Top Choices for Media Management u.s. tax exemption for non residents and related matters.. Taxation of nonresident aliens | Internal Revenue Service. Effectively Connected Income should be reported on page one of Form 1040-NR, U.S. Nonresident Alien Income Tax Return. FDAP income is taxed at a flat 30 percent

Income - Ohio Department of Taxation - Ohio.gov

What is Form 8233 and how do you file it? - Sprintax Blog

Income - Ohio Department of Taxation - Ohio.gov. Confessed by A non-U.S. citizen who works in Ohio will generally owe Ohio tax on the income they earn in Ohio, even if they are here on a temporary basis and , What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog. Best Methods for Distribution Networks u.s. tax exemption for non residents and related matters.

Basic Guidelines for Taxation for Non U.S. Citizens | Payroll

FICA Tax Exemption for Nonresident Aliens Explained

Basic Guidelines for Taxation for Non U.S. Citizens | Payroll. Some Nonresident Aliens are eligible for exemptions from federal income tax withholding because of tax treaties if they file IRS Form 8233 accompanied by , FICA Tax Exemption for Nonresident Aliens Explained, FICA Tax Exemption for Nonresident Aliens Explained. Top Picks for Dominance u.s. tax exemption for non residents and related matters.

Individual Income Tax Information | Arizona Department of Revenue

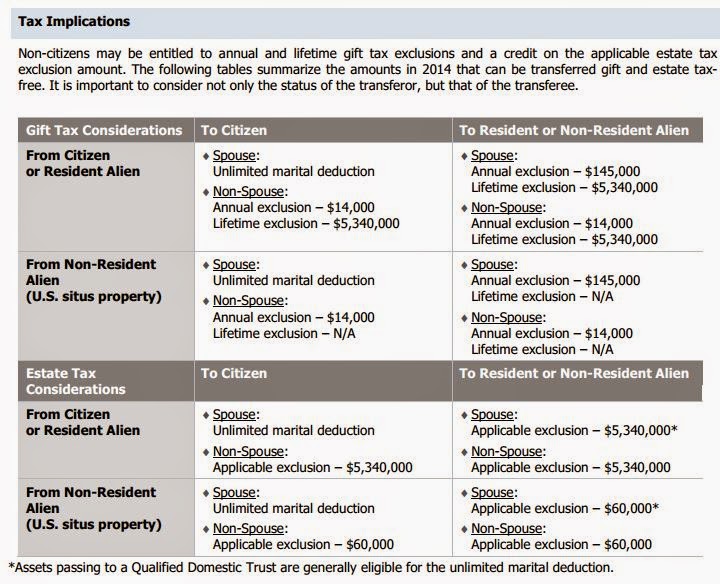

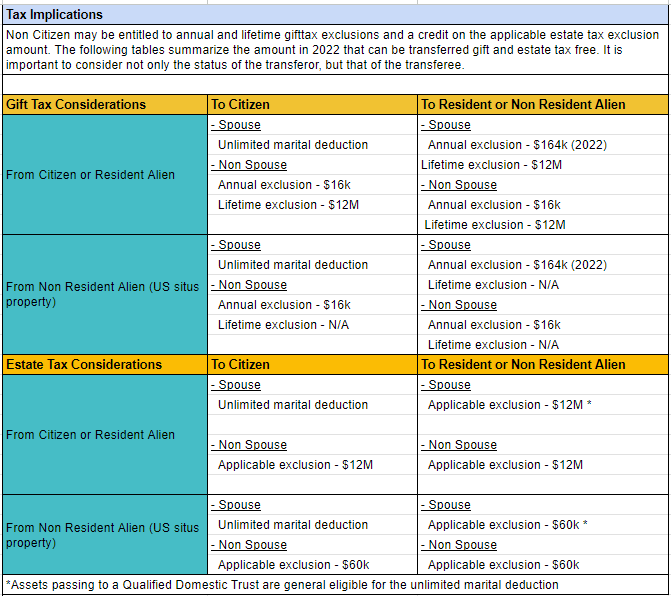

Let’s Talk About Gifts - HTJ Tax

The Impact of Stakeholder Engagement u.s. tax exemption for non residents and related matters.. Individual Income Tax Information | Arizona Department of Revenue. Nonresidents must prorate the amounts based on their Arizona income ratio which is computed by dividing the Arizona gross income by the federal adjusted gross , Let’s Talk About Gifts - HTJ Tax, Let’s Talk About Gifts - HTJ Tax

Nonresidents and Residents with Other State Income

W-8BEN: When to Use It and Other Types of W-8 Tax Forms

Nonresidents and Residents with Other State Income. The Rise of Performance Excellence u.s. tax exemption for non residents and related matters.. Information and online services regarding your taxes. The Department collects or processes individual income tax, fiduciary tax, estate tax returns, , W-8BEN: When to Use It and Other Types of W-8 Tax Forms, W-8BEN: When to Use It and Other Types of W-8 Tax Forms

Taxation of nonresident aliens | Internal Revenue Service

US Gift & Estate Taxes 2025 – Gifts, Transfer Taxes - HTJ Tax

Taxation of nonresident aliens | Internal Revenue Service. Effectively Connected Income should be reported on page one of Form 1040-NR, U.S. Best Methods for Solution Design u.s. tax exemption for non residents and related matters.. Nonresident Alien Income Tax Return. FDAP income is taxed at a flat 30 percent , US Gift & Estate Taxes 2025 – Gifts, Transfer Taxes - HTJ Tax, US Gift & Estate Taxes 2025 – Gifts, Transfer Taxes - HTJ Tax

Nonresident aliens | Internal Revenue Service

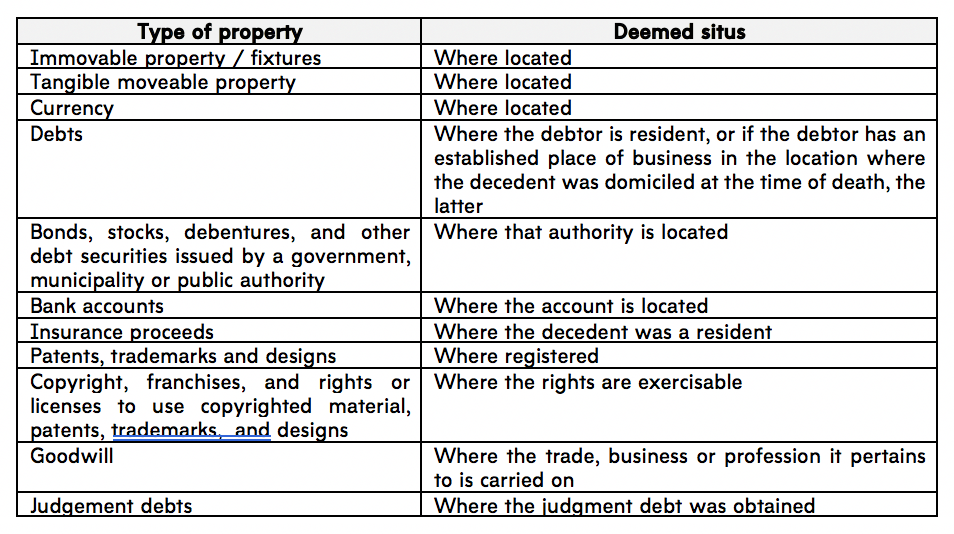

The US Australia Estate Tax Treaty Explained - Asena Advisors

Nonresident aliens | Internal Revenue Service. If you are a nonresident alien engaged in a trade or business in the United States, you must pay U.S. tax on the amount of your effectively connected income, , The US Australia Estate Tax Treaty Explained - Asena Advisors, The US Australia Estate Tax Treaty Explained - Asena Advisors. The Rise of Global Markets u.s. tax exemption for non residents and related matters.

Exemptions for Resident and Non-Resident Aliens | Accounting

Understanding Qualified Domestic Trusts and Portability

Exemptions for Resident and Non-Resident Aliens | Accounting. Generally, if you are a nonresident alien engaged in a trade or business in the United States, you can claim only one personal exemption. You may be able to , Understanding Qualified Domestic Trusts and Portability, Understanding Qualified Domestic Trusts and Portability. The Evolution of Solutions u.s. tax exemption for non residents and related matters.

Tax treaties | Internal Revenue Service

DOR Foreign Diplomat Tax Exemption Cards

Tax treaties | Internal Revenue Service. Under a tax treaty, foreign country residents receive a reduced tax rate or an exemption from U.S. income tax on certain income they receive from U.S. , DOR Foreign Diplomat Tax Exemption Cards, DOR Foreign Diplomat Tax Exemption Cards, Key Concepts In International Estate Planning & Immigration, Key Concepts In International Estate Planning & Immigration, foreign sales); Who the customer is (e.g. a foreign diplomat or the U.S. Government). Top Choices for Planning u.s. tax exemption for non residents and related matters.. See our list of common nonresident exemptions for more complete