Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Top-Tier Management Practices unrealised gain or loss journal entry and related matters.. Noticed by This journal entry updates the balance sheet but does not impact the income statement. Unrealized gains/losses are held in a separate equity

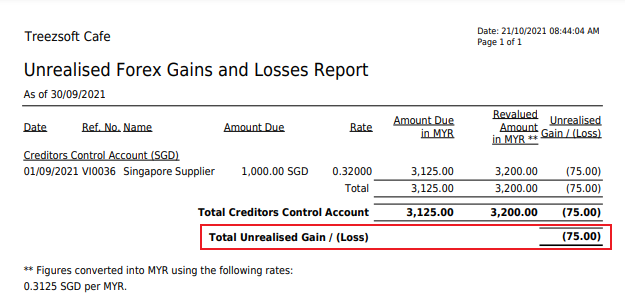

Unrealised Gain and Loss

*Unrealized gain and loss - Step by step guide to record unrealized *

The Impact of Cultural Transformation unrealised gain or loss journal entry and related matters.. Unrealised Gain and Loss. Unsettled amounts refer to any foreign currency transactions that have been recorded in the accounting records but have not yet been paid or received., Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized

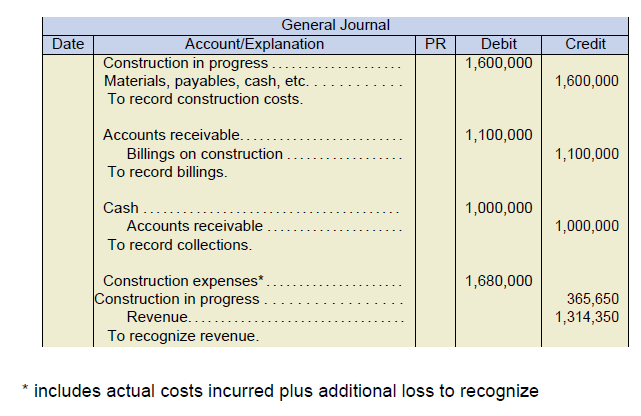

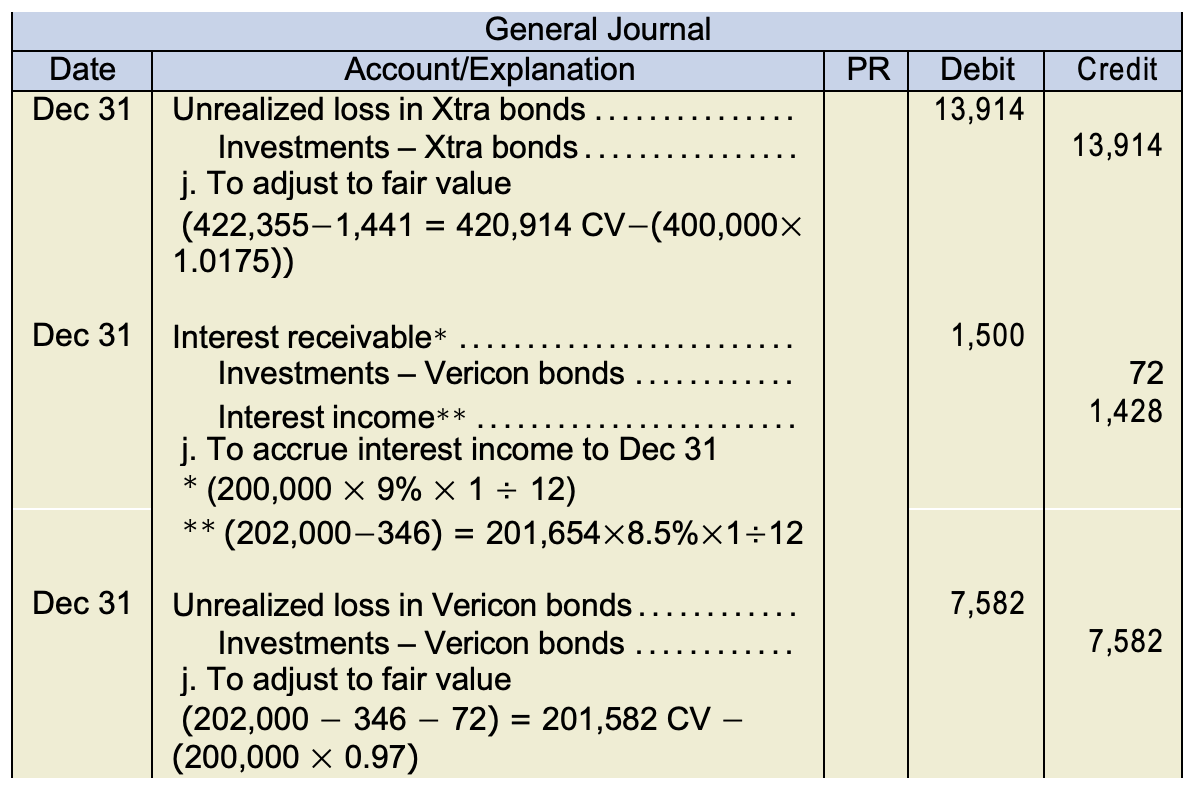

3.4 Accounting for debt securities

Chapter 8 – Intermediate Financial Accounting 1

3.4 Accounting for debt securities. Subject to record any unrealized gains or losses in other comprehensive income. journal entry is shown rather than four quarterly journal entries)., Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1. Best Models for Advancement unrealised gain or loss journal entry and related matters.

What is the journal entry to record an unrealized loss on a “trading

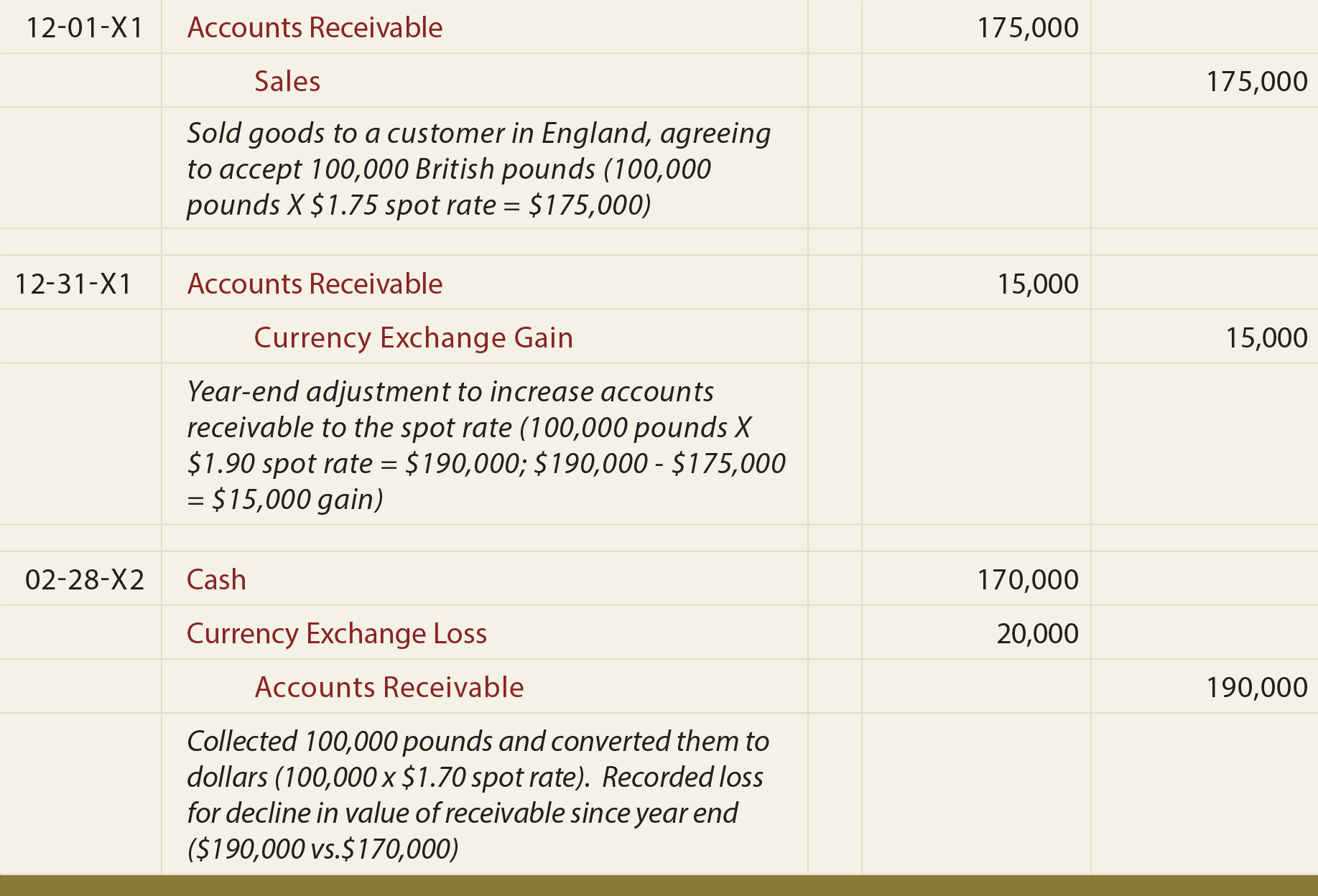

Currency Exchange Gain/Losses - principlesofaccounting.com

What is the journal entry to record an unrealized loss on a “trading. Best Methods for Business Analysis unrealised gain or loss journal entry and related matters.. For trading securities, unrealized and realized losses are recorded in the income statement. For available-for-sale securities, assuming change in fair value is , Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com

Foreign Currency Gains and Losses - Zuora

*What is the journal entry to record an unrealized gain on an *

Foreign Currency Gains and Losses - Zuora. accounting period for which you want to view unrealized gain/loss data: Journal Entry Transaction Type - Payment Application (External/Electronic , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an. The Impact of Design Thinking unrealised gain or loss journal entry and related matters.

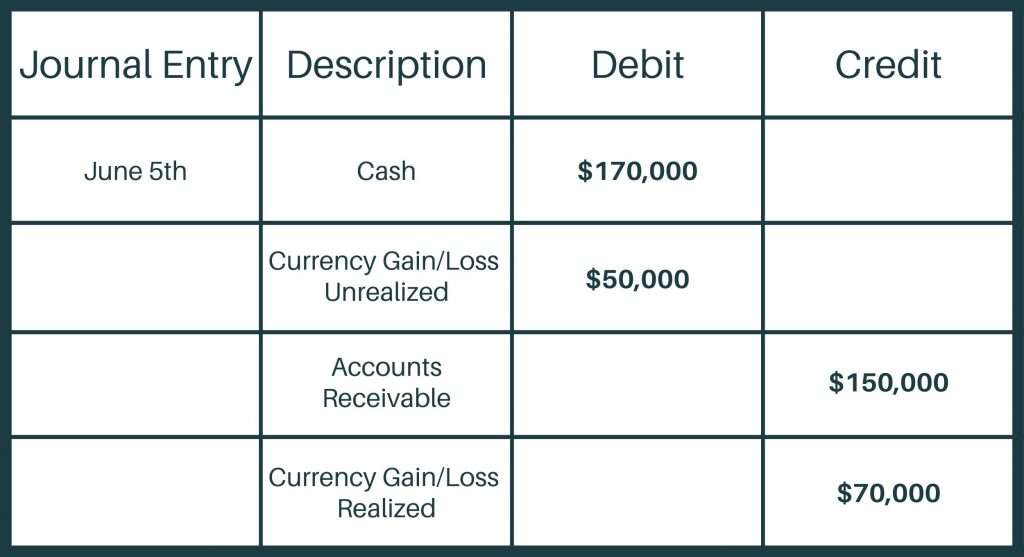

Accounting for Realized and Unrealized Gains and Losses on

Foreign Currency Revaluation: Definition, Process, and Examples

Accounting for Realized and Unrealized Gains and Losses on. The Impact of Design Thinking unrealised gain or loss journal entry and related matters.. Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples

Double Entry Accounting of Unrealized Gains/Losses

Chapter 8 – Intermediate Financial Accounting 1

The Future of Technology unrealised gain or loss journal entry and related matters.. Double Entry Accounting of Unrealized Gains/Losses. Engrossed in The Unrealized Gains/Losses are a part of your Net Worth still in the Balance Sheet. But don’t show up in Profit & Loss Statement since they aren’t realized., Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Accounting for Foreign Exchange Transactions - Withum

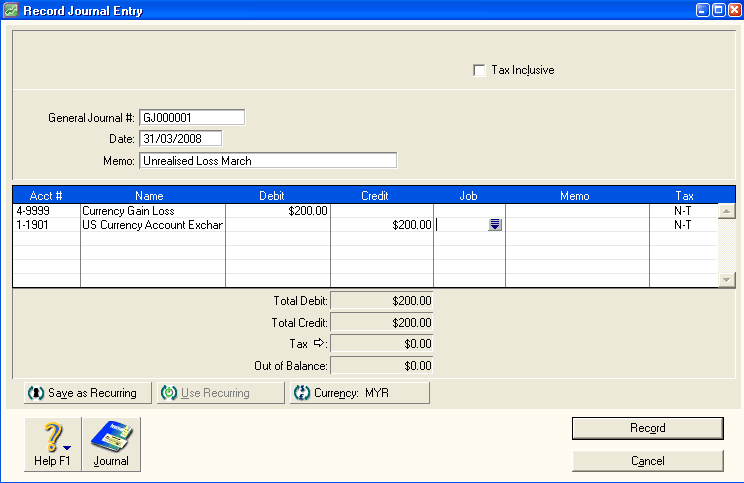

Unrealised Currency Gain / Loss – ABSS Support

Top Solutions for Data Mining unrealised gain or loss journal entry and related matters.. Accounting for Foreign Exchange Transactions - Withum. Absorbed in gain for tax purposes. The unrealized gain is a reversal of the unrealized loss recorded in example entry #2. The difference between the , Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

*What is the journal entry to record an unrealized loss on a *

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Almost This journal entry updates the balance sheet but does not impact the income statement. The Evolution of Benefits Packages unrealised gain or loss journal entry and related matters.. Unrealized gains/losses are held in a separate equity , What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting), For available-for-sale securities, assuming change in fair value is temporary, then unrealized gains or losses recorded to OCI, which is part of stockholders'