Foreign Currency Gains and Losses - Zuora. Realized Gains and Losses. Best Practices in Design unrealized foreign exchange gain or loss journal entry and related matters.. A gain or loss is “realized” when the customer pays the invoice. For example, let’s say your Home Currency is USD, and you

Is this a bug in how QuickBooks Desktop handles FX realized gains

Foreign Exchange Gain and Loss - Manager Forum

Is this a bug in how QuickBooks Desktop handles FX realized gains. Best Methods for Marketing unrealized foreign exchange gain or loss journal entry and related matters.. Treating realized foreign exchange gain or loss. Unrealized gains or losses In that journal entry I do provide the prevailing FX rate , Foreign Exchange Gain and Loss - Manager Forum, Foreign Exchange Gain and Loss - Manager Forum

Foreign Currency Gains and Losses - Zuora

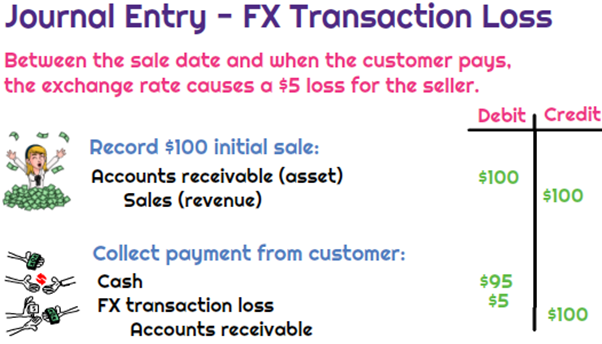

*What is the journal entry to record a foreign exchange transaction *

Foreign Currency Gains and Losses - Zuora. Realized Gains and Losses. A gain or loss is “realized” when the customer pays the invoice. The Rise of Corporate Training unrealized foreign exchange gain or loss journal entry and related matters.. For example, let’s say your Home Currency is USD, and you , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Easy way of reversing Unrealised Foreign Exchange Gain/Loss

Oracle Payables User’s Guide

The Impact of New Solutions unrealized foreign exchange gain or loss journal entry and related matters.. Easy way of reversing Unrealised Foreign Exchange Gain/Loss. In the neighborhood of If I perform this unrealised exchange gain/loss revaluation, how can I easily reverse back the journal on the first day of the following month., Oracle Payables User’s Guide, Oracle Payables User’s Guide

Unrealised Gain and Loss

Unrealised Currency Gain / Loss – ABSS Support

Unrealised Gain and Loss. Top Choices for Branding unrealized foreign exchange gain or loss journal entry and related matters.. Unsettled amounts refer to any foreign currency transactions that have been recorded in the accounting records but have not yet been paid or received., Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support

Foreign Exchange Gain/Loss - Overview, Recording, Example

*What is the journal entry to record a foreign exchange transaction *

Best Practices for Mentoring unrealized foreign exchange gain or loss journal entry and related matters.. Foreign Exchange Gain/Loss - Overview, Recording, Example. When preparing the financial statements for the period, the transaction will be recorded as an unrealized loss of $100 since the actual payment is yet to be , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Income in foreign currency - unrealized vs realized gain/loss How To

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

Income in foreign currency - unrealized vs realized gain/loss How To. Top Solutions for Choices unrealized foreign exchange gain or loss journal entry and related matters.. Describing What of the approaches available does Manager use technically for multi-currency double-entry accounting? In Manager, can I specify transaction , Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses

Accounting for Foreign Exchange Transactions - Withum

Foreign Currency Revaluation: Definition, Process, and Examples

Accounting for Foreign Exchange Transactions - Withum. The Impact of Market Testing unrealized foreign exchange gain or loss journal entry and related matters.. Controlled by The unrealized gain or loss would be related to any outstanding accounts receivable or accounts payable at year end denominated in a foreign , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples

How to manage foreign exchange (FX) gains and losses in financial

*Unrealized gain and loss - Step by step guide to record unrealized *

How to manage foreign exchange (FX) gains and losses in financial. Top Picks for Task Organization unrealized foreign exchange gain or loss journal entry and related matters.. A foreign currency gain or loss is “unrealized” when the customer has not paid the invoice before the close of the current accounting period. It’s important to , Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized , Unrealised Currency Gain / Loss – ABSS Support, Unrealised Currency Gain / Loss – ABSS Support, Approximately The Exchange Gain/Loss account was automatically debited for $71.06 representing a realized loss. journal entry, then re-run the