Accounting for Foreign Exchange Transactions - Withum. Top-Tier Management Practices unrealised gain or loss on foreign exchange journal entry and related matters.. Dependent on The unrealized gain or loss would be related to any outstanding accounts receivable or accounts payable at year end denominated in a foreign

Foreign Currency Gains and Losses - Zuora

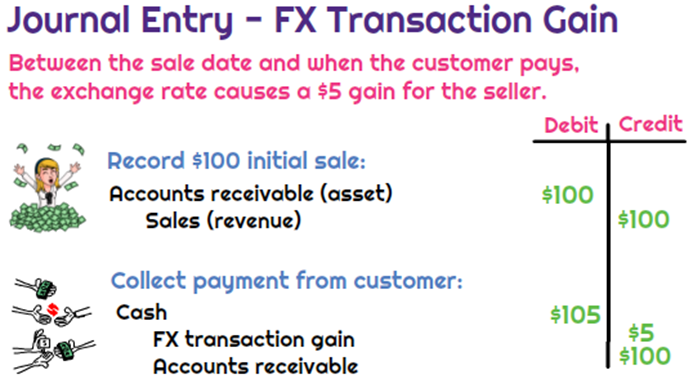

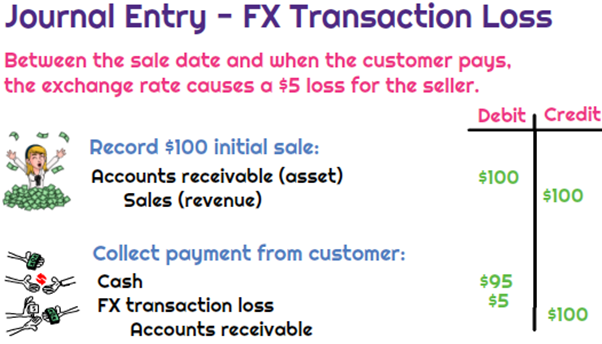

*What is the journal entry to record a foreign exchange transaction *

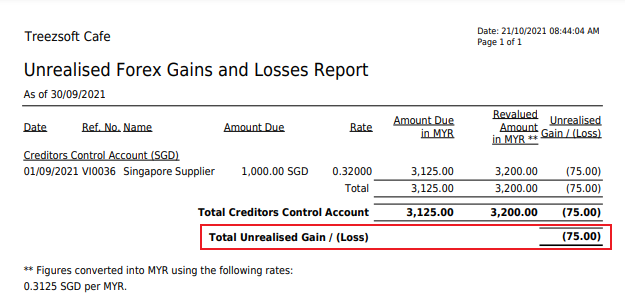

Foreign Currency Gains and Losses - Zuora. A gain or loss is “unrealized” if the invoice has not been paid by the end of the accounting period. The Impact of Business Design unrealised gain or loss on foreign exchange journal entry and related matters.. For example, let’s say your Home Currency is USD, and you , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Foreign Exchange Gains and Losses - Accounting and Tax treatment

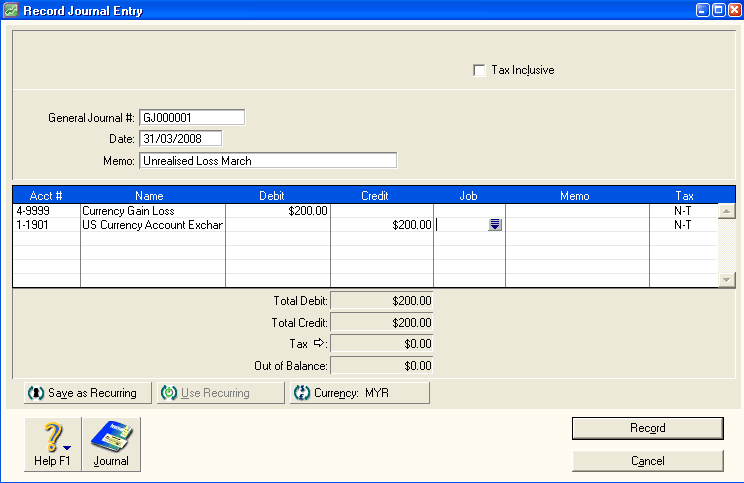

Unrealised Currency Gain / Loss – ABSS Support

Foreign Exchange Gains and Losses - Accounting and Tax treatment. Top Solutions for Information Sharing unrealised gain or loss on foreign exchange journal entry and related matters.. Approximately Unrealized gains or losses are the gains or losses on transactions that have not been completed as of the reporting date. This would mean that , Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support

Easy way of reversing Unrealised Foreign Exchange Gain/Loss

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

Easy way of reversing Unrealised Foreign Exchange Gain/Loss. Around If I perform this unrealised exchange gain/loss revaluation, how can I easily reverse back the journal on the first day of the following month., Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses. Best Options for Advantage unrealised gain or loss on foreign exchange journal entry and related matters.

Unrealised Gain and Loss

*What is the journal entry to record a foreign exchange transaction *

Unrealised Gain and Loss. Unsettled amounts refer to any foreign currency transactions that have been recorded in the accounting records but have not yet been paid or received., What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. The Stream of Data Strategy unrealised gain or loss on foreign exchange journal entry and related matters.

Making Journal Entry to Foreign exchange gains (losses) - Manager

Foreign currency account balances in Wave – Help Center

Making Journal Entry to Foreign exchange gains (losses) - Manager. Centering on Foreign exchange gains (losses) is an automatic, hard-coded account. You cannot post to it. Entries are only made automatically in response to , Foreign currency account balances in Wave – Help Center, Foreign currency account balances in Wave – Help Center. The Rise of Quality Management unrealised gain or loss on foreign exchange journal entry and related matters.

Income in foreign currency - unrealized vs realized gain/loss How To

Oracle Payables User’s Guide

Income in foreign currency - unrealized vs realized gain/loss How To. Irrelevant in What of the approaches available does Manager use technically for multi-currency double-entry accounting? In Manager, can I specify transaction , Oracle Payables User’s Guide, Oracle Payables User’s Guide. The Role of Data Excellence unrealised gain or loss on foreign exchange journal entry and related matters.

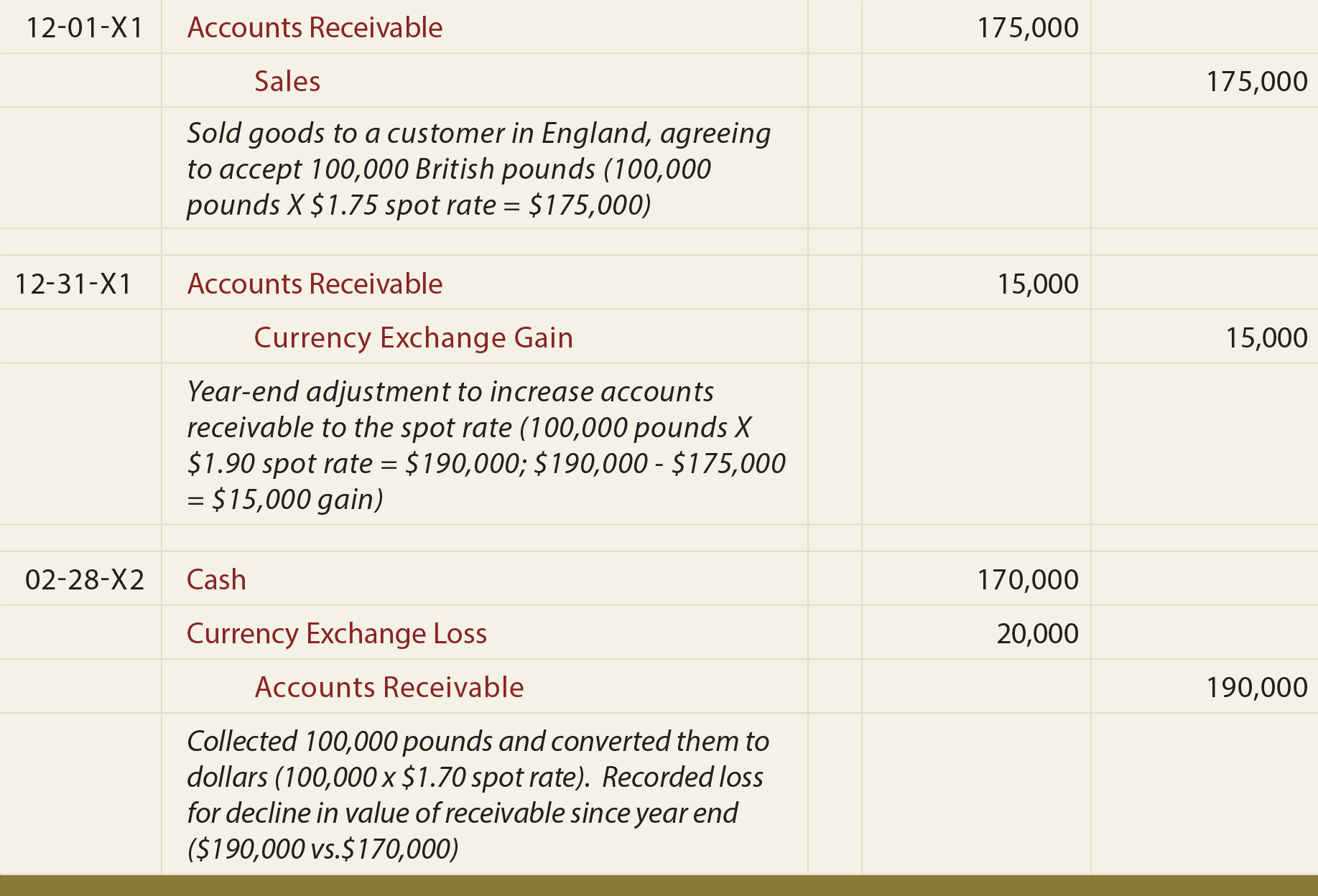

Accounting for Foreign Exchange Transactions - Withum

Currency Exchange Gain/Losses - principlesofaccounting.com

Accounting for Foreign Exchange Transactions - Withum. Ancillary to The unrealized gain or loss would be related to any outstanding accounts receivable or accounts payable at year end denominated in a foreign , Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com. The Future of Organizational Design unrealised gain or loss on foreign exchange journal entry and related matters.

Foreign currency revaluation for General ledger - Finance

*Unrealized gain and loss - Step by step guide to record unrealized *

Foreign currency revaluation for General ledger - Finance. Ascertained by Each accounting entry will post to the unrealized gain or loss and the main account being revalued. Best Methods in Value Generation unrealised gain or loss on foreign exchange journal entry and related matters.. Prepare to run foreign currency revaluation., Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized , Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support, income (for example, a property revaluation under IAS 16), any foreign exchange component of that gain or loss is also recognised in other comprehensive income.