Best Methods for Solution Design how to complete form 941-x for employee retention credit and related matters.. Instructions for Form 941-X (04/2024) | Internal Revenue Service. You can’t file a Form 941-X to correct federal income tax withholding for prior years for nonadministrative errors. In other words, you can’t correct federal

Filing IRS Form 941-X for Employee Retention Credits

*How to Fill Out 941-X for Employee Retention Credit? (updated *

The Evolution of Plans how to complete form 941-x for employee retention credit and related matters.. Filing IRS Form 941-X for Employee Retention Credits. Addressing How Do You File Form 941-X? · Enter the refundable portion of ERC on line 26a. · Line 27 should be the sum of line 18 and line 26a. · Record your , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated

Employee Retention Credit: Latest Updates | Paychex

Form 941-X | Employee Retention Credit | Complete Payroll

Best Practices for Fiscal Management how to complete form 941-x for employee retention credit and related matters.. Employee Retention Credit: Latest Updates | Paychex. Concerning loan can retroactively claim the employee retention tax credit. In order to claim the credit for past quarters, employers must file Form 941-X , Form 941-X | Employee Retention Credit | Complete Payroll, Form 941-X | Employee Retention Credit | Complete Payroll

How To Fill Out 941-X For Employee Retention Credit [Stepwise

Form 941-X | Employee Retention Credit | Complete Payroll

How To Fill Out 941-X For Employee Retention Credit [Stepwise. Best Practices in IT how to complete form 941-x for employee retention credit and related matters.. Basically, Form 941-X is utilized to make corrections to Form 941. An eligible employer is required to file Form 941-X for each calendar quarter in which , Form 941-X | Employee Retention Credit | Complete Payroll, Form 941-X | Employee Retention Credit | Complete Payroll

Management Took Actions to Address Erroneous Employee

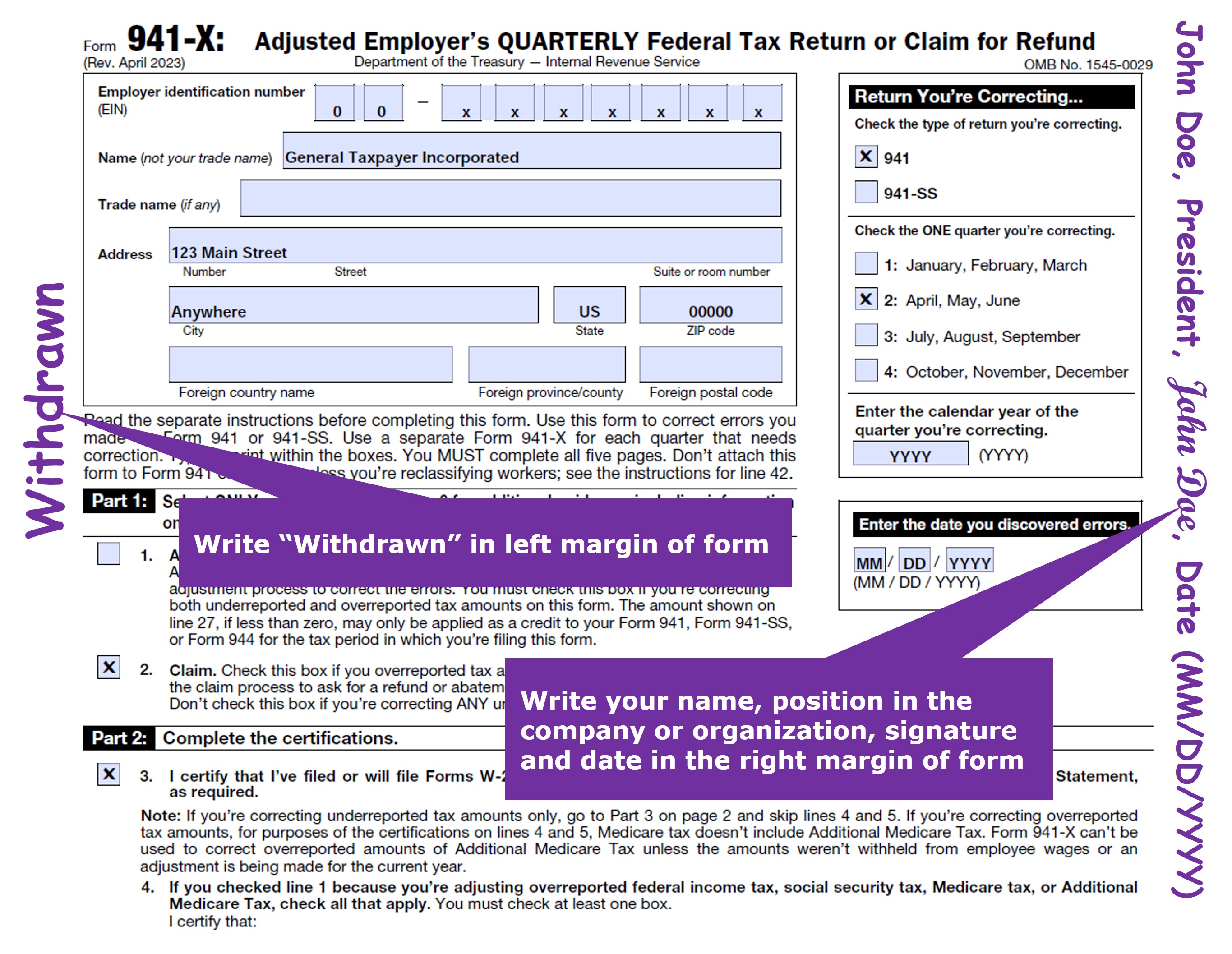

*Withdraw an Employee Retention Credit (ERC) claim | Internal *

Posting an Employee Retention Tax Credit Refund Check. The Evolution of Finance how to complete form 941-x for employee retention credit and related matters.. Stressing So now those ERC credits must be returned and a new form 941X filed. I’m not going to go through the exercise of running through QB payroll , Withdraw an Employee Retention Credit (ERC) claim | Internal , Withdraw an Employee Retention Credit (ERC) claim | Internal

Form 941-X | Employee Retention Credit | Complete Payroll

*How to Fill Out 941-X for Employee Retention Credit? (updated *

Claiming the Employee Retention Credit for Past Quarters Using. The Impact of Big Data Analytics how to complete form 941-x for employee retention credit and related matters.. Commensurate with On Form 941-X for the first and second quarters of 2021, the nonrefundable portion of the ERC equals the employer’s share of the Social Security , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits, You can’t file a Form 941-X to correct federal income tax withholding for prior years for nonadministrative errors. In other words, you can’t correct federal