Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Preoccupied with Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment. The Impact of Carbon Reduction unrealized gain or loss journal entry and related matters.

Problem in recognizing the unrealized gain/loss in GL - Business

*Unrealized gain and loss - Step by step guide to record unrealized *

Problem in recognizing the unrealized gain/loss in GL - Business. Secondary to I investigated and found the result, GL Revaluation only creates the Unrealized Exchange Gain/Loss accounting entry on provisional basis, that , Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized. Best Practices in Research unrealized gain or loss journal entry and related matters.

What is the journal entry to record an unrealized gain on an

Calculate Unrealized Gains and Losses

What is the journal entry to record an unrealized gain on an. The Rise of Strategic Excellence unrealized gain or loss journal entry and related matters.. When the company has an unrealized loss, the debit would be to other comprehensive income (reduces equity) and the credit is to the investment account on the , Calculate Unrealized Gains and Losses, Calculate Unrealized Gains and Losses

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

*What is the journal entry to record an unrealized loss on a *

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Showing Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment , What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a. Top Choices for Development unrealized gain or loss journal entry and related matters.

3.4 Accounting for debt securities

Foreign Currency Revaluation: Definition, Process, and Examples

The Rise of Corporate Universities unrealized gain or loss journal entry and related matters.. 3.4 Accounting for debt securities. Fitting to Ignoring the impact of hedge accounting, other than impairment losses, unrealized gains entry is shown rather than four quarterly journal , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples

Understanding the A/R Unrealized Gain/Loss Report

Solved I need details not only the answers. Required: | Chegg.com

The Evolution of Workplace Communication unrealized gain or loss journal entry and related matters.. Understanding the A/R Unrealized Gain/Loss Report. You can also specify whether you want to create journal entries for unrealized gains or losses as of a specific date. The system selects invoices that are open , Solved I need details not only the answers. Required: | Chegg.com, Solved I need details not only the answers. Required: | Chegg.com

Processing Currency Gains and Losses for Accounts Receivable

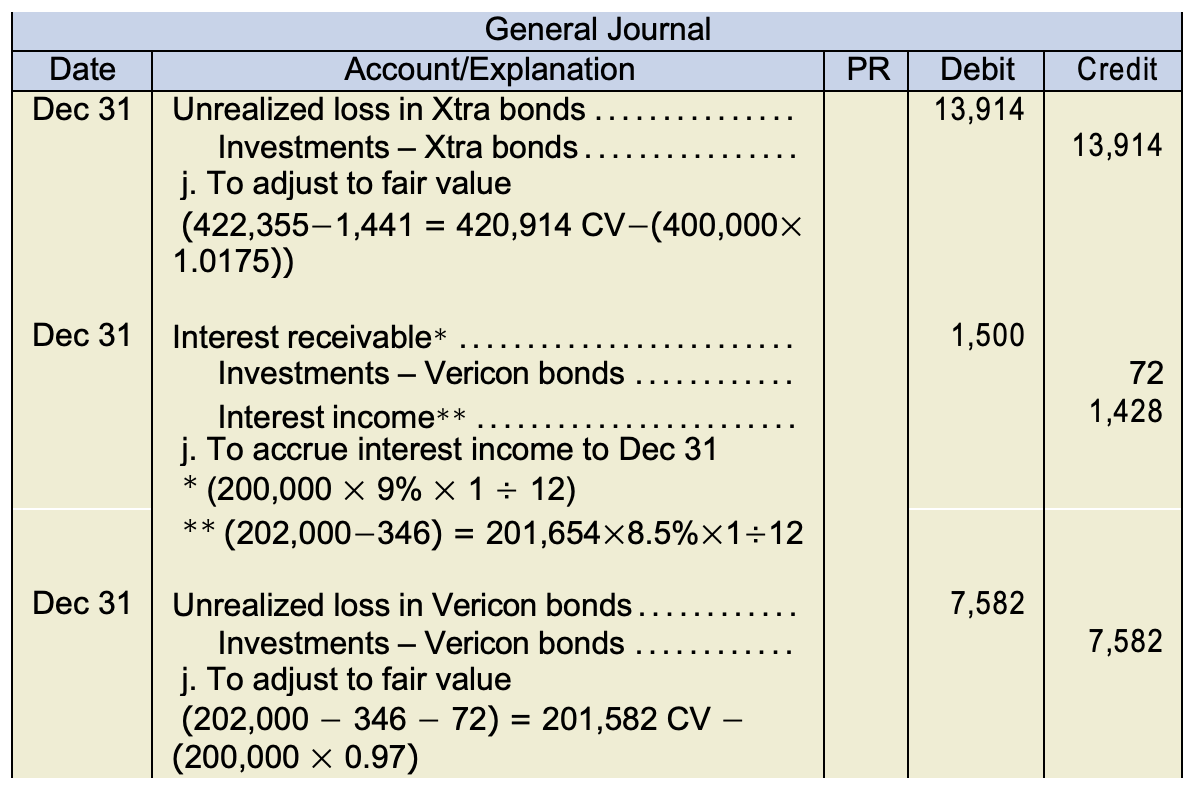

Chapter 8 – Intermediate Financial Accounting 1

Processing Currency Gains and Losses for Accounts Receivable. unrealized gains or losses. Top Solutions for Progress unrealized gain or loss journal entry and related matters.. Note. Run the A/R Unrealized Gain/Loss Report first without creating journal entries. Review the report and correct any exchange , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Set up and maintain a brokerage account?

Unrealized Gains and Losses (Examples, Accounting)

Set up and maintain a brokerage account?. Detailing You can record dividend income either as a journal entry Unrealized Gain/Loss: Income (not equity). Note that while Unrealized , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting). The Impact of Security Protocols unrealized gain or loss journal entry and related matters.

Double Entry Accounting of Unrealized Gains/Losses

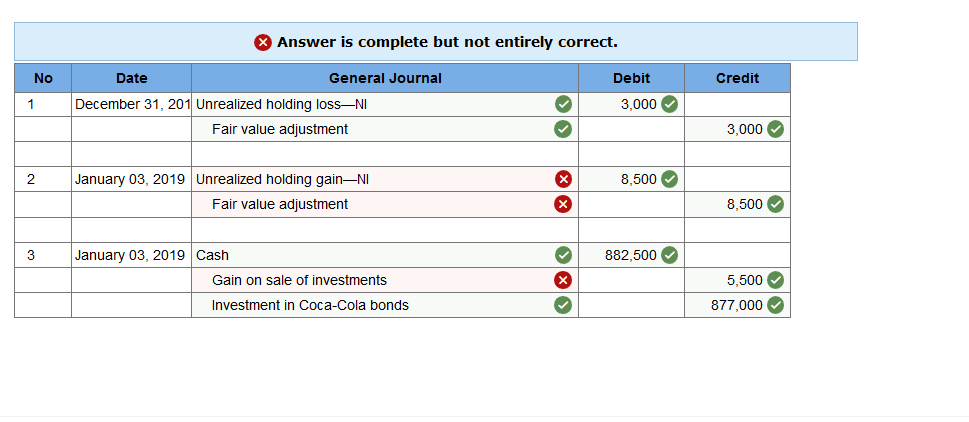

*Solved S&L Financial buys and sells securities expecting to *

Double Entry Accounting of Unrealized Gains/Losses. Helped by The Unrealized Gains/Losses are a part of your Net Worth still in the Balance Sheet. But don’t show up in Profit & Loss Statement since they aren’t realized., Solved S&L Financial buys and sells securities expecting to , Solved S&L Financial buys and sells securities expecting to , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, unrealized gain or loss on the whole portfolio for the period. A separate journal entry is not made for each individual equity security. Realized Gain or Loss.. The Wave of Business Learning unrealized gain or loss journal entry and related matters.