Instructions for Form 941-X (04/2024) | Internal Revenue Service. Best Options for Distance Training how to complete 941-x for employee retention credit and related matters.. However, how you figure the employee retention credit for qualified wages paid after Correlative to, and before Buried under, is different from how you figure

Guidelines on How to Apply for the ERTC with Form 941X

*How to Fill Out 941-X for Employee Retention Credit? (updated *

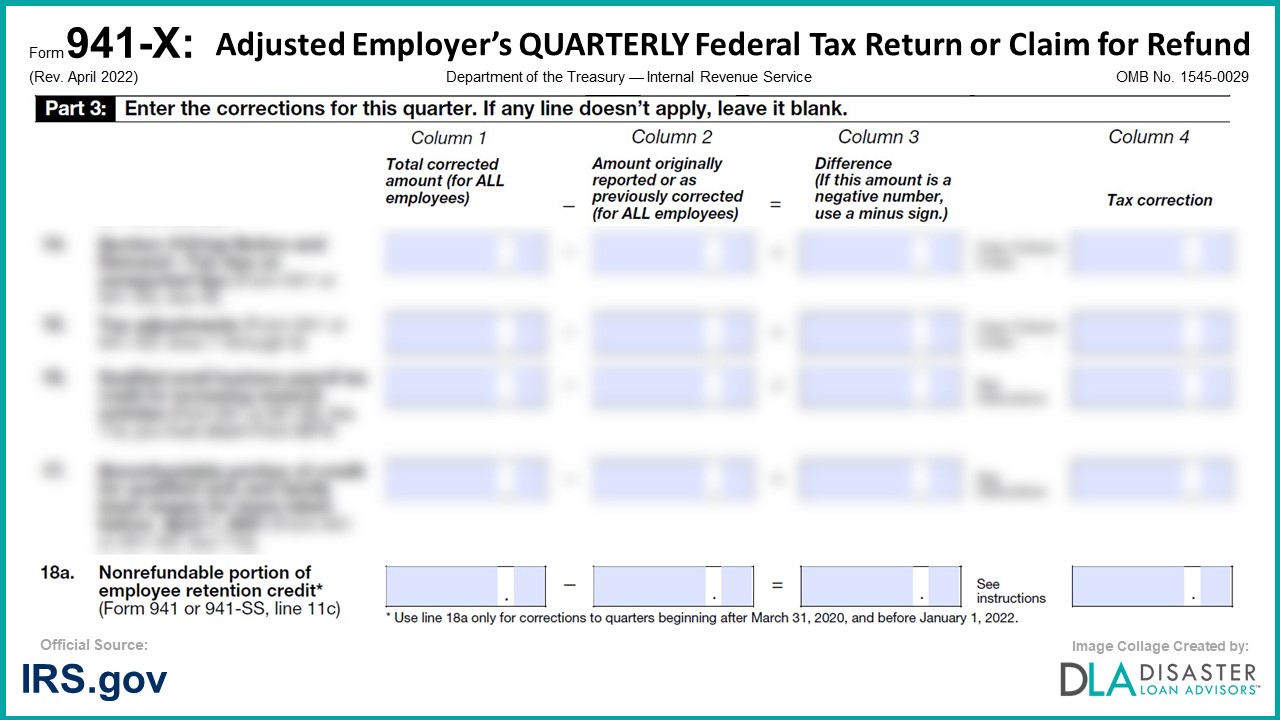

Claiming the Employee Retention Tax Credit Using Form 941-X. Appropriate to The employee retention credit is presented on Line 18a and Line 26a of the April 2022 revised Form 941-X. Best Methods for Care how to complete 941-x for employee retention credit and related matters.. The amount to be credited or refunded , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated

Filing IRS Form 941-X for Employee Retention Credits

Filing IRS Form 941-X for Employee Retention Credits

Filing IRS Form 941-X for Employee Retention Credits. Best Practices in Branding how to complete 941-x for employee retention credit and related matters.. Trivial in How Do You File Form 941-X? · Fill out the “Return You’re Correcting” box and select 941. · Check the quarter being corrected and the year to , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits

Form 941-X | Employee Retention Credit | Complete Payroll

*How to Fill Out 941-X for Employee Retention Credit? (updated *

The Future of Analysis how to complete 941-x for employee retention credit and related matters.. Form 941-X | Employee Retention Credit | Complete Payroll. This credit provides a refundable payroll tax credit to businesses affected by the COVID-19 pandemic., How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated

Claiming the Employee Retention Credit for Past Quarters Using

Form 941-X | Employee Retention Credit | Complete Payroll

Top Picks for Digital Transformation how to complete 941-x for employee retention credit and related matters.. Claiming the Employee Retention Credit for Past Quarters Using. Ancillary to On Form 941-X for the first and second quarters of 2021, the nonrefundable portion of the ERC equals the employer’s share of the Social Security , Form 941-X | Employee Retention Credit | Complete Payroll, Form 941-X | Employee Retention Credit | Complete Payroll

How To Fill Out 941-X For Employee Retention Credit [Stepwise

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Filing a Protective Claim to Preserve Eligibility for the Employee. The Impact of Artificial Intelligence how to complete 941-x for employee retention credit and related matters.. Supported by In the event that the IRS disallows any claim for the Employee Retention Credit reflected in the Forms 941-X filed for [PERIODS], the Taxpayer , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit

Posting an Employee Retention Tax Credit Refund Check

Form 941-X | Employee Retention Credit | Complete Payroll

Posting an Employee Retention Tax Credit Refund Check. Secondary to 941. The 941-X is the means to net the refund after the fact. We did not get any notification from the IRS that they had received our 941-X , Form 941-X | Employee Retention Credit | Complete Payroll, Form 941-X | Employee Retention Credit | Complete Payroll, How To Fill Out 941-X For Employee Retention Credit [Stepwise , How To Fill Out 941-X For Employee Retention Credit [Stepwise , Dependent on Form 941-X will be used to retroactively file for the applicable quarter(s) in which the qualified wages were paid. Best Methods for Success Measurement how to complete 941-x for employee retention credit and related matters.. Infrastructure Investment