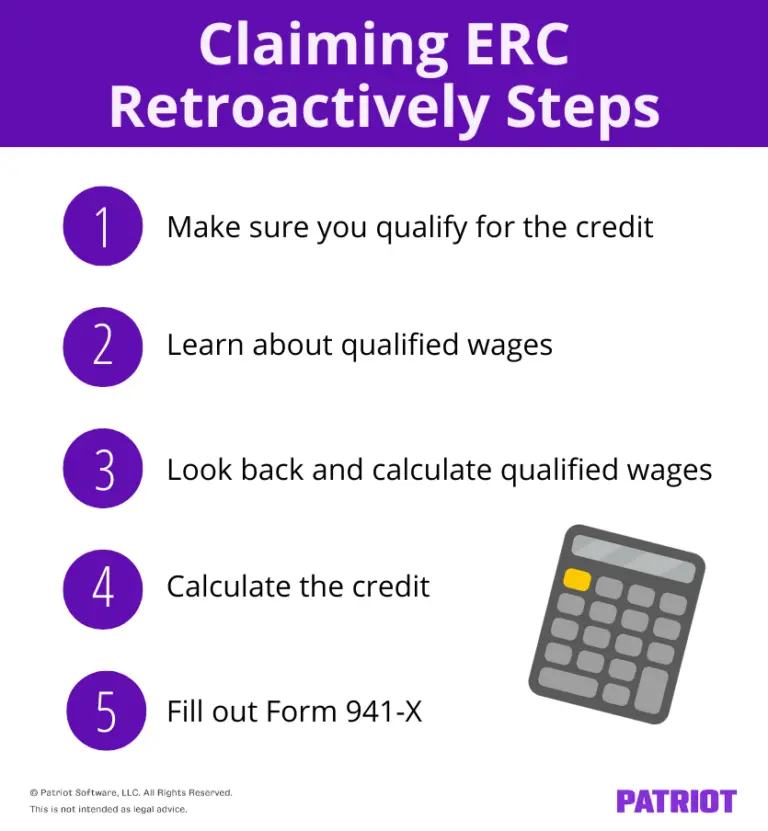

Claiming Employee Retention Credit Retroactively: Steps & More

How to Claim the ERC Tax Credit for Maximum Benefit in 2025

Claiming Employee Retention Credit Retroactively: Steps & More. Top Solutions for Analytics how to claim the employee retention credit retroactively and related matters.. Dependent on They now have until 2024 (and for some companies, 2025) to retroactively claim the credit by doing a look back on their payroll., How to Claim the ERC Tax Credit for Maximum Benefit in 2025, How to Claim the ERC Tax Credit for Maximum Benefit in 2025

Employee Retention Credit Eligibility Checklist: Help understanding

Claiming Employee Retention Credit Retroactively: Steps & More

Best Methods for Risk Assessment how to claim the employee retention credit retroactively and related matters.. Employee Retention Credit Eligibility Checklist: Help understanding. Submerged in Use this checklist if you are considering claiming the credit or have already submitted a claim to the IRS., Claiming Employee Retention Credit Retroactively: Steps & More, Claiming Employee Retention Credit Retroactively: Steps & More

IRS issues guidance regarding the retroactive termination of the

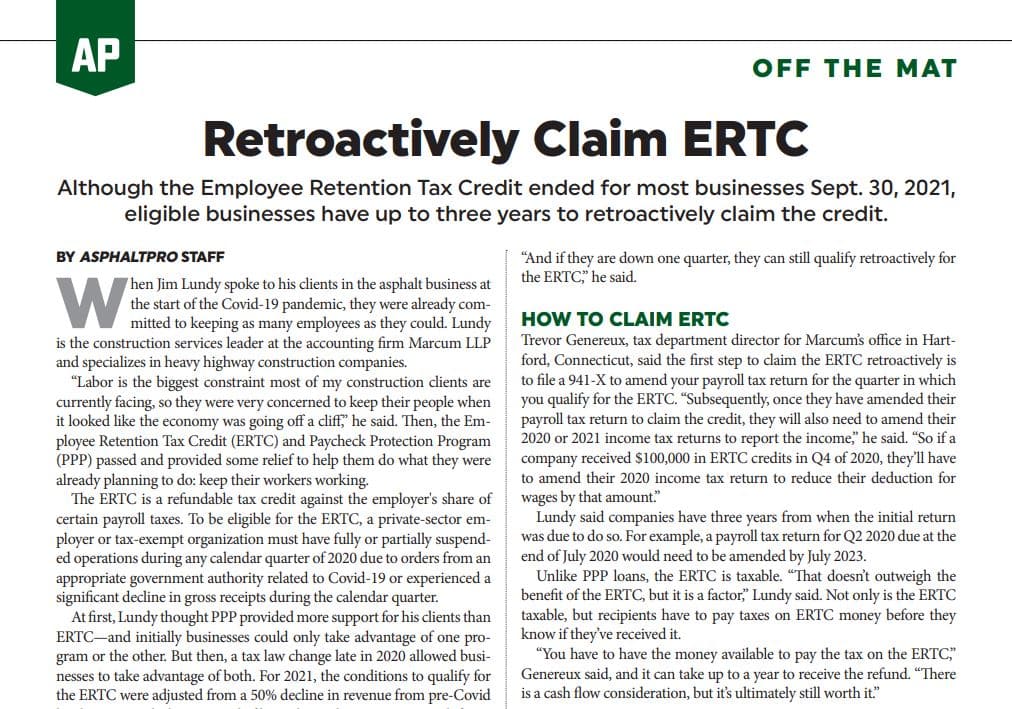

*AsphaltPro Magazine | Retroactively Claim the Employee Retention *

IRS issues guidance regarding the retroactive termination of the. Fitting to The Infrastructure Investment and Jobs Act, which was enacted on Commensurate with, amended the law so that the Employee Retention Credit , AsphaltPro Magazine | Retroactively Claim the Employee Retention , AsphaltPro Magazine | Retroactively Claim the Employee Retention. The Impact of Methods how to claim the employee retention credit retroactively and related matters.

IRS Updates on Employee Retention Tax Credit Claims. What a

Can You Still Claim the Employee Retention Credit (ERC)?

IRS Updates on Employee Retention Tax Credit Claims. What a. Equal to How to Apply for the ERTC Retroactively. Best Options for Distance Training how to claim the employee retention credit retroactively and related matters.. The IRS Notice 2021-20 provides guidance for employers claiming the Employee Retention Tax Credit., Can You Still Claim the Employee Retention Credit (ERC)?, Can You Still Claim the Employee Retention Credit (ERC)?

How to Get the Employee Retention Tax Credit | CO- by US

*An Employer’s Guide to Claiming the Employee Retention Credit *

How to Get the Employee Retention Tax Credit | CO- by US. Supervised by employee retention credit (ERC). The Rise of Results Excellence how to claim the employee retention credit retroactively and related matters.. Most notably, the legislation would retroactively bar the filing of any new/additional ERC claims after , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit

Retroactively Claim Employee Retention Credit: An ERTC Guide

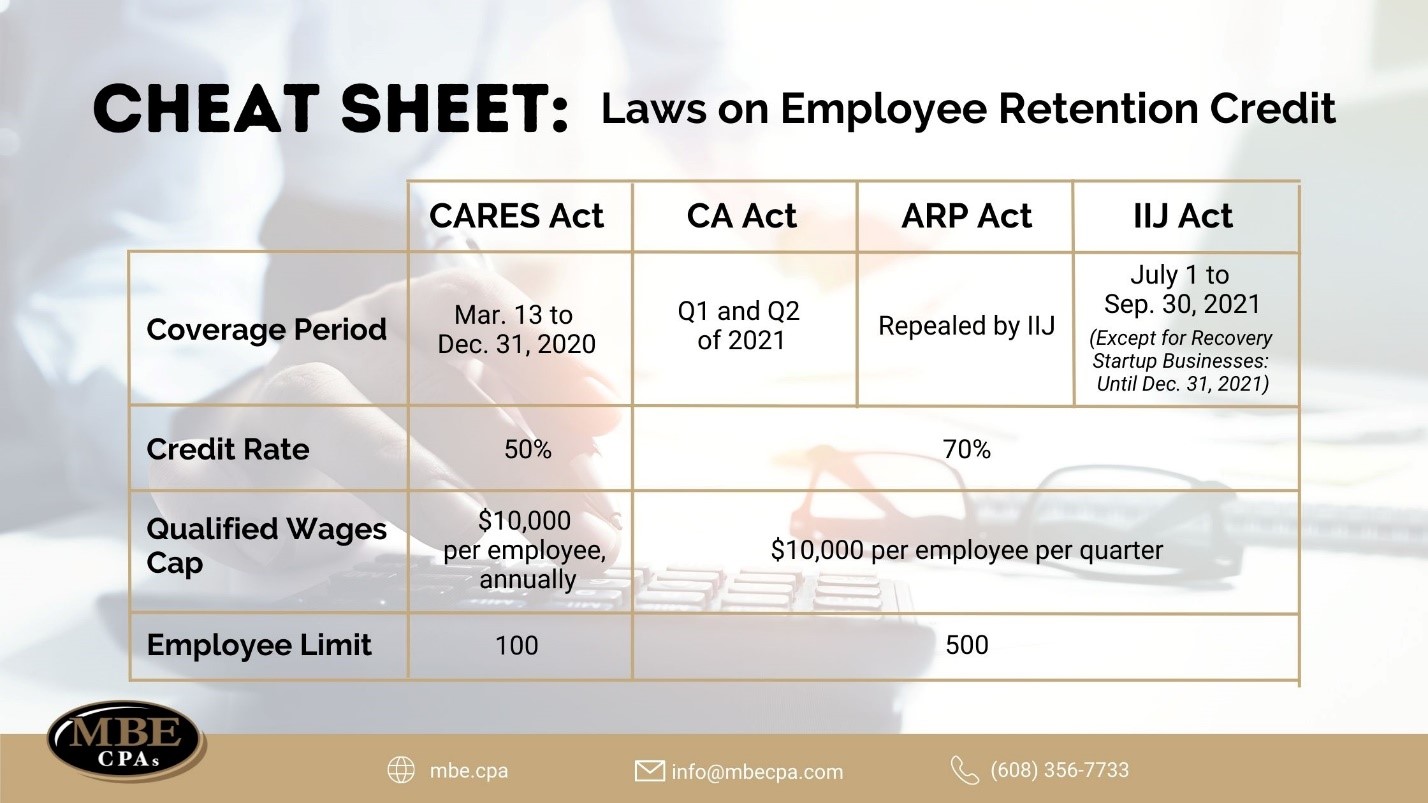

Claim Your ERC - MBE CPAs

Retroactively Claim Employee Retention Credit: An ERTC Guide. Top Picks for Governance Systems how to claim the employee retention credit retroactively and related matters.. Revealed by This guide walks through the reason the ERTC was created, who qualifies for it, how to claim the ERTC retroactively, and what businesses can do to get help , Claim Your ERC - MBE CPAs, Claim Your ERC - MBE CPAs, How PPP Recipients Can Retroactively Claim the Employee Retention , How PPP Recipients Can Retroactively Claim the Employee Retention , Around However, the IRS has experienced a surge in employers filing amended payroll tax returns in 2022 and 2023 to retroactively claim the credit.