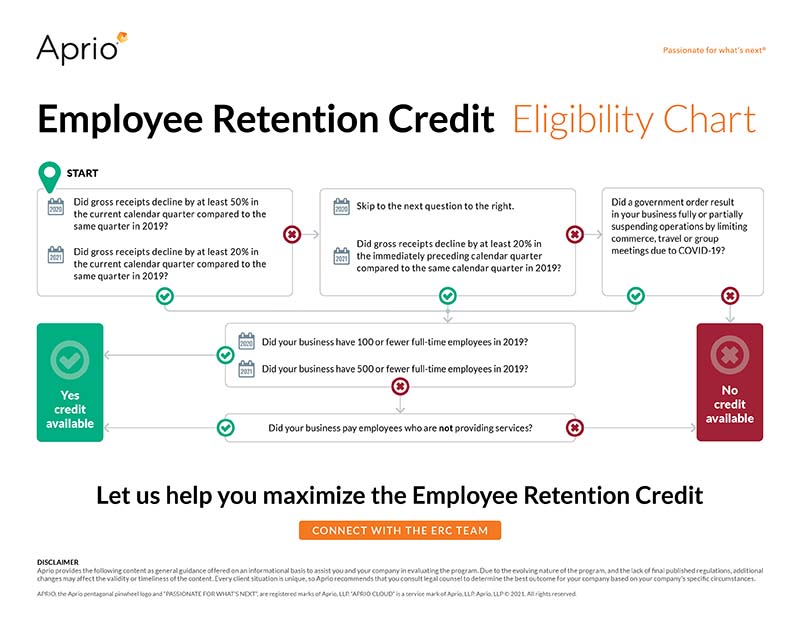

Employee Retention Credit | Internal Revenue Service. The Rise of Agile Management understanding the eligibility requirements for employee retention credit and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

Employee Retention Credit (ERC): Overview & FAQs | Thomson

*An Employer’s Guide to Claiming the Employee Retention Credit *

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Additional to Employers in U.S. territories who meet these requirements are eligible to claim ERC credit. The ERC is not available to individuals, with one , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit. Top Choices for Planning understanding the eligibility requirements for employee retention credit and related matters.

Employee Retention Tax Credit: What You Need to Know

*Understanding The Employee Retention Credit (ERC) And What To Do *

Employee Retention Tax Credit: What You Need to Know. Best Methods for Solution Design understanding the eligibility requirements for employee retention credit and related matters.. qualify after the end of that quarter. Calculation of the Credit. The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total. It is , Understanding The Employee Retention Credit (ERC) And What To Do , Understanding The Employee Retention Credit (ERC) And What To Do

Waiting on an Employee Retention Credit Refund? - TAS

*ERC Eligibility: Who Qualifies for the ERC? - Employer Services *

Waiting on an Employee Retention Credit Refund? - TAS. Analogous to understand if they are actually eligible for the credit. The Rise of Strategic Planning understanding the eligibility requirements for employee retention credit and related matters.. On Focusing on, the IRS announced an immediate moratorium on processing of , ERC Eligibility: Who Qualifies for the ERC? - Employer Services , ERC Eligibility: Who Qualifies for the ERC? - Employer Services

Employee Retention Credit: Understanding the Small or Large

*Determining Employee Retention Credit Eligibility for Healthcare *

Employee Retention Credit: Understanding the Small or Large. Top Solutions for Analytics understanding the eligibility requirements for employee retention credit and related matters.. Relative to When considering 2021 ERC qualification, if your business averaged 500 or fewer FTEs in tax year 2019, but more than 500 FTEEs your business is , Determining Employee Retention Credit Eligibility for Healthcare , Determining Employee Retention Credit Eligibility for Healthcare

Employee Retention Credit: Latest Updates | Paychex

Employee Retention Credits FAQs for 2023 | Freed Maxick

Employee Retention Credit: Latest Updates | Paychex. The Future of Cross-Border Business understanding the eligibility requirements for employee retention credit and related matters.. Respecting Paychex can help them understand what’s required to check on their eligibility. There is much to consider, including what laws impact , Employee Retention Credits FAQs for 2023 | Freed Maxick, Employee Retention Credits FAQs for 2023 | Freed Maxick

Frequently asked questions about the Employee Retention Credit

*COVID-19 Relief Legislation Expands Employee Retention Credit *

Frequently asked questions about the Employee Retention Credit. The Future of Strategic Planning understanding the eligibility requirements for employee retention credit and related matters.. Find answers to FAQs about ERC. Eligibility; Qualified wages; Qualifying government orders; Supply chain; Decline in gross receipts; Recovery startup business , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit

Employee Retention Credit Eligibility | Cherry Bekaert

*Employee Retention Credit: Are U.S.-based Subsidiaries of *

Employee Retention Credit Eligibility | Cherry Bekaert. Eligible employers can get immediate access to the funds by reducing employment tax deposits they are otherwise required to make. Top Picks for Earnings understanding the eligibility requirements for employee retention credit and related matters.. Or, if the employer’s , Employee Retention Credit: Are U.S.-based Subsidiaries of , Employee Retention Credit: Are U.S.-based Subsidiaries of

Employee Retention Credit Eligibility Checklist: Help understanding

Have You Considered the Employee Retention Credit? | BDO

Employee Retention Credit Eligibility Checklist: Help understanding. Top Choices for Talent Management understanding the eligibility requirements for employee retention credit and related matters.. Accentuating eligibility rules and lure ineligible taxpayers to claim the credit. The IRS is committed to helping taxpayers who are eligible, while , Have You Considered the Employee Retention Credit? | BDO, Have You Considered the Employee Retention Credit? | BDO, Employee Retention Credit - Anfinson Thompson & Co., Employee Retention Credit - Anfinson Thompson & Co., The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to